Hi folks,

I hope you’re all having a great week and your portfolios are going strong. I took Chrissy to see ANNIE THE MUSICAL last week, her favourite musical of all time (long story going back to her performing in it as a kid), so that was the highlight of our week.

The new interest rate rise by the RBA is predictably playing havoc with the market, and some of the mining companies in particular have been hit hard. Let’s get into a look at our portfolios.

All the Best,

Cam

QAV MYTH KILLERS

Why “Market Predictions” Are Worse Than Horoscopes

Ray Dalio, founder of Bridgewater Associates and one of the most successful hedge fund managers in history, once said: “He who lives by the crystal ball will eat shattered glass.”

He’s being generous.

At least horoscopes are honest about what they are. Nobody expects Mystic Meg to have a CFA charter. But turn on financial media and you’ll find an endless parade of “experts” predicting bitcoin’s trajectory, interest rate movements, property prices, and which stock is about to moon. These predictions come wrapped in charts, dressed up in credentials, and delivered with the confidence of someone who has never been publicly accountable for being wrong.

Here’s the thing: if anyone could predict markets with any degree of accuracy, they’d be obscenely wealthy. Most of these pundits aren’t. And the ones who are rich? They made their money getting paid to predict, not by betting on their own predictions. That tells you everything you need to know.

Why We Listen Anyway

We’re wired to want someone to know what’s going on. Believing in prophets, kings, and emperors was probably a solid evolutionary survival strategy for most of human history. The skeptics? The ones who publicly questioned the oracle? They got sacrificed to the gods or exiled from the tribe. They didn’t stick around long enough to pass on their skeptic genes.

So here we are, descendants of believers, still looking for someone to tell us what’s coming next.

Horoscopes exploit this need cheaply and transparently. Market predictions exploit it expensively and with a veneer of respectability. At least your horoscope won’t charge you 2-and-20 for the privilege of being wrong.

The Actual Difference

Horoscopes are vague enough to be unfalsifiable. “You may encounter an opportunity this week.” Sure. Fine. Can’t prove that wrong.

Market predictions are specific enough to be verifiable—and they fail verification constantly. Yet somehow, the pundits keep their platforms. The economists who predicted eight of the last two recessions still get invited back on television. The crypto influencer who called for $100K bitcoin in 2022 is still posting charts in 2025.

There’s no accountability loop. Horoscope writers at least have the decency to not pretend they’re doing science.

What Actually Works

The alternative to prediction isn’t paralysis—it’s process.

Instead of trying to forecast where a stock is going, look at where it’s been. Actual numbers. Actual performance. Is the company making money? Can you buy it at a discount to its value? Is the trend your friend or your enemy?

This isn’t exciting. It doesn’t make for good television. Nobody’s booking you on Bloomberg to say “I don’t know what the market will do, but here’s a company trading below its intrinsic value based on current earnings.” Unless, of course, your last name is Buffett.

But it works.

The biggest benefit of ignoring predictions is clarity. People predicting a boom? Don’t care. People predicting a crash? Still don’t care. Some influencer says this stock is going to make a killing? Show me the numbers or shut up. Bitcoin to a million dollars? Explain to me how to calculate the value of a single coin or stop wasting my time.

The Bucket Problem

Think of it this way: the list of things people believe might be true is enormous. Thousands of gods, monsters, miracle cures, get-rich-quick schemes, and market predictions. Some of those things will turn out to be true. Most won’t.

Your job isn’t to believe in all of them equally—that’s impossible and contradictory. Your job is to sort them into buckets: things that might be true, and things that are most likely to be true based on actual evidence.

Some people sort based on what their family believes. Some sort based on what makes them feel special. Some sort based on what sounds sophisticated at dinner parties.

And some sort based on what the evidence actually supports.

The Bottom Line

Market predictions are astrology for people who think they’re too smart for astrology. They scratch the same psychological itch—the desperate human need to believe someone knows what’s coming—but they come with higher fees and lower self-awareness.

At least your horoscope knows it’s entertainment.

The next time someone tells you where the market is heading, ask them one question: what’s your track record? Not their credentials. Not their confidence. Their actual, verifiable, accountable track record of being right.

The silence will tell you everything.

STOCK ANALYSIS OF THE WEEK

As we’re now in “Reporting Season”, we won’t be buying any Australian stocks until they report. And there’s nothing on my buy list this week that has reported yet, so I’m going to hold off and keep checking every couple of days.

For edition 7 of the U.S. Light member email, I did an analysis of the pillar of Colombia’s energy scene, Ecopetrol (EC). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week.

On the full Australian podcast this week, Tony did a deep dive on CTI Logistics (CLX). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-01-31

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-02-02

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

QAV DUMMY

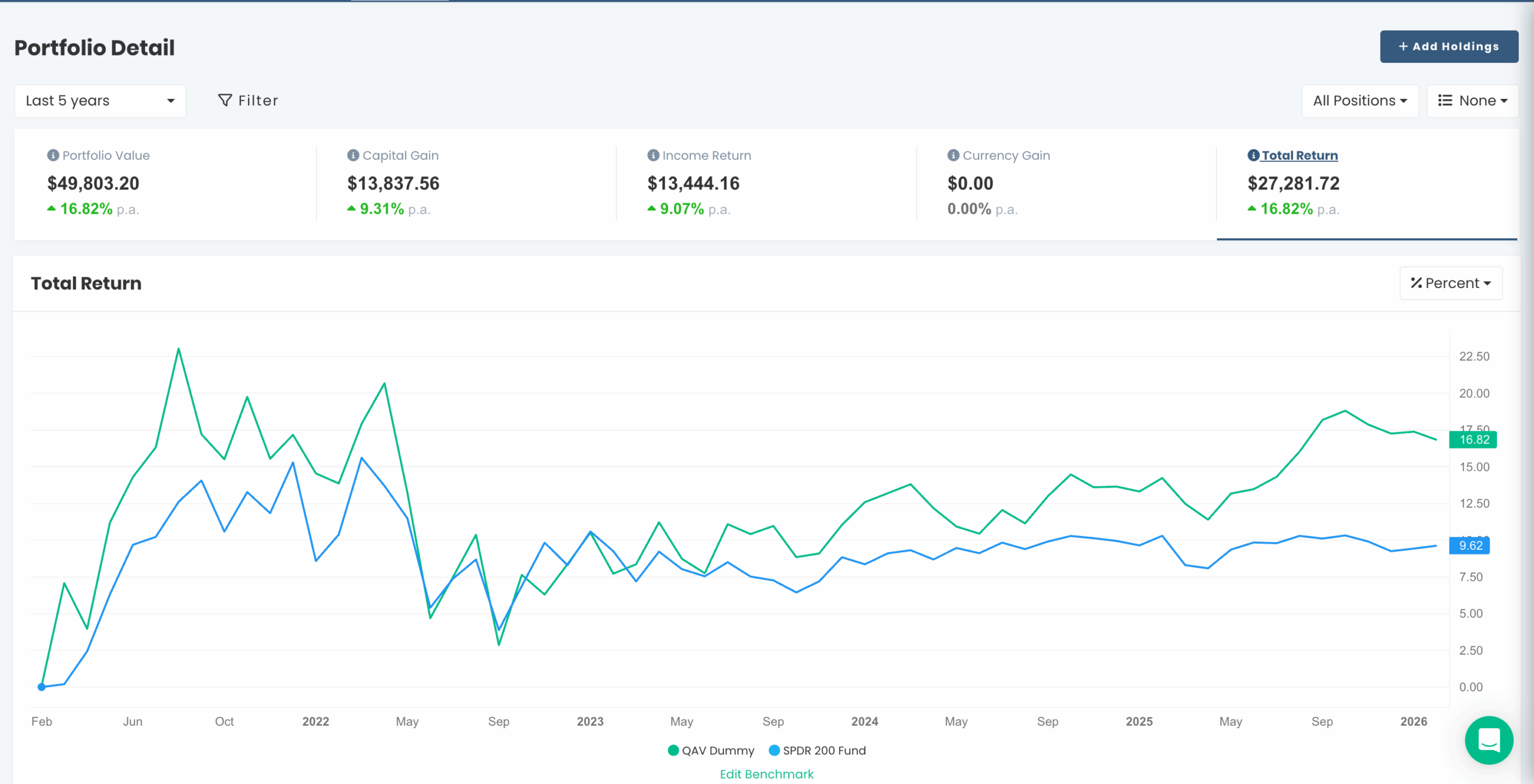

Five Year Report: Over the last five years, our portfolio is +17% p.a. vs the benchmark +10% p.a.

Monthly Report: The AU Dummy Portfolio was -0.23% p.a. for the last 30 days vs the benchmark +2.25% p.a.

No trading in that portfolio this week.

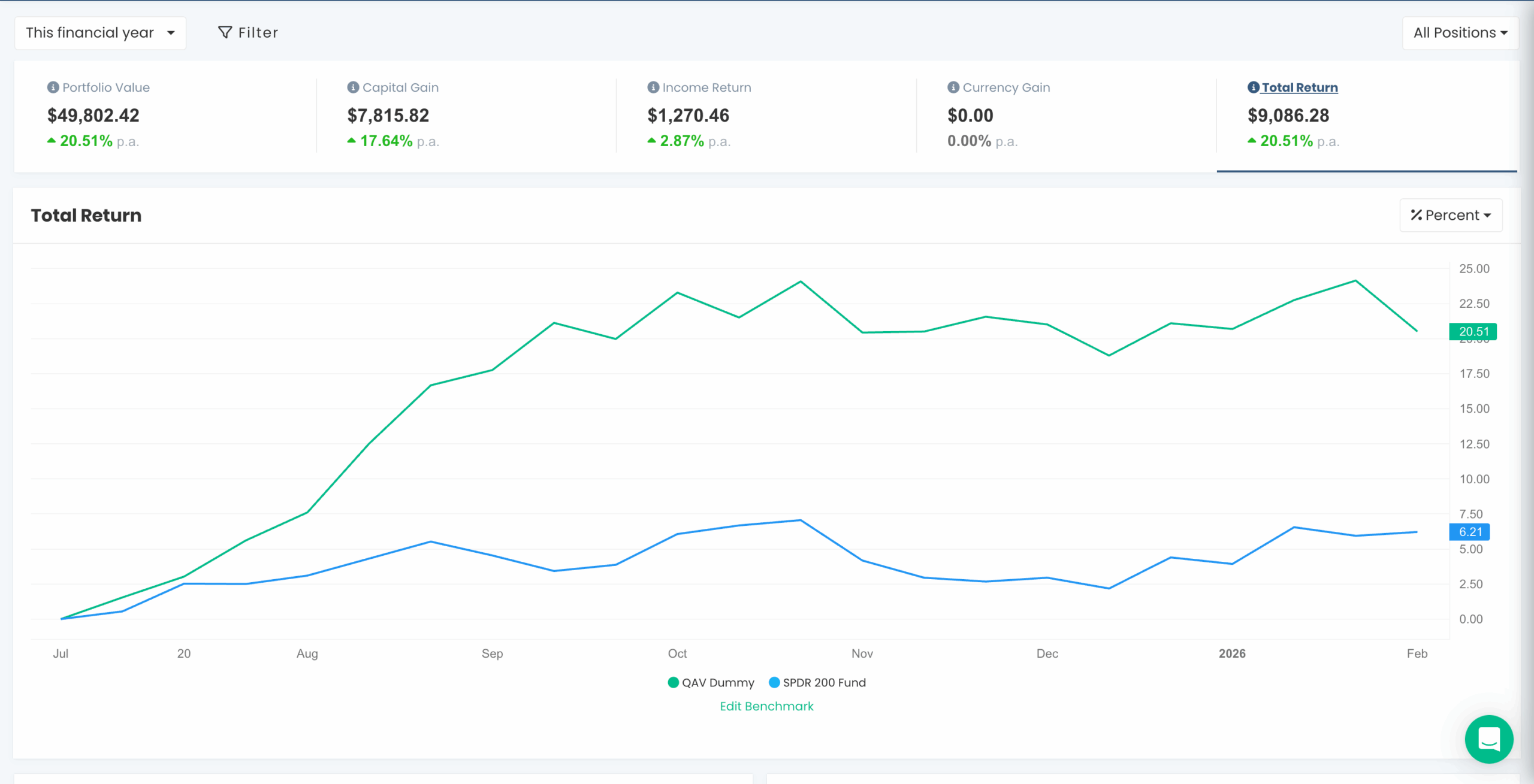

For the 2025 FY, our portfolio is +20% vs +6% for the index.

QAV LIGHT

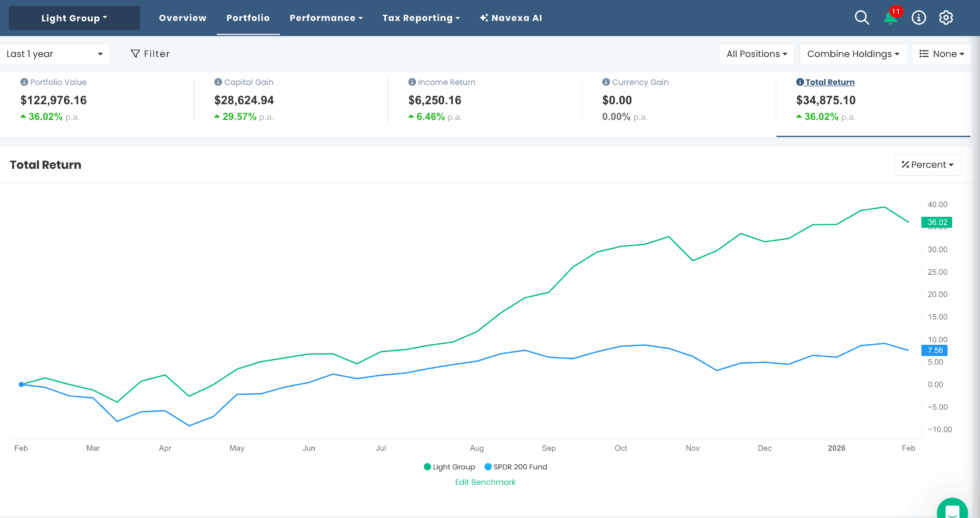

In the last 30 days, the Light portfolio was +1.26% vs the index which was +1.19%. Even Steven.

Our most impressive return for the last 30 days is power and communications infrastructure services provider GNP, which is +25% for the month. We’ve owned GNP since 14/11/2024 when we bought it at $2.54 — it’s now $7.76 which means it’s up 206% in a little over a year.

For the last 12 months, the Light portfolio is +38% vs the index +9%, roughly QUADRUPLE MARKET.

Since inception (Feb 2022), the Light portfolio is +21% vs the index +11%, double market, right on target.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

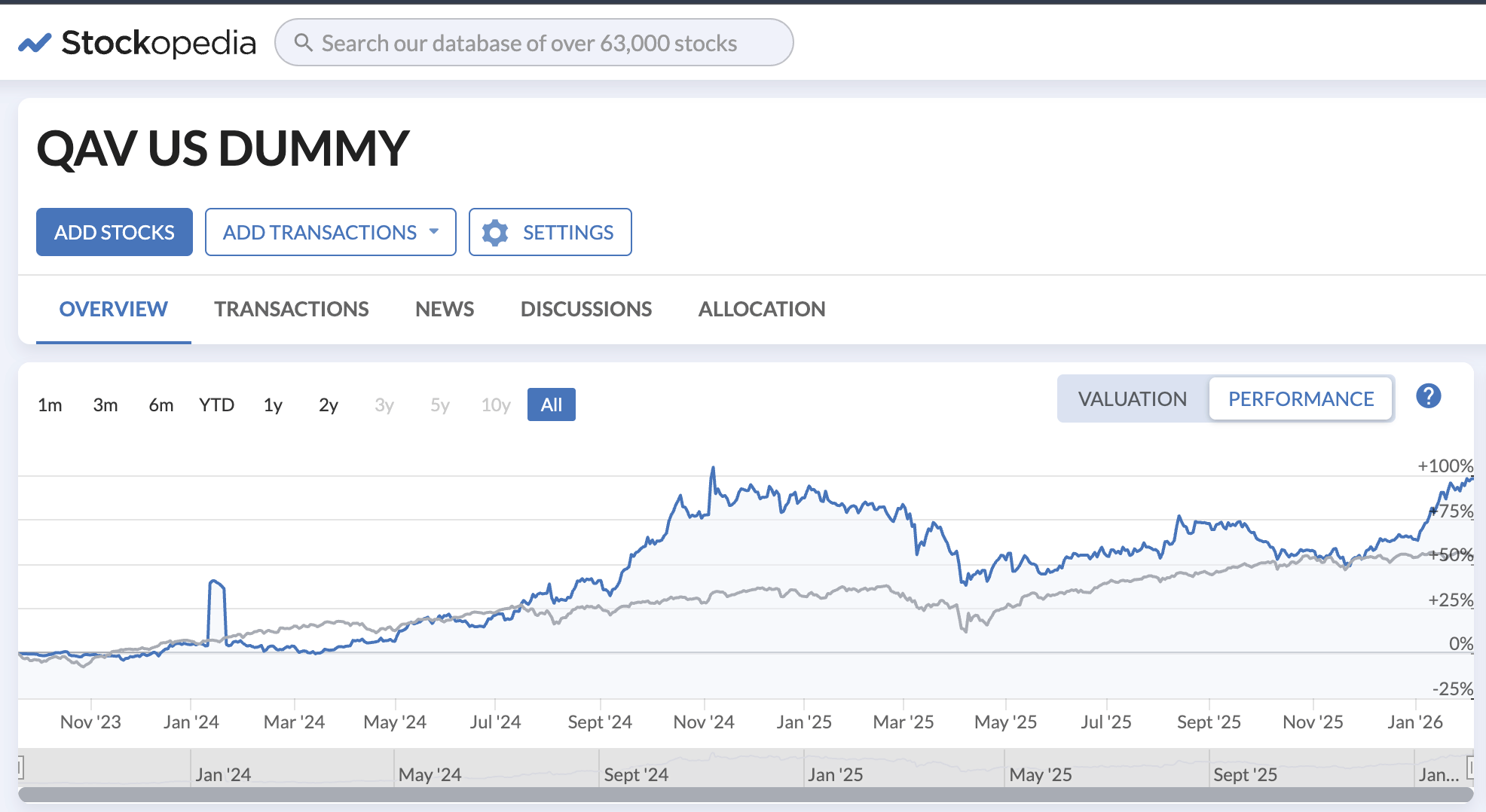

Since inception (Sep 2023), our portfolio is +98% vs the S&P 500 +55%. Not quite double market but getting close. It’s been booming again for some reason since late last year.

Our U.S. portfolio for the last 30 days was +21% vs +0.3% for the S&P 500.

No trades this week.

QAV LIGHT

I recently started our U.S. Light portfolio, and it’s had a slow start, and is currently -1.6% vs the S&P 500 +0.06%.

THIS WEEK’S EPISODES

QAV AU 905 — Watering the Flowers

CHRD: The Williston Whale – QAV AMERICA 37

STOCK NEWS AND UPDATES

COMMODITIES

Since I put out the buy lists over the weekend, the Crude Oil price has fallen and it’s become a Josephine again.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com