Hi folks,

I hope you’re all having a great week and your portfolios are doing well.

All the Best,

Cam

QUIZ OF THE WEEK!

Tony suggested we start a weekly quiz to spice things up.

Each week we’ll ask you to choose from two stocks from our buy list this week. Which do you think will be the best performer over the next 12 months?

Click the image and take your chances!

May the Force be with you.

QAV MYTH KILLERS

Last week I wrote about mass versus gas when it comes to value investing. Someone suggested that this week I should talk about value investing in terms of quantum mechanics.

Challenge accepted!

If you’ve ever spent time reading about quantum physics, you’ll have come across one of my all-time favourite experiments – the double slit . I read up on it at least once a year, just to refresh my memory, and it always gives me a thrill (not unlike when I play through the Donald Byrne vs Bobby Fischer ”The Game of the Century” from 1956, something I also do once a year).

It was first performed by the British polymath Thomas Young in 1801. At the time, he wasn’t trying to prove quantum weirdness, he was trying to settle a debate about whether light was a particle (as Isaac Newton had believed) or a wave. By shining light through two thin slits and seeing the “interference pattern” on the wall, he proved light behaved like a wave.

A century-and-a-half later, in 1959, the first “true” double-slit experiment using electrons was performed by German applied physicist Claus Jönsson (who, I just found out, only passed away in 2024… I feel like that should have been bigger news). He confirmed that matter (not just photons) has a “wave-particle duality” and that observing it changes its behaviour.

Jönsson fired particles (like electrons) at a barrier with two slits. When no one was watching, the particles acted like waves, passing through both slits simultaneously and creating an “interference pattern” on the back wall, which means they existed in a state of multiple possibilities at once. However, the moment a sensor was placed at the slits to “observe” which path the particle takes, the behaviour instantly changed. The particles stopped acting like waves and started acting like little solid marbles, hitting the wall in two straight lines. As it turns out, the act of measurement collapses the wave of possibility into a single, fixed reality.

By observing something, you change its reality. Think about that for a minute and I guarantee it’ll blow your mind.

Why is it so?

It’s because in every bar of Cadbury dairy milk chocolate… no, wait, wrong experiment.

We don’t know why waves become particles. We don’t even know what “observing” really means in this context. Read five books on quantum physics and you’ll get five different interpretations.

BUT WHAT (I hear you ask) does this have to do with investing?

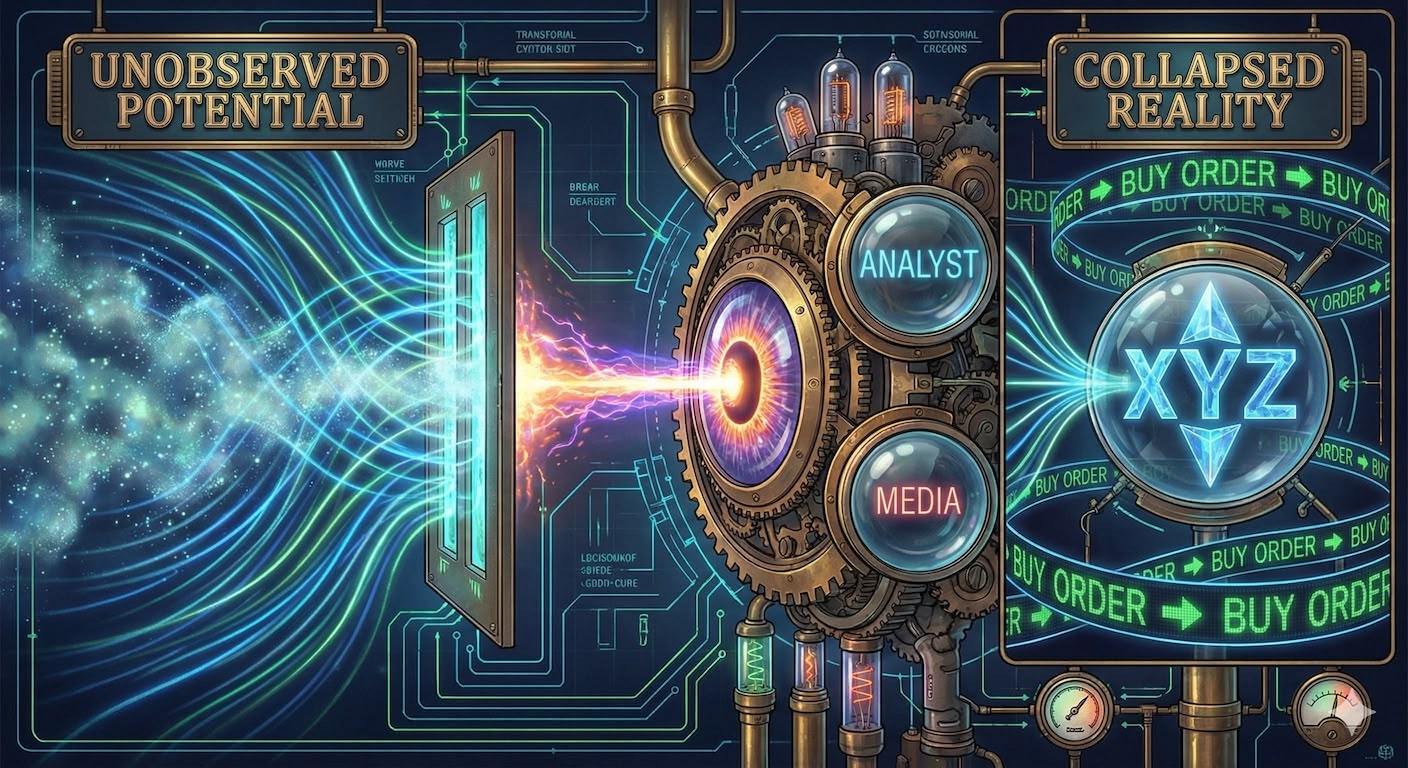

In investing we also have “the observer effect”. How often have I heard TK say that he likes it when we don’t have any analyst forecasts for a stock on our buy list because it means it isn’t getting any attention yet and we might be picking it up first?

Think of a hot AI stock, gold or crypto. Millions of eyes are on it. This “observation energy” creates a massive Hype Cycle, pumping the stock full of “Gas.” The trajectory is no longer based just on the business fundamentals, but on the heat of the crowd, the heat of expectations. It seems like everyone is talking about it, everyone thinks it’s a great idea, and you’d be an idiot not to invest in it.

Strangely enough, I also see this all the time on the value investing sub-reddit, where I post my weekly American pulled pork. Have a look through that and see how many people are posting about tech stocks. It’s unbelievable.

When a stock is “unobserved”, ie no analysts, no AFR / CNBC coverage, no Reddit coverage, no TikToks, it exists in a state of undiscovered potential. But the moment the “Observers” (the herd or a potential acquirer) turn their flashlights on it, the value “collapses” because the price adjusts to reflect all that new attention.

We might say that QAV lives in the Low-Observation Zone (LOZ). And doesn’t it feel that way at times? We are often talking about companies and stocks that seem completely incognito. Select Harvests? Almonds?? Really? How sexy. Servcorp? Office rentals? Not going to be great conversation at a dinner party.

“So, Barry, what are you investing in these days? Bitcoin? Gold”

“Let me tell you about almond harvesting….”

Yawn.

Eventually, after the Observers find out about it, a QAV stock might hit The Measurement Zone (TMZ), not the celebrity rumour site, but that time when a major analyst or influencer “observes” the stock, which causes the wavefunction to collapse, making the price jump, or “revert to the mean”, as Tony says. It stops being undervalued and starts to become fairly valued, or, sometimes, overvalued. The TMZ itself becomes the thing driving the price. This is where the Mass (Value) can be replaced by Gas (Sentiment). That’s fine with us, as long as we bought it when it was still in the LOZ.

Eventually it will enter the Decay Zone: once there are no new observers left to join, the energy dissipates. The “Gas” evaporates, and the stock crashes back to its original “Mass.” This might take months or even years, and we hold on to it as long as our rules allow us to.

Eventually, as it decays, our sell triggers activate and we get out at a profit (…. most of the time). No tree grows to the sky, as TK says.

So stay in the LOZ, friends. It’s going to make for boring dinner party conversation… UNLESS YOU START COMPARING INVESTING TO QUANTUM MECHANICS.

Nope, Chrissy says. STILL boring. Ah well.

STOCK ANALYSIS OF THE WEEK

We are still in “Reporting Season” in Australia, and there’s still been nothing on my buy list for most of the week, but I found something this morning.

For edition 9 of the U.S. Light member email, I did an analysis of Shinhan Financial Co (SHG). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week. It’s another pretty crazy story involving three current scandals.

On the full Australian podcast this week, Tony did a deep dive on Global Value Fund (GVF). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

In the absence of anything to buy, I didn’t bother to publish an Australian list this week.

Below is a link to the US list for this week (available to our U.S. Club members):

QAV American Value Investing Buy List 2026-02-15

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

QAV DUMMY

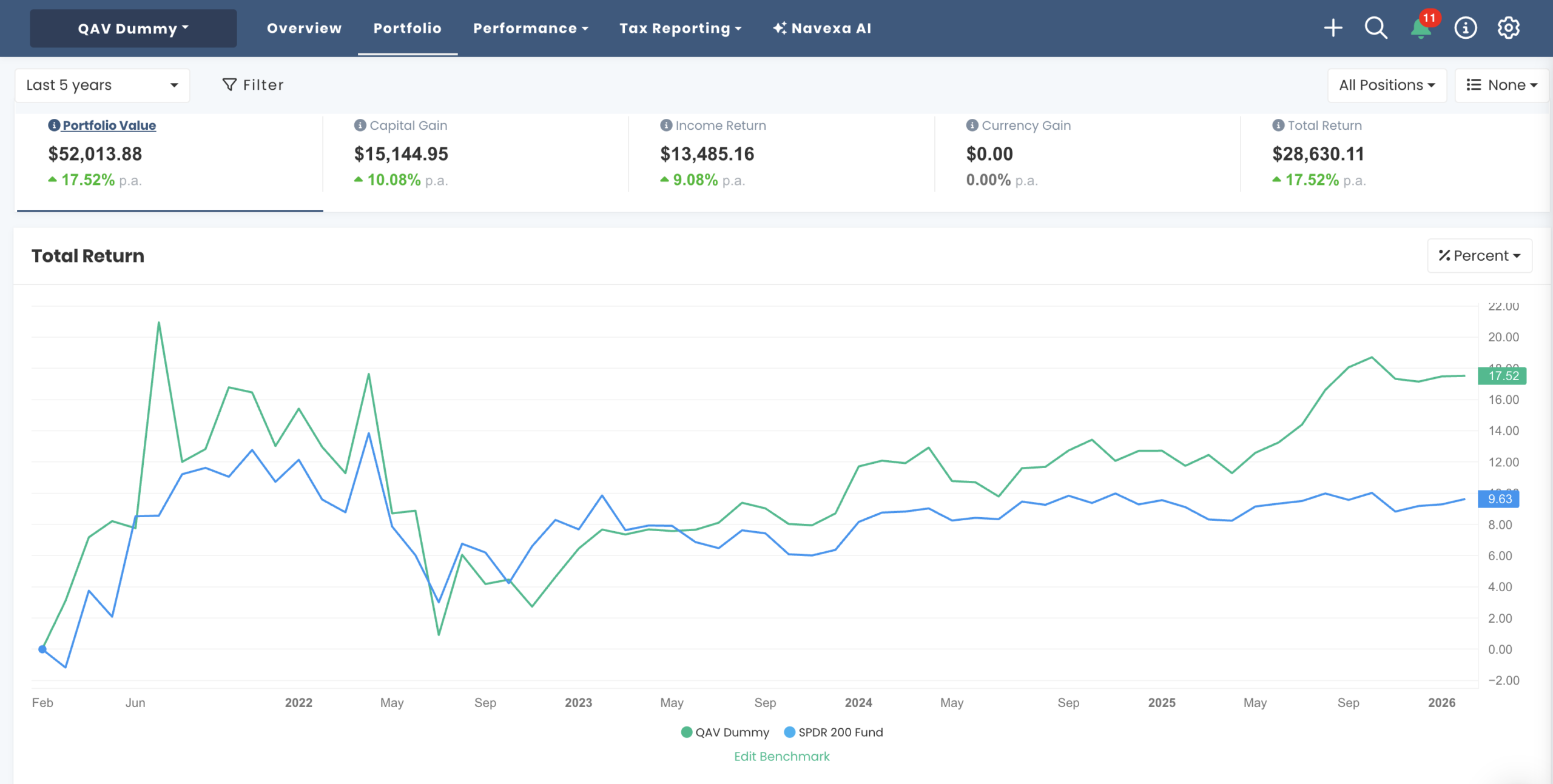

Five Year Report: Over the last five years, our portfolio is +17.5% p.a. vs the benchmark +9.6% p.a.

Monthly Report: The AU Dummy Portfolio was +2.9% p.a. for the last 30 days vs the benchmark +3.3% p.a.

I sold PLT from the portfolio this week but haven’t replaced it because we don’t have enough cash for a full position in anything at the moment.

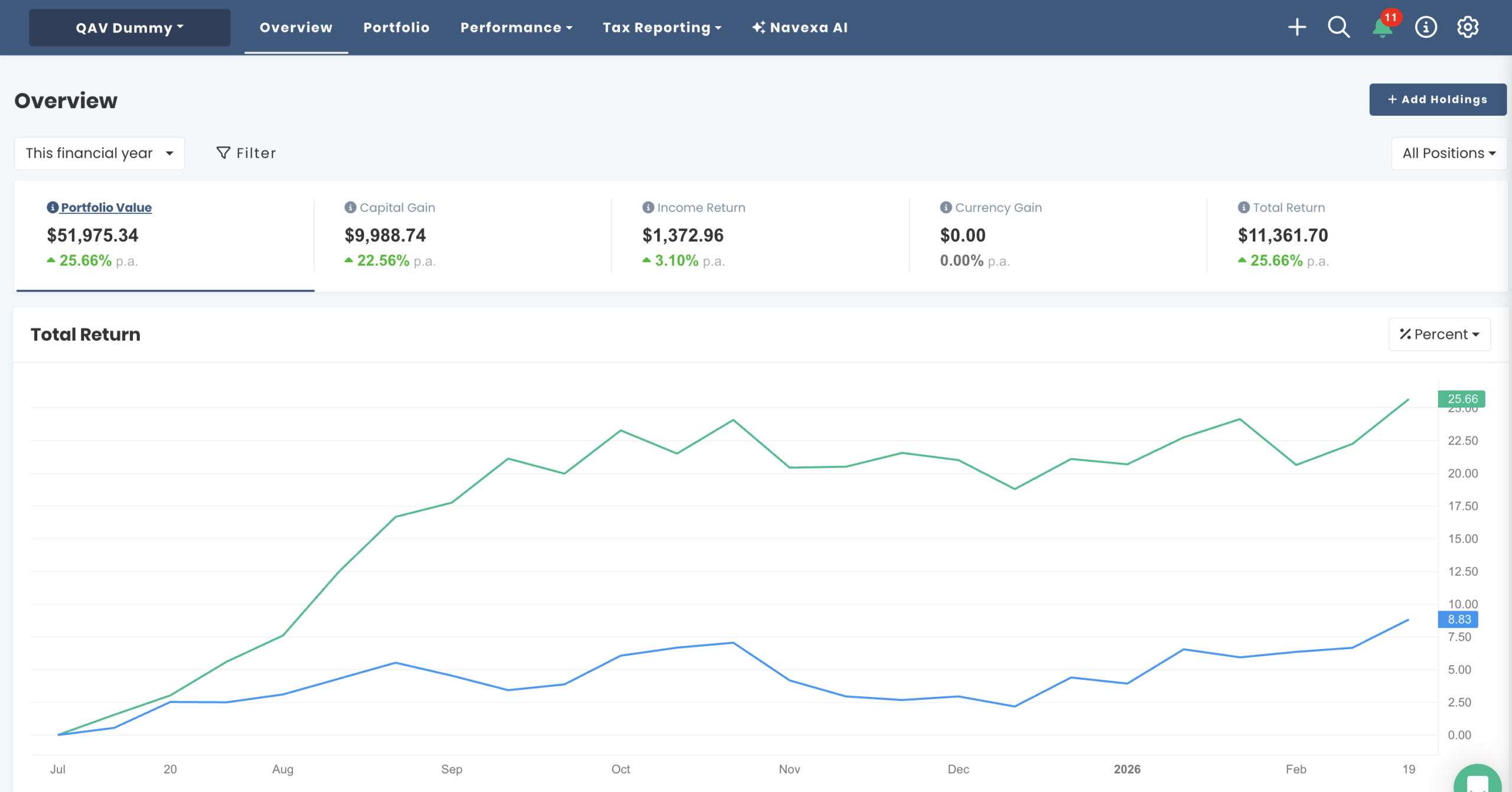

For FY26, our portfolio is +25.6% vs +8.8% for the index.

QAV LIGHT

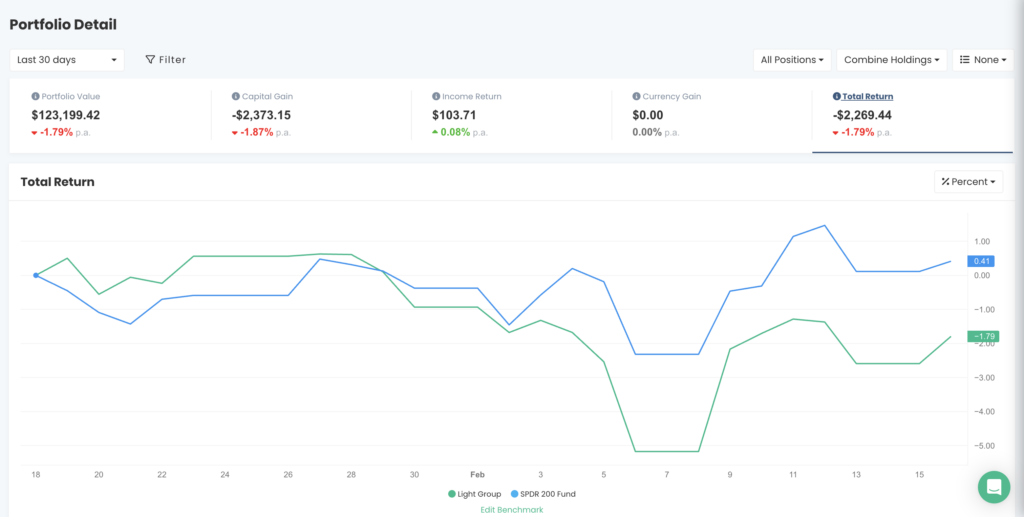

As of Monday this week (the last time I did a report), in the last 30 days, the Light portfolio the Light portfolio was ‑1.79% vs the index which was +0.41%.

Our most impressive return for the last 30 days is SXE (Southern Cross Electrical Engineering) which is +13%. But we’ve held it in two parcels since 2023.

SXE up 287%

Bought 30/8/2023 at $0.780 (+278%)

Bought 2/11/2023 at $0.820 (+260%)

Yet again, another reminder why we don’t sell stocks because they hit some arbitrary price. If they are good businesses, we hold them for as long as we can.

A QUADRUPLE MARKET YEAR

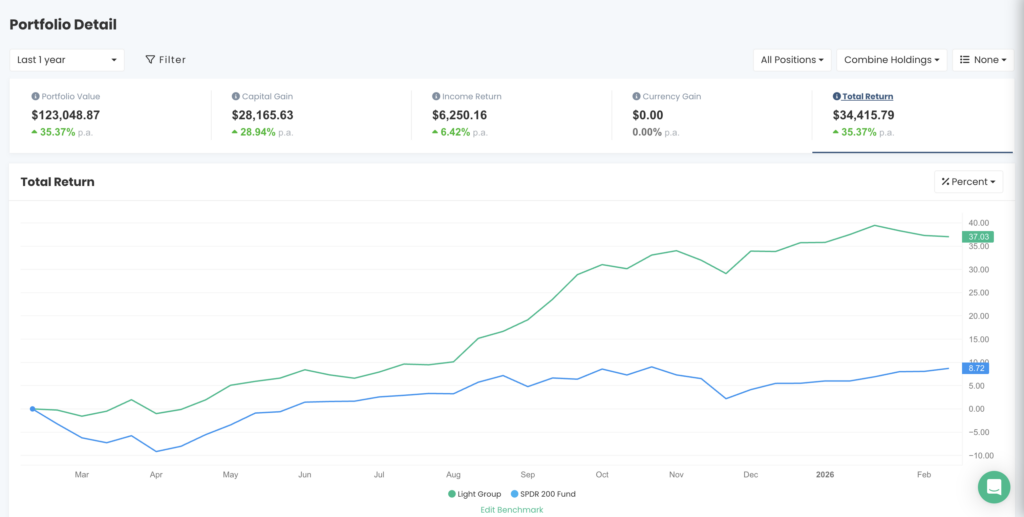

For the last 12 months, the Light portfolio is +37% vs the index +8.7%.

Since inception (Feb 2022), the Light portfolio is +20% vs the index +11%, double market, right on target (hey that rhymes!).

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

Since inception (Sep 2023), our portfolio is +105% vs the S&P 500 +55%. Not quite double market but getting very close.

Our U.S. portfolio for the last 30 days was +7.6% vs -0.8% for the S&P 500.

No trades this week.

QAV LIGHT

I recently started our U.S. Light portfolio, and it’s had a slow start, and is currently -2% vs the S&P 500 +0.4%.

THIS WEEK’S EPISODES

TUSK – The Cobra’s Bite – QAV AMERICA 39

STOCK NEWS AND UPDATES

COMMODITIES

This week all of the commodities were either in a Sell or a Josephine state with the exception of Gold, which remains a buy, and Coal (thermal) and Crude Oil which both became a Buy.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com