Hi folks,

I hope 2026 has started well for you. It’s pretty crazy around the world right now, but, as always, we just try to stick to doing what we do – following the rules. Let’s see where things are at the end of the week!

All the Best,

Cam

QAV MYTH KILLERS

Tony once told me, in the early days of the show: “If I wanted to hear a story, I’d buy a book.”

We don’t listen to company stories. And before you think that’s some kind of anti-intellectual stance or wilful ignorance, let me explain why.

Every company has a story. Every single one. And it always sounds terrific.

The CEO is visionary. The team is world-class. The market opportunity is massive. The execution is flawless. The competitive advantage is insurmountable. The growth trajectory is exponential.

That’s the job.

A CEO’s job isn’t just to run the company. It’s to sell the company. To investors. To the media. To employees. To customers. The story is the product, and they’ve got PR teams on six-figure retainers making sure that story sounds absolutely bulletproof.

And most of them are good at it. They should be. They’re professionals.

The Media’s Role

The business media exists to write stories about businesses. The Australian Financial Review, the Wall Street Journal, the New York Times business section—they’re in the story business.

Why? So they can sell subscriptions and advertising to fill the gaps around those stories.

That’s their business model.

Do they really care where you invest or how well your portfolio performs? Of course not. That’s not their job. Their job is to keep you reading. Engaged readers become subscribers. Subscribers become revenue.

There’s nothing sinister about this. It’s just incentives doing what incentives do.

But it means the stories they publish are optimised for engagement, not outcomes. Drama sells. Complexity sells. “The next big thing” sells. “Company quietly compounds at 12% for a decade” doesn’t.

What We Actually Do

Don’t get me wrong—we read the AFR. We read the business press most days. We listen to the stories.

But our job is to make sure we don’t accept those stories as gospel when we’re deciding what to invest in.

We let the numbers tell the story. Not the CEO. Not the PR team. And certainly not the business media.

It’s not that the numbers never lie. They do. They’re compiled and reported by humans, after all. And those humans sometimes have incentives to make the numbers look better than they really are.

But here’s the difference: there are serious legal consequences for publishing incorrect numbers. There aren’t really legal consequences for “selling a vision.”

You can promise the moon. You can talk about disruption and transformation and paradigm shifts until everyone in the room is nodding along. None of that is actionable if it doesn’t materialise.

But if you misreport revenue? If you hide liabilities? If you cook the books? That’s fraud. That’s jail time.

So we focus on the numbers that are harder to fake and have consequences attached.

The Numbers That Matter

The price-to-operating cash flow ratio tells a story. The growth-over-PE ratio tells a story. The amount of equity the owners hold tells a story. How many consecutive quarters of equity growth the company has tells a story.

These aren’t exciting stories. They don’t involve disruption or moonshots or revolutionary technology that’s going to change everything.

They’re boring stories. Stories about profitability. About cash generation. About balance sheets that don’t require you to squint and believe in the future.

From time to time, these numbers tell us the story we want to hear.

It’s always the same story: a company that is making money but can be picked up momentarily at a discount to its true valuation.

That’s the only story we really care about. The story about quality and value.

The Growth Trap

Growth stories are seductive. They have to be. That’s how they work.

“We’re not profitable yet, but once we reach scale…”

“We’re investing heavily in R&D because the market opportunity is…”

“Traditional metrics don’t apply to us because we’re…”

Maybe it works out. Sometimes it does. Occasionally, spectacularly.

But most of the time? Most of the time, the growth story is just an expensive way to lose money while feeling smart about it.

The market is full of companies that had incredible stories. Visionary CEOs. Enthusiastic media coverage. Excited investors.

And then the numbers didn’t show up.

Because here’s the thing about stories: they’re forward-looking. They’re about what could happen. What might happen. What the CEO really, really believes will happen.

Numbers are backward-looking. They’re about what did happen. What actually occurred. What the company proved it could do.

We prefer proof to promises.

Once Upon a Time

“Once upon a time, in a land not that far away, there lived a company that was unloved by the market…”

That’s the beginning of our favourite story.

Not “Once upon a time, there was a visionary founder with a revolutionary idea that would change the world.”

We want the company that’s already doing the work. Generating cash. Growing equity. Trading at a discount because it’s boring, or out of favour, or in an unsexy industry, or just temporarily forgotten.

The market will tell you a thousand stories about the future.

We’d rather invest in the companies with a track record in the present.

Because when it comes to your money, the only story that matters is the one the numbers tell.

And numbers don’t need a PR team.

STOCK ANALYSIS OF THE WEEK

For edition 204 of my weekly Australian Light member email this Monday, I did an analysis of Harmoney Corp Limited (HMY). Australian Light and Club members can read it here.

For edition 3 of the U.S. Light member email, I did an analysis of XPLR Infrastructure LP (XIFR). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week.

On the full weekly podcast, Tony did a deep dive on Fenix Resources (FEX). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-01-04

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-01-03

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

QAV DUMMY

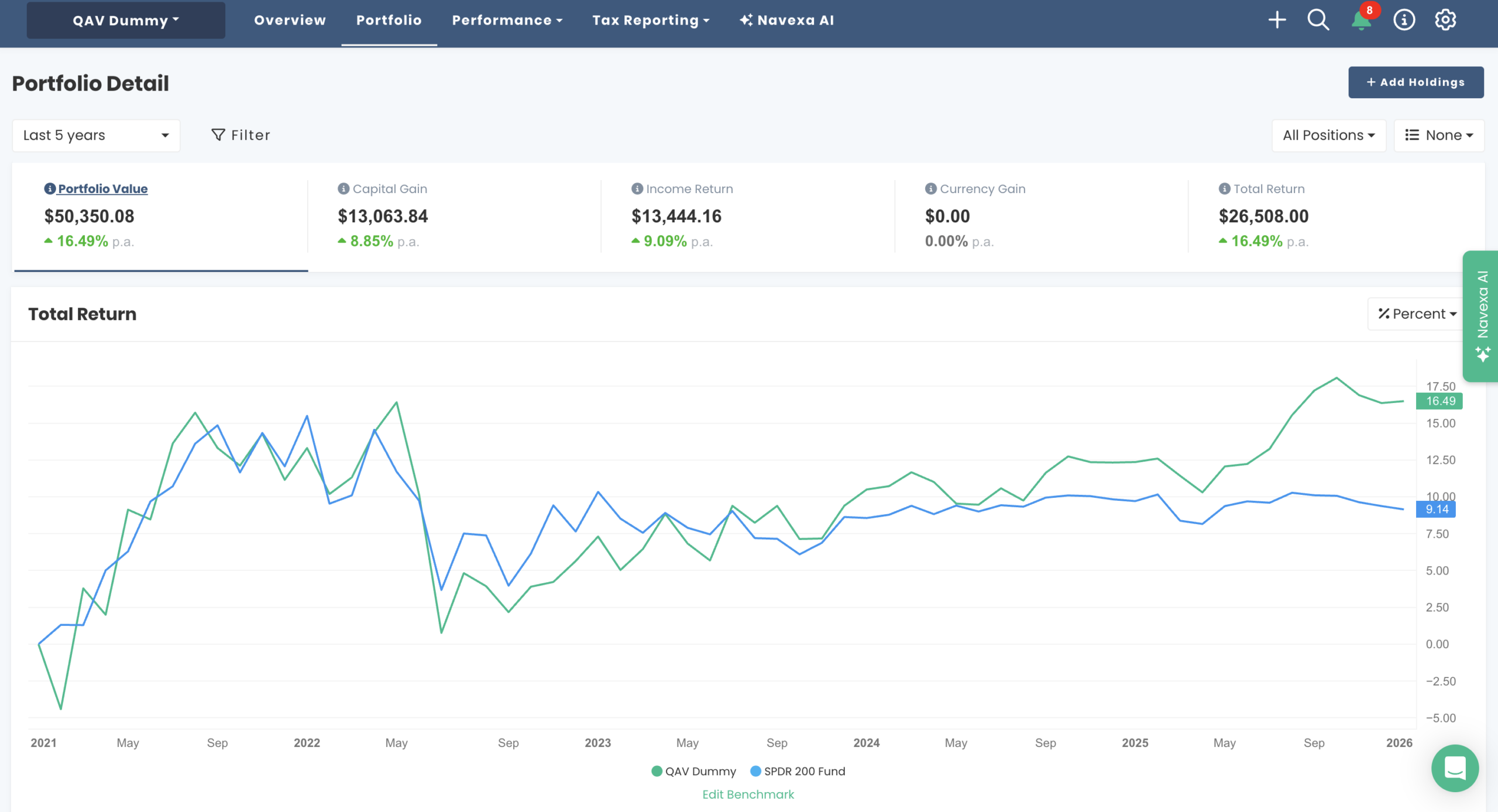

Five Year Report: Over the last five years, our portfolio is +16% p.a. vs the benchmark +9% p.a.

Monthly Report: The AU Dummy Portfolio was +2% p.a. for the last 30 days vs the benchmark +0.9% p.a.

No trading in that portfolio this week.

For the 2025 CY, our portfolio was +27% vs +10% for the index – nearly TRIPLE MARKET.

QAV LIGHT

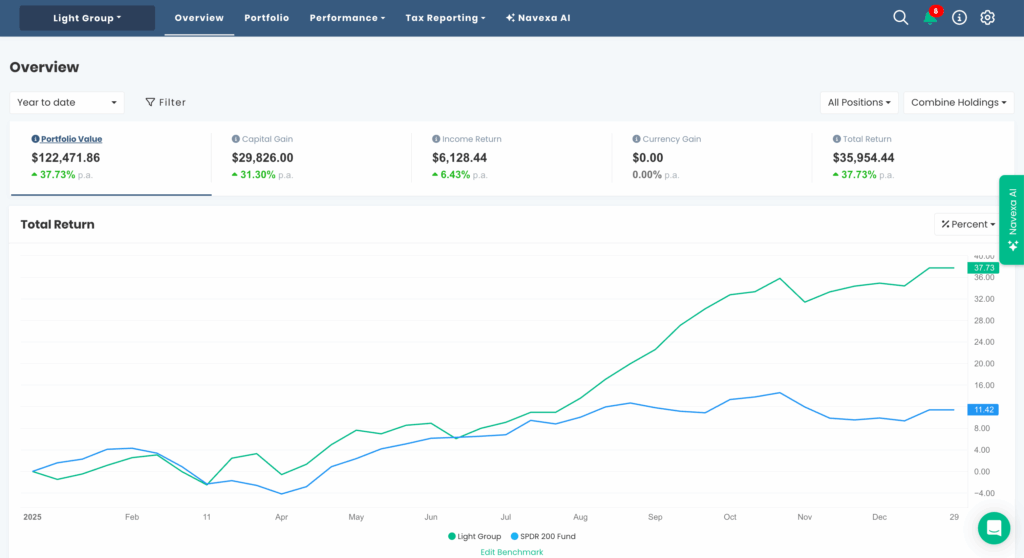

In the last 30 days, the Light portfolio was +4% vs the index which was +0.9%.

Our most impressive return for the last 30 days is CVL (+25%).

For the last 12 months, the Light portfolio is +37% vs the index +9%. In other words — TRIPLE MARKET.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

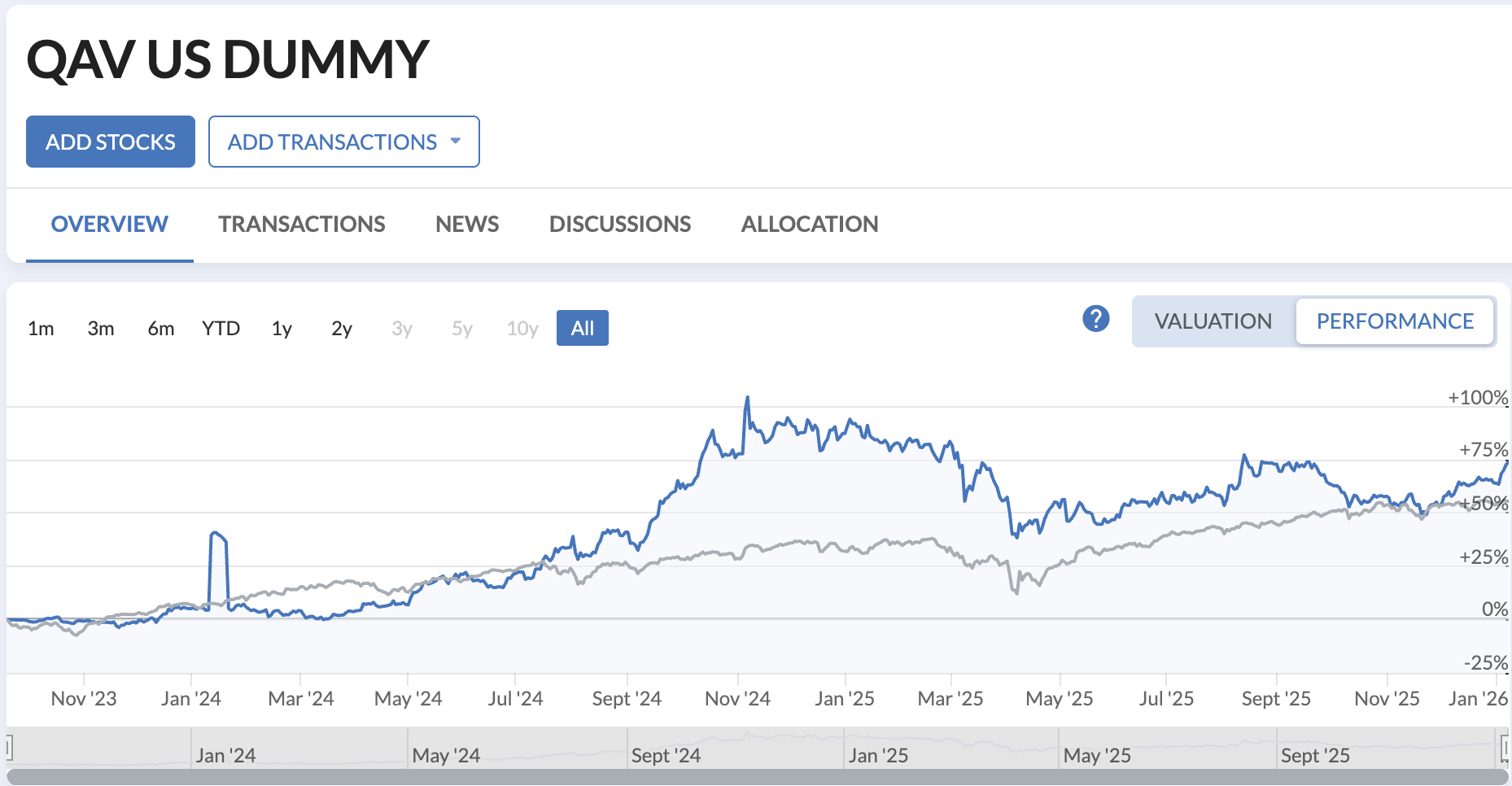

Since inception (Sep 2023), our portfolio is +74% vs the S&P 500 +55%.

Our U.S. portfolio for the last 30 days was +8% vs +0.7% for the S&P 500.

No trades this week.

QAV LIGHT

I’ve recently started our U.S. Light portfolio, too, but it’s too early to bother reporting.

THIS WEEK’S EPISODES

QAV AU 901 — Broccoli Investing

The Walking Dead Investment: AMC Networks – QAV AMERICA 33

STOCK NEWS AND UPDATES

- Trump’s Venezuela plan risks intensifying an oil price collapse

- Every Wall Street analyst now predicts a stock rally in 2026

- Equity investors could not be more optimistic, and it is terrifying

- Insider Stock Buying Reaches AU$7.45m On Bhagwan Marine

- The Holy Grail of investing: How to spot ASX Ten Baggers before the masses pile in

- COMMODITIES

This week we reported that Steel has become a Buy.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com