Hi folks

Here’s my weekly update and some thoughts on how we “buy low, sell high”.

As we’re nearly at the end of 2025, Tony and I would like to thank you for your support over the year and ask a question:

What would you like to see from QAV in 2026? Is there something we’re not doing that you’d like us to do? Something you’d like more or less of? Please shoot me an email if you have any thoughts on how we can improve QAV.

all the best,

Cam

QAV MYTH KILLERS

The Myth

“Buy low, sell high.”

Okay so it’s not really a “myth”. But it’s the kind of pithy investing advice that sounds like a strategy – but isn’t. As soon as you start investing you hear it all the time because, on the surface, it’s makes sense. That is the basic idea of investing. The problem is that it hides all the hard parts. And it begs the question – how do we define “low” and “high”?

Why People Say It

It sounds smart. And our brains love slogans that fit on a bumper sticker. It’s why politicians use three or four word slogans. “STOP THE BOATS”. They comtain just enough information to make them hard to argue with but little enough to hide the messy details. And, yes, we should invest the same way we shop for anything else in life: we should try to buy things when they are available at a discount.

The idea isn’t foolish. And that’s exactly why it causes trouble.

The Trap Behind the Logic

The real question is: How do we know when “low” is actually low?

Low compared to what?

Yesterday’s price? Last year’s? Its competitors? Vibes?

I see people say the price of bitcoin is low. Gold is low. Google is low. I don’t think any of them are low because I think they are all way above their intrinsic value.

We can only call a price “low” when we know what the underlying asset is worth. Without value, “low” is just a guess. It might be a discount… it might be a warning sign… or it might just be low compared to the massively inflated price it was commanding a month ago.

Same with “sell high”. High compared to what?

Ten percent above what you paid? Twenty? Double? Triple?

How do you know it won’t keep going up? Investors cut their best performers short all the time because a number on a screen makes them nervous. “High” only makes sense relative to value. And without value, “high” becomes a moving target defined by your feelings.

Picking the right stocks is hard enough as it is. Even the great Buffett says he only has a 60% success rate. Do you really want to sell your winners and replace them with something that might not do as well?

That’s the flaw of buy low, sell high. The slogan skips the only part that matters:

How do you measure value in the first place?

The Hidden Cost

When investors don’t have a way to define value, the slogan becomes a trap disguised as wisdom.

Sometimes prices look low because the price fell… for a reason. Sometimes we think the price is low because someone convinced us the price will be higher in a year, based on…. vibes.

Sometimes we sell things because they look high… only to watch them continue to go up for another two years.

Sometimes we rebalance at the wrong time because we’re trying to “take profits” instead of keeping our strongest performers on the court. Buffett’s line said it clearly: why would you bench Michael Jordan?

Over decades, trying to buy low and sell high can be expensive:

• Strong stocks are sold too early

• Weak stocks held too long

• We buy stocks we shouldn’t have bought

• Portfolios underperform not because we were reckless, but because the logic we’re following is incomplete

Every trade costs us in lots of ways. Some are monetary costs – brokerage fees and capital gains tax. Some are energy costs – our time, our mental load. Therefore we should want to avoid trading as much as possible.

This is why the slogan feels right but behaves badly in practice. The missing layer is value. Without it, the phrase becomes a coin toss masquerading as a strategy.

The Fix

There is a way to buy low and sell high consistently, but it has nothing to do with intuition, chart shapes, or “feel for the market”.

It comes from rules.

Rules that define what value is.

Rules that tell us when something is genuinely on a discount.

Rules that tell us when it’s time to sell, so we don’t cut our best performers and don’t hang on to dead weight.

We don’t eyeball it. We don’t guess. We don’t time emotions. We don’t try to time the market.

We let rules make the hard decisions. Rules that have been market tested over decades. Our rules may not be perfect, but they are there for a reason. They exist to stop us from making bad decisions.

“Buy low, sell high” isn’t wrong. It’s just unfinished. Once you see the missing pieces, you stop treating it like a strategy and start treating it like an outcome.

BUY LIST

Each week we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week.

QAV America Value Investing Buy List 2025-12-01

PORTFOLIOS

AUSTRALIAN

QAV DUMMY

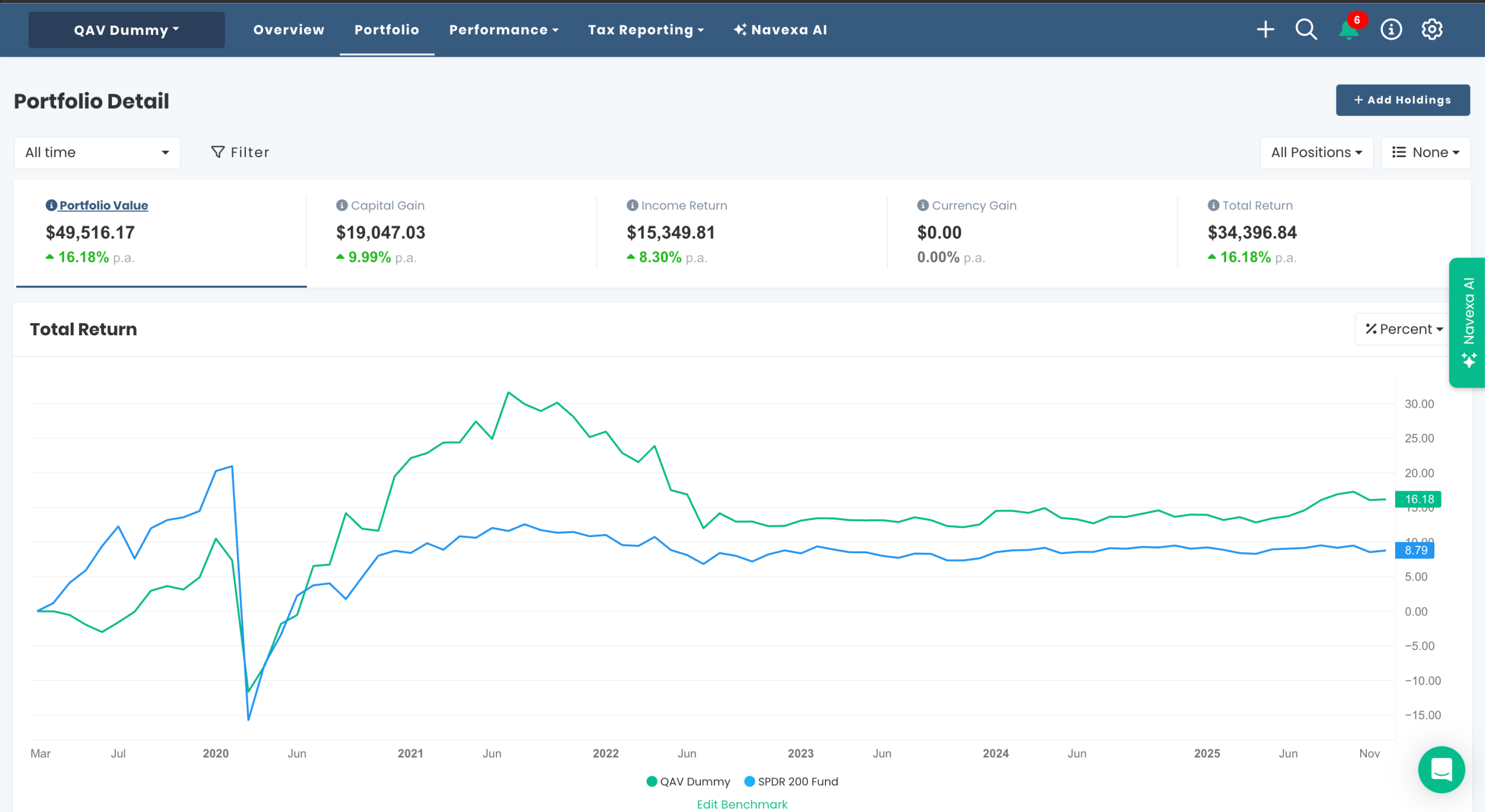

Monthly Report: The AU Dummy Portfolio was -3% for the last 30 days vs the benchmark -2.6%.

Inception Report: Since inception (Sept 2019) our portfolio is +16% pa vs the benchmark +8% pa.

No trades to report from the last week.

QAV LIGHT

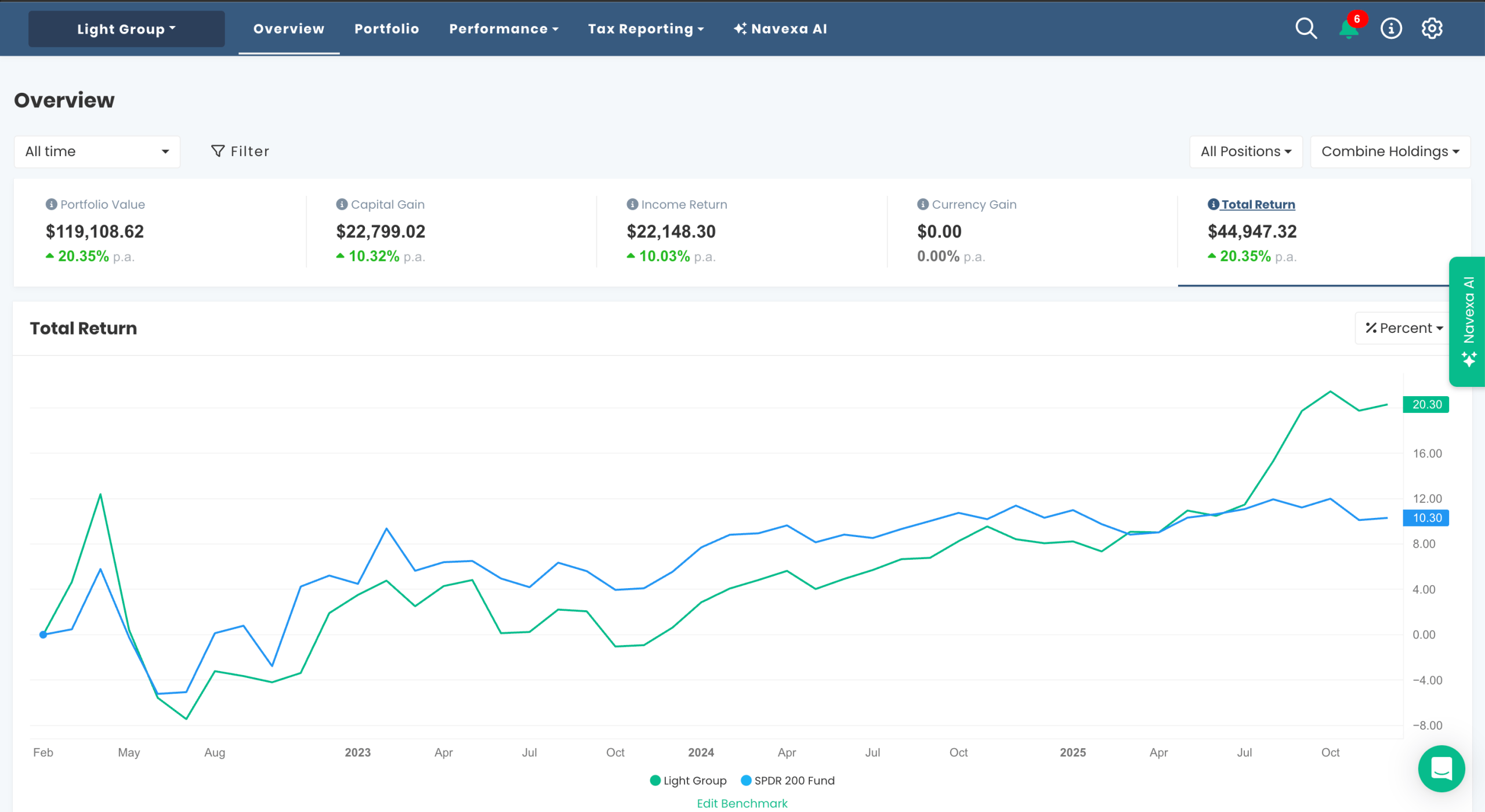

Monthly Report: The AU Light Portfolio was +1.3% for the last 30 days vs the benchmark -2.6%.

Inception Report: Since inception (Feb 2022) our portfolio is +20% pa vs the benchmark +10% pa.

We did do some trading in the last week of November, which Light members are already aware of.

AMERICAN

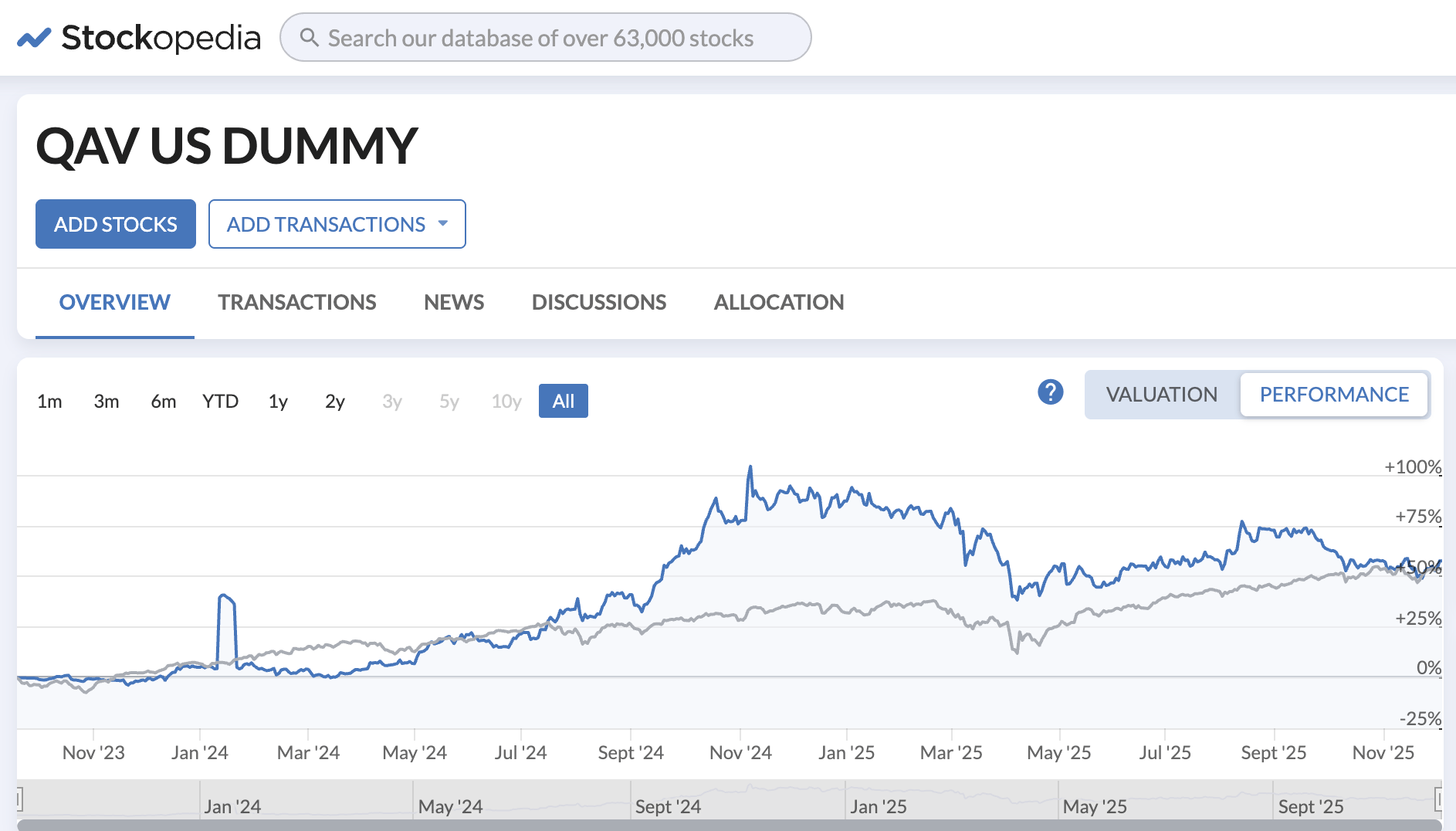

Our U.S. portfolio for the last 30 days was +0.37% vs -0.03% for the S&P500.

Since inception (Sep 2023), our portfolio is +54% vs the S&P500 +53%.

On Nov 24 I did sell VSAT and replaced it with KEP.

LATEST EPISODES

QAV AU 848 — ASX Meltdown, Bauxite Boom, and the Case of the Vanishing CEO

KEP: Korea’s Cash-Gushing Nuclear Giant – QAV America #29

STOCK NEWS AND UPDATES

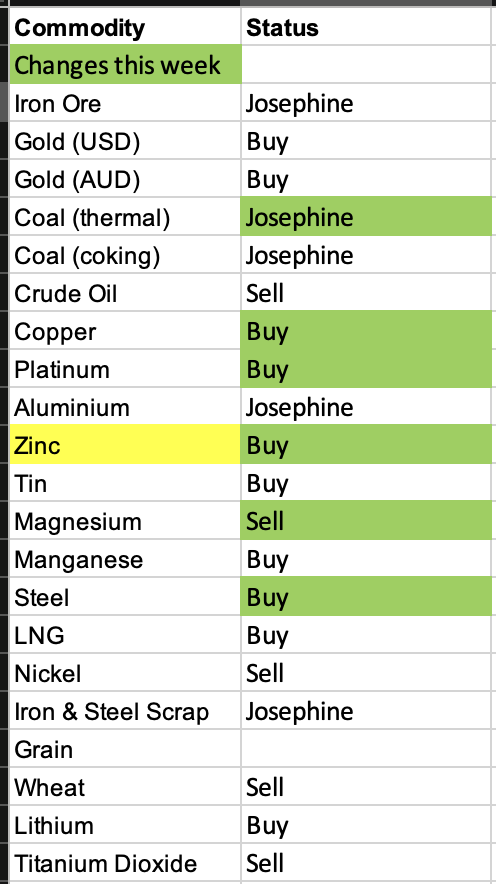

On the commodities front, this week’s buy list had a few new buys.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavpodcast.com.au