Hi folks,

Here’s my weekly portfolio and podcast update and some thoughts on why it’s important to have firm rules governing your investing.

As I mentioned last week, I’m looking for some members to come on the Xmas show while Tony takes a week off to play golf. Tell me about your investing journey pre- and post-QAV. We want to hear your story! I know a lot of our members have had stunning performance this year, sometimes for the first time in their investing careers. Let’s hear about it! Shoot me an email if you’re interested in being a guest.

All the Best,

Cam

QAV MYTH KILLERS

Here’s the uncomfortable truth most of the investment industry would rather you didn’t sit with for too long.

Your instincts are terrible at picking stocks.

Not because you’re stupid. Because you’re human.

And the entire financial media ecosystem is built to exploit that.

The Manufactured Drama

The dominant belief pushed by financial TV, newspapers, podcasts, brokers, influencers and “market experts” is that good investing comes from being informed, staying close to the action, reacting quickly, and trusting experienced voices who “know what’s going on.”

Watch more. Read more. Trade more. React faster.

The subtext is always urgency. Something is happening. Something is about to happen. Something has just happened and you’re already late.

This isn’t accidental. These businesses don’t get paid when you sit still. They get paid when you click, watch, trade, rebalance, switch funds, chase themes, panic, and FOMO your way into action.

Ask a simple question: who pays their bills?

Advertisers. Fund managers. Brokers. Trading platforms. Asset gatherers.

None of them benefit when you do nothing. None of them benefit when you stick to a boring process and ignore the noise. None of them benefit when you quietly compound over decades.

So they manufacture drama. They turn markets into a 24-hour reality show. And they sell you the illusion that reacting emotionally is the same thing as being intelligent.

It isn’t.

Why People Fall For It

Most people start investing knowing almost nothing. That’s normal. We don’t get taught this stuff properly, if at all.

So we assume the loudest voices know what they’re doing. We assume suits, charts, jargon and confidence equal competence. We assume “experts” must have our interests at heart because surely they wouldn’t be allowed to talk if they didn’t.

Add fear and greed to the mix and you have a perfect psychological storm.

Fear of missing out. Fear of looking stupid. Fear of losing everything. Greed for easy wins. Greed for status. Greed for the story you’ll tell at dinner.

Influencers understand this. Media producers understand this. Brokers understand this. They aren’t stupid. They know exactly which emotional buttons to press.

And we press them ourselves.

The Quiet Collapse

Here’s the assumption that quietly collapses the whole story.

If these people genuinely knew how to consistently beat the market, they wouldn’t need to sell you commentary.

They wouldn’t need to pump content. They wouldn’t need affiliate links. They wouldn’t need constant visibility. They wouldn’t need your attention at all.

They would be quietly, professionally, relentlessly compounding their own capital.

That’s what real edge looks like. Silence. Boredom. Repetition.

Instead, what you mostly see are people whose income depends on activity, not outcomes. On engagement, not results. On persuasion, not accuracy.

That doesn’t mean everyone is lying. It means incentives matter. And when incentives are misaligned, the advice becomes noise, even if it sounds smart.

The Real Damage

The real damage isn’t one bad trade.

It’s thousands of small emotional decisions stacked on top of each other over decades.

Buying because you’re excited. Selling because you’re scared. Holding because you’re hopeful. Dumping because you’re embarrassed. Chasing because “everyone’s talking about it.” Freezing because you don’t want to be wrong.

Each decision feels small. Each one feels justified in the moment. But each one quietly leaks value from your portfolio.

A one percent difference per year doesn’t sound like much. Over thirty years, it’s the difference between “comfortable” and “why did I bother.”

Worse, this emotional churn trains people to believe investing is impossibly complex. That it’s a game for insiders. That ordinary people can’t win unless they’re glued to screens or gifted some mystical intuition.

That belief alone has probably destroyed more wealth than any bear market.

The Actual Solution

Emotion is the enemy. Not markets. Not volatility. Not uncertainty.

The moment you remove emotion from decision-making, outcomes improve. Not perfectly. Not magically. But meaningfully.

An algorithm doesn’t get excited. It doesn’t panic. It doesn’t care about headlines, hot takes, or vibes. It does the same thing today that it did yesterday, and it will do the same thing tomorrow.

If those rules are grounded in evidence, logic, and long-term testing across multiple market cycles, they don’t need to be clever. They need to be consistent.

No system wins all the time. Anyone claiming otherwise is selling something. A realistic goal is being right more often than you’re wrong and letting compounding do the heavy lifting. Even legendary investors admit they’re wrong a lot.

The edge isn’t perfection. It’s discipline.

And discipline is almost impossible for humans to maintain without rules.

You don’t need more opinions. You don’t need better intuition. You don’t need another guru.

You need a process that doesn’t care how you feel.

We use one. It’s boring. It’s rule-based. It ignores the noise. It doesn’t need to explain itself on television.

And it exists for a reason.

STOCK ANALYSIS

For edition #201 of my weekly Light member email this Monday, I did an analysis of a retail institution that’s older than the Commonwealth of Australia itself. We’re talking about Myer Holdings Limited (ASX: MYR) — the department store chain that’s been helping Aussies look sharp, deck out their homes, and buy slightly overpriced luggage since 1900. Light and Club members can read it here.

On the full weekly podcast, Tony did a deep dive on copper miner Aeris Resources (ASX: AIS). See the podcast link down below if you want to listen to his analysis. That episode is also available to free listeners.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week.

QAV Value Investing Buy Lists 2025-12-15

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

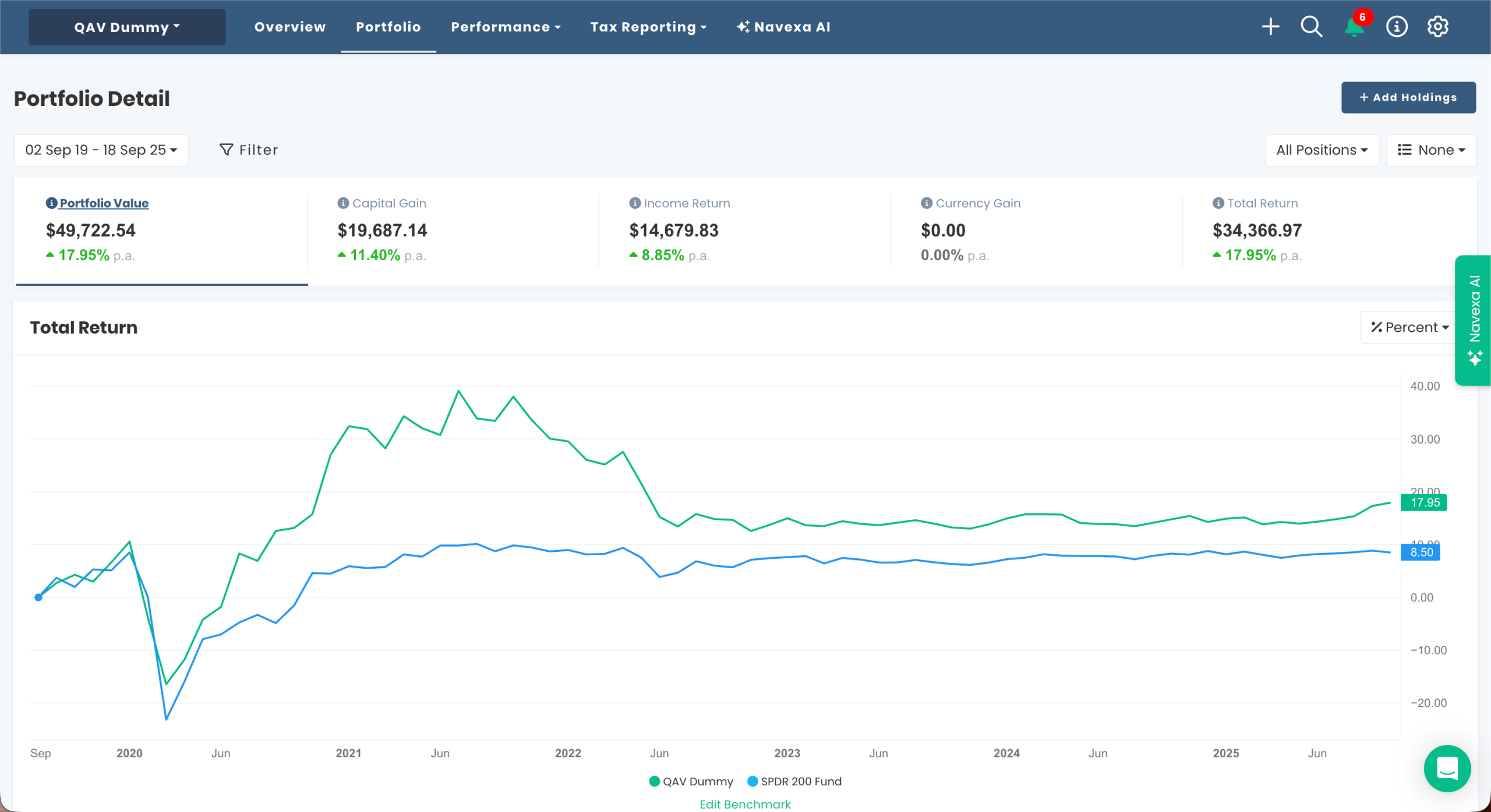

QAV DUMMY

Inception Report: Since inception (Sept 2019) our portfolio is +18% p.a. vs the benchmark +8% p.a.

Monthly Report: The AU Dummy Portfolio was +0.53% p.a. for the last 30 days vs the benchmark +2.14% p.a.

No trading in that portfolio this week.

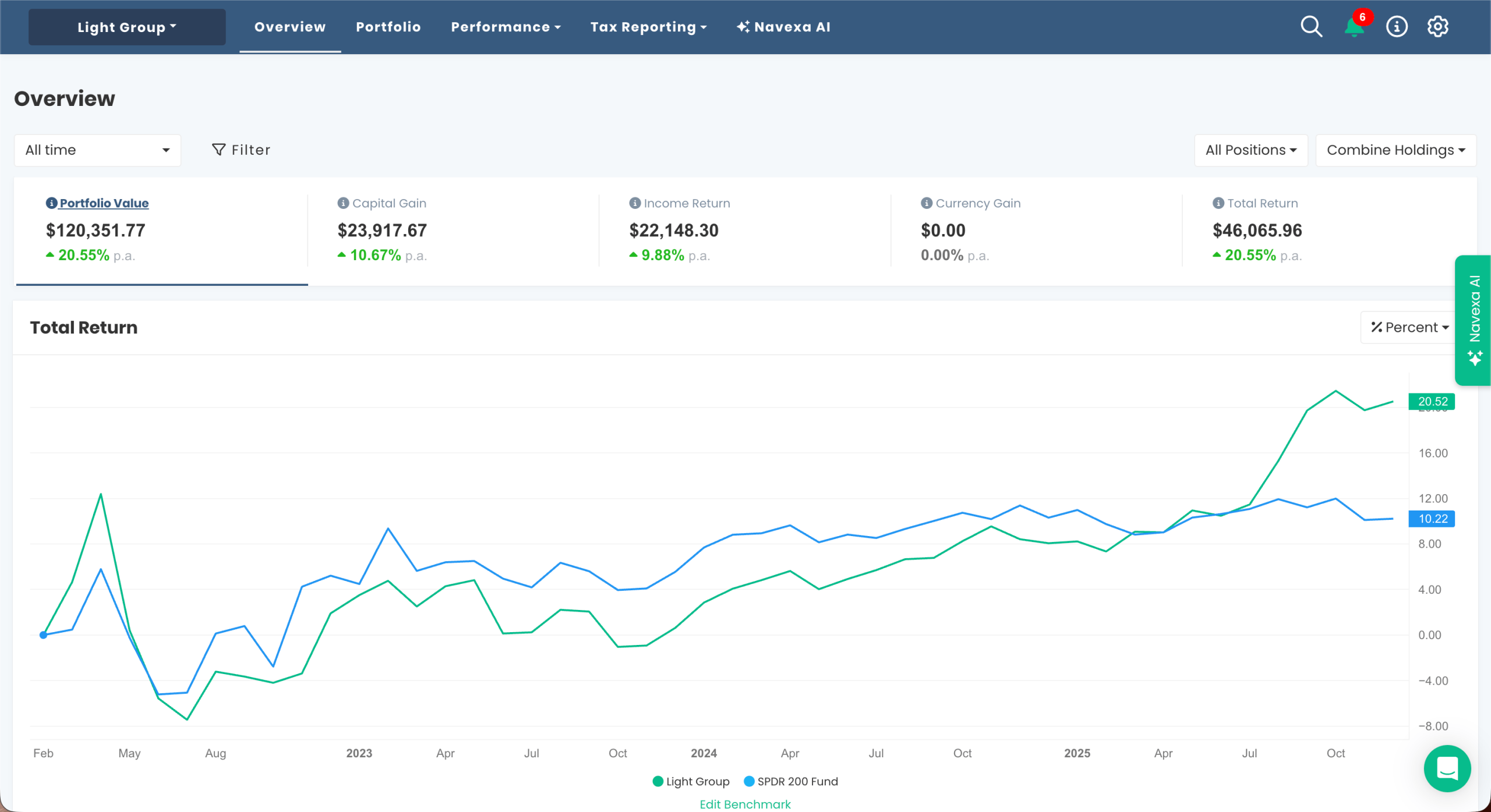

QAV LIGHT

Inception Report: Since inception (Feb 2022) our portfolio is +20% p.a. vs the benchmark +10% p.a.

Monthly Report: The AU Light Portfolio was +3.5% p.a. for the last 30 days vs the benchmark +2% p.a.

No trading in those portfolios this week.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

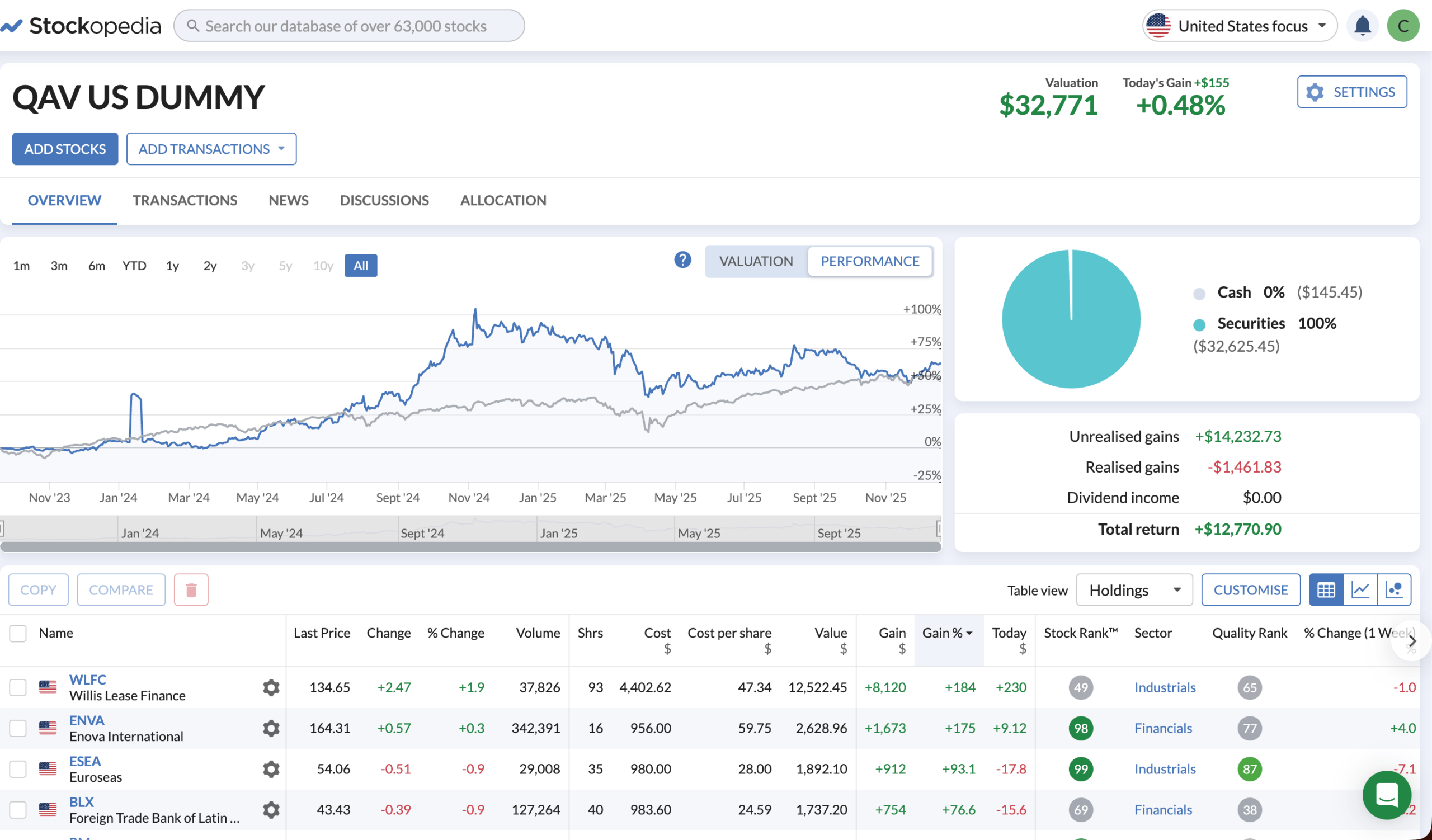

AMERICAN

Since inception (Sep 2023), our portfolio is +63% vs the S&P 500 +52%.

Our U.S. portfolio for the last 30 days was +6% vs +2% for the S&P 500.

No trades this week.

THIS WEEK’S EPISODES

Vale – The World’s Largest Iron Ore Producer – QAV America #31

STOCK NEWS AND UPDATES

Gold was back to being a buy on our commodity list this week, and Iron Ore and LNG both became Josephines.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com