Hi folks,

I hope you’re all staying out of the heat and are safe from the fires. Despite all that and an endless series of crazy global events, our portfolios continue to crush it. Let’s see where we are at this week!

All the Best,

Cam

QAV MYTH KILLERS

Why We Don’t Believe in “Diversification for Safety”

The Myth

Every financial advisor, superannuation fund manager, and investment guru will tell you the same thing: spread your money across 20, 30, even 50 stocks to “reduce risk.” Diversify across sectors, asset classes, geographies. Never put too many eggs in one basket. It’s the gospel of modern portfolio theory, and it’s sold as the safest way to invest.

It’s also a confession of incompetence.

Why People Believe It

Look, the fear is real. People have lost everything betting on single stocks or sectors. The dot-com crash, the GFC, countless individual company collapses – the wreckage is everywhere. So when someone in a suit tells you that owning 40 stocks will “smooth out the volatility” and protect you from disaster, it sounds sensible. Responsible, even.

And for most people – people who have no system, no analysis, no edge – it probably is the least-bad option. Better to own the market than to gamble on tips from your mate’s cousin.

The Trap Behind the Logic

But here’s what they don’t tell you: diversification for safety only makes sense if you’re investing blind.

If you have no idea which companies are genuinely undervalued, which have strong fundamentals, which are actually worth owning – then yes, buy everything and hope the winners cancel out the losers. That’s not investing. That’s statistical hedging against your own ignorance.

The dirty secret of “safe diversification” is that it guarantees mediocrity. When you own 40 stocks, you’re not reducing risk – you’re diluting conviction. You’re buying your 34th favourite company because some theory tells you to, not because it’s actually a good investment. You’re owning businesses you don’t understand, in sectors you haven’t analyzed, at prices you haven’t validated, all in the name of “balance.”

Warren Buffett called it exactly right: “Diversification is protection against ignorance.” If you know what you’re doing, spreading capital across dozens of positions isn’t safety – it’s sabotage.

The Hidden Cost

The real damage isn’t just the underperformance, though that’s painful enough. It’s what happens over 10, 20, 30 years.

Over-diversification trains you to be passive. You stop analyzing. You stop thinking critically about what you own. You become a collector of ticker symbols, not an investor in businesses. You check your portfolio balance but couldn’t explain what half your holdings actually do or why you own them.

Worse, it makes you feel safe while delivering market-average returns – which, after fees and inflation, often means you’re barely keeping up. You’re working harder, saving more, taking “safe” advice, and ending up in the same place you would have by just buying an index fund and ignoring the noise.

The fund managers love it, though. More holdings mean more trades, more fees, more justification for their existence. Your safety is their revenue stream.

The Principle (Not the Recipe)

There’s another way. Instead of owning everything because you understand nothing, you could own fewer positions because you understand them better. You could have a system – a repeatable, evidence-based process—that identifies quality companies at genuine value. You could invest with conviction in businesses you’ve actually analyzed, rather than statistical safety nets.

This isn’t about concentration for the sake of it. It’s about letting genuine opportunity drive your portfolio, not arbitrary rules about sector balance or position limits. Some periods, quality and value show up in gold miners. Other times, it’s financials or industrials or something else entirely. The market doesn’t care about your diversification spreadsheet.

We don’t diversify for safety. We invest with rules. There’s a difference.

What Now?

If this resonates – if you’re tired of mediocre returns wrapped in the language of prudence – maybe it’s time to see what investing with an actual system looks like.

Not tips. Not predictions. Not guru nonsense.

Rules.

STOCK ANALYSIS OF THE WEEK

For edition 205 of my weekly Australian Light member email this Monday, I did an analysis of Aurelia Metals Limited (AMI). Australian Light and Club members can read it here.

For edition 4 of the U.S. Light member email, I did an analysis of Controladora Vuela Compania de Aviacion SAB de CV (VLRS). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week.

On the full Australian podcast this week, Tony did a deep dive on KME (Kip McGrath Education Centres). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-01-11

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-01-10

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

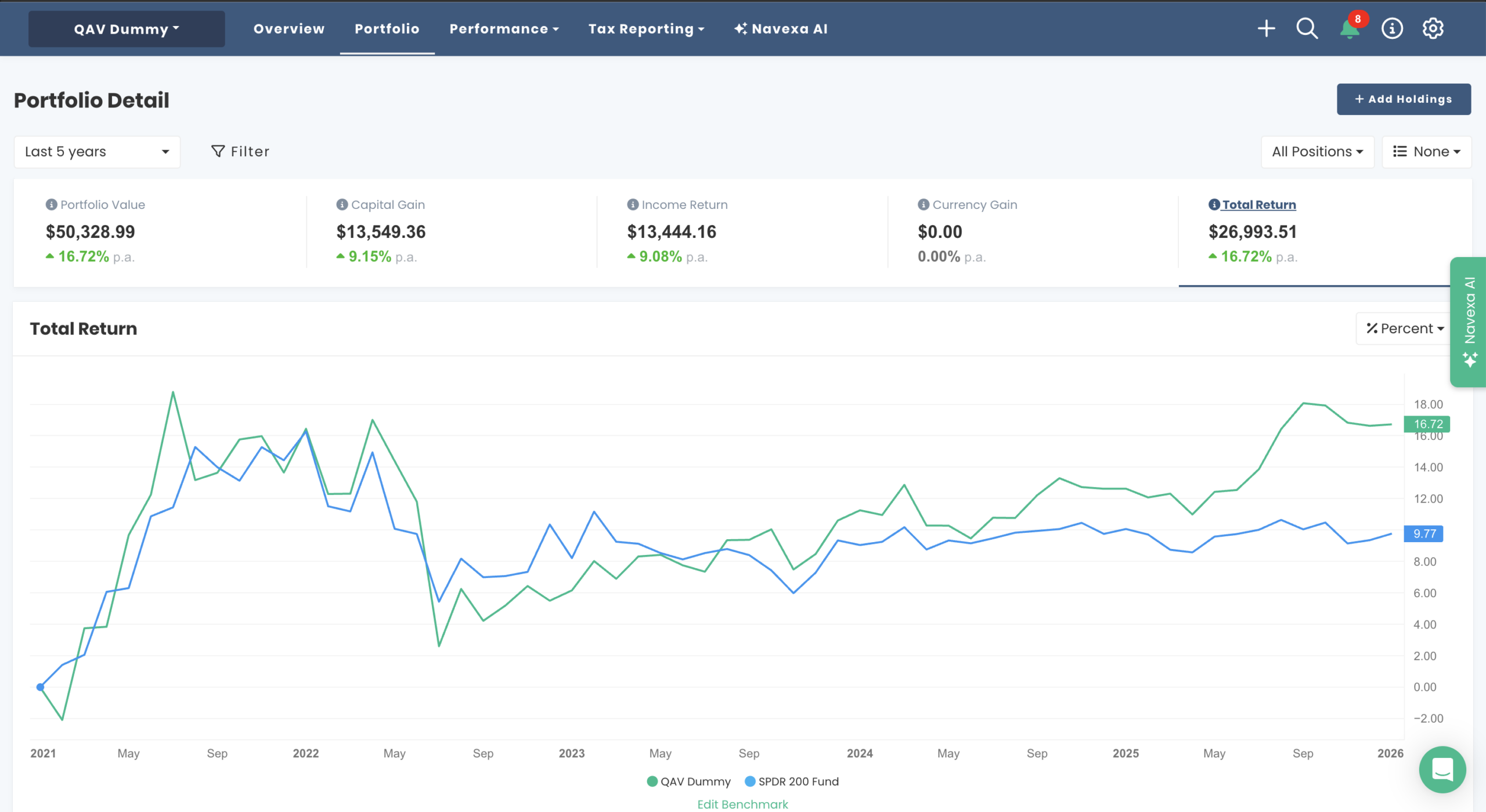

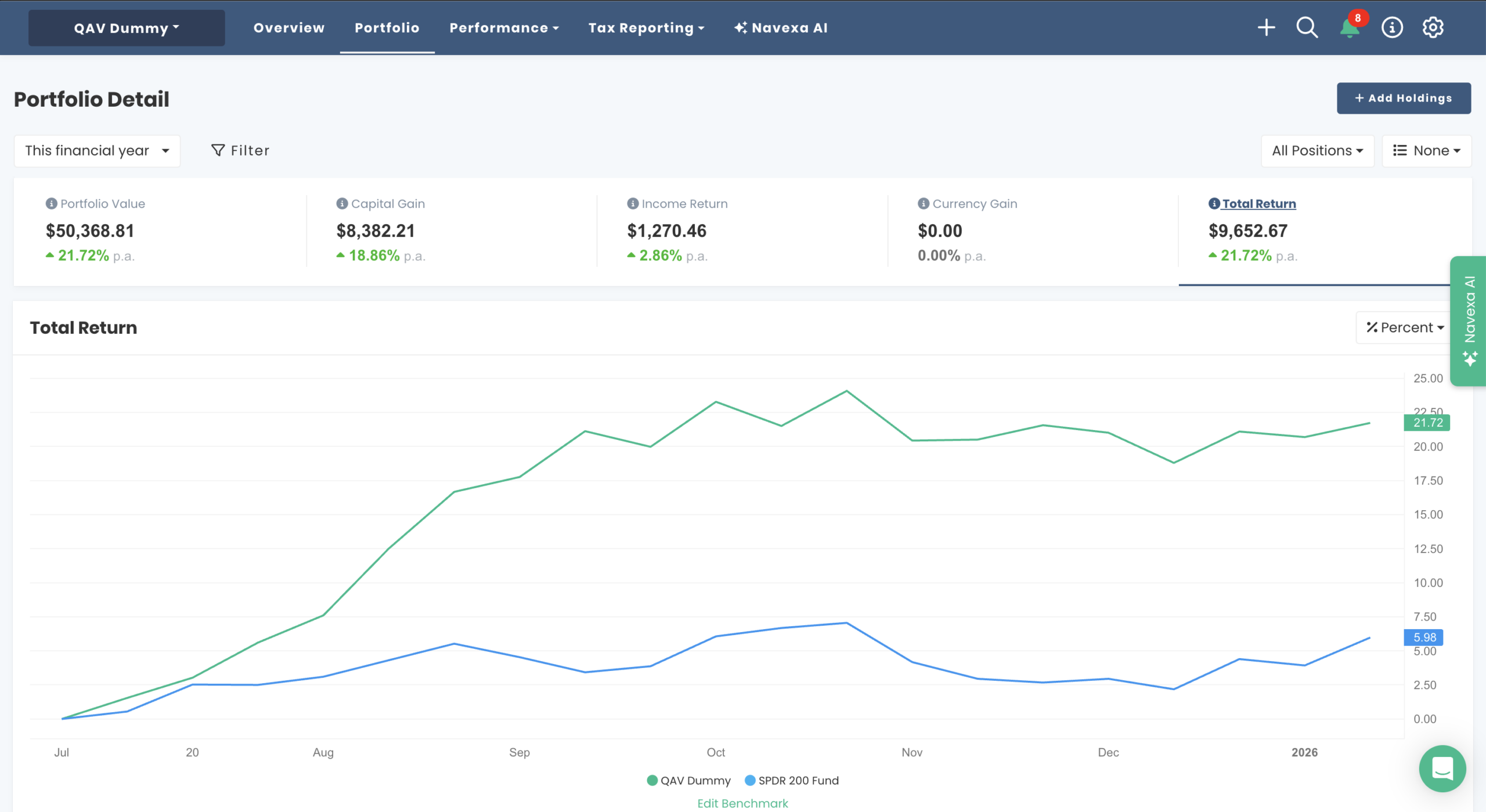

QAV DUMMY

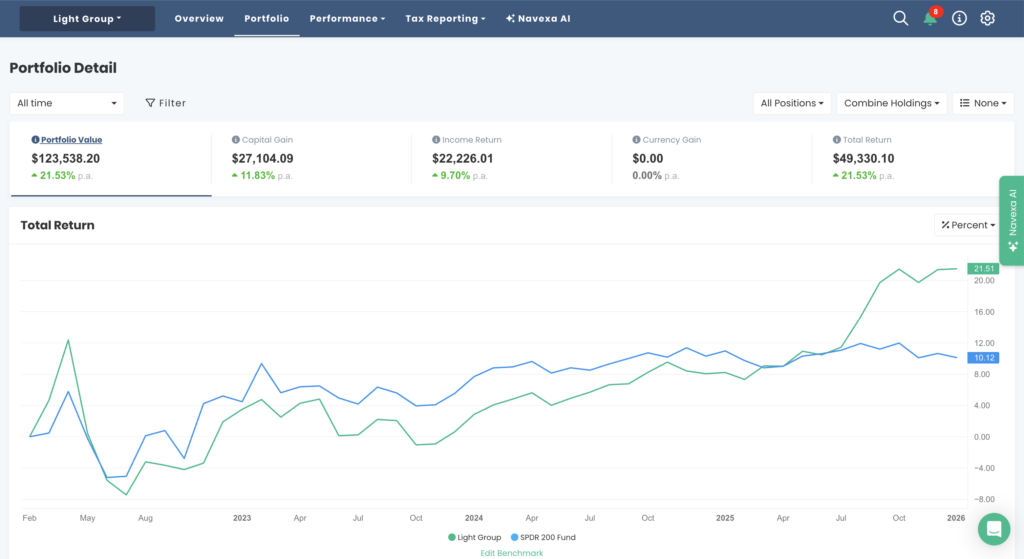

Five Year Report: Over the last five years, our portfolio is +17% p.a. vs the benchmark +10% p.a.

Monthly Report: The AU Dummy Portfolio was +2% p.a. for the last 30 days vs the benchmark +3.5% p.a. The benchmark really shot up this week.

No trading in that portfolio this week.

For the 2025 FY, our portfolio is +22% vs +6% for the index – nearly QUADRUPLE MARKET.

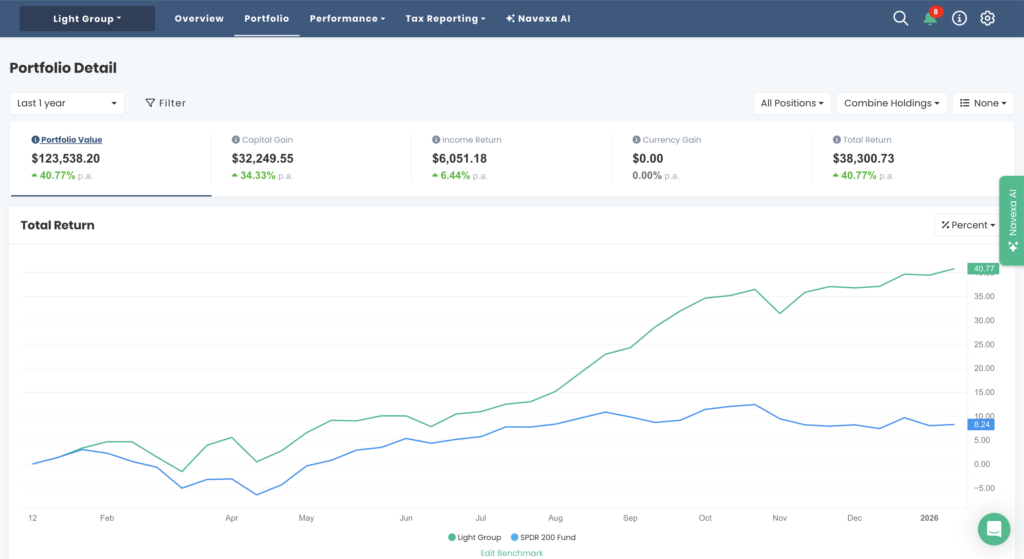

QAV LIGHT

In the last 30 days, the Light portfolio was +3% vs the index which was ‑0.6%.

Our most impressive return for the last 30 days is mining services company MAH which is +27% over the last 30 days and +50% since we added it on 3/11/2025.

For the last 12 months, the Light portfolio is +40% vs the index +8%. In other words — QUINTUPLE MARKET. Insane. It won’t last, of course, But it should give us a nice buffer for when things balance out. I’ve learned that over the years. We have periods of terrific out-performance, and that’s balanced by periods of under-performance and average performance. Over the long term, we aim for an average of double market.

Since inception (Feb 2022), the Light portfolio is +21% vs the index +10%.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

Since inception (Sep 2023), our portfolio is +82% vs the S&P 500 +56%.

Our U.S. portfolio for the last 30 days was +11.5% vs +1% for the S&P 500.

No trades this week.

QAV LIGHT

I’ve recently started our U.S. Light portfolio, too, but it’s too early to bother reporting.

THIS WEEK’S EPISODES

Picking Through the Wreckage of XPLR Infrastructure (XIFR) – QAV AMERICA 34

STOCK NEWS AND UPDATES

- Super Retail dropped 5.3 per cent as its first-half earnings guidance fell short of expectations

- US federal prosecutors open criminal inquiry into US Federal Reserve chair

COMMODITIES

This week we reported that Gold (AUD), Coal (thermal), Magnesium and Wheat had all become a BUY. LNG became a SELL.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com