How To Build A Value Investing Portfolio

It's not magic. It's just a sensible strategy.

To demonstrate how the QAV system works, we run public “dummy” portfolios.

Our audience watch in real time which stocks we’re buying and selling.

The goal of QAV is to perform, on average, roughly double the index (the S&P 500 in the U.S. or the SPDR S&P/ASX 200 ‘STW’ in Australia) by running a relatively low risk and low effort strategy. By comparison, Warren Buffett has averaged an 19.8% annual compound growth over the last 60 years.

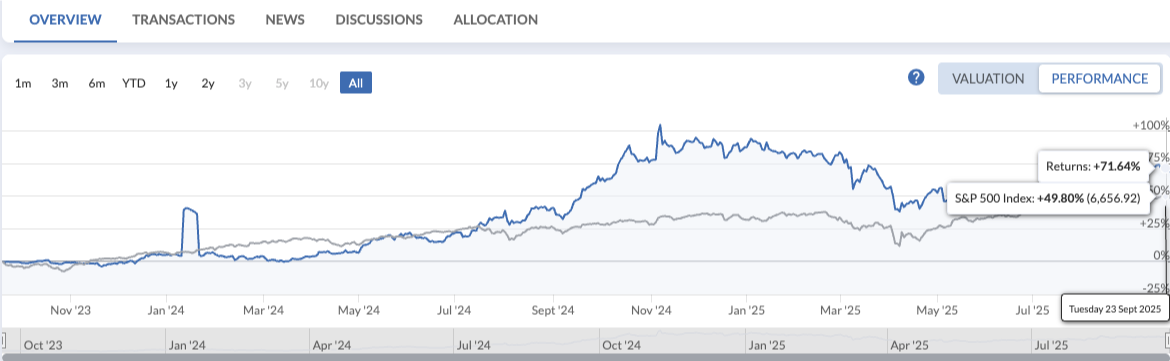

Our U.S. portfolio has been running since September 2023.

So far it’s performing at roughly 1.5x-3x the performance of the S&P 500. This is without buying any of the “Mag 7” stocks. We focus entirely on stocks that meet our criteria.

As of 2025-09-23, our return since inception is 71% over two years.

Our Australian dummy portfolio has been running since September 2019.

It consistenly outperforms the Australian index, doing roughly double market. The results in the chart are per annum CAGR.

Two Ways to Get Started

QAV Light is for beginner DIY investors.

QAV Club gives you full access so you can master the QAV checklist system.