Hi folks

Here’s my weekly update and some thoughts on how we think about the financial press.

To mix it up this year, I’m looking for some members to come on the Xmas show while Tony takes a week off to play golf. Tell me about your investing journey pre- and post- QAV. We want to hear your story! I know a lot of our members have had stunning performance this year, sometimes for the first time in their investing careers. Let’s hear about it! Shoot me an email if you’re interesting in being a guest.

all the best,

Cam

QAV MYTH KILLERS

Why We Ignore the Financial Press (Mostly)

Okay so this one isn’t really about debunking a “myth” – it’s about debunking the financial press.

When we say “we ignore the financial press,” I don’t mean we’re wandering around like investing monks who’ve taken a vow of headline celibacy. That’s not it. I read the Financial Review (the Australian version of the Wall Street Journal) every day. I’m just not reading it the way some other investors do.

Here’s what you need to understand: the financial press isn’t designed to make you money. It’s designed to make the PUBLISHER money.

They manufacture stories. Stories keep you clicking. Clicking keeps the ad revenue flowing and keeps the lights on. That’s their business model.

And stories are easy to make. PR agencies feed journalists polished narratives in boardroom language. Entire articles begin as pitch emails from people whose job is literally “make my client look investable.” Nothing sinister. Just incentives doing what incentives do.

Which leads to the question I always want to ask finance journalists: if you’re so good at this, why are you still working?

Tony and I have been surprised over the years we’ve been doing the show when we’ve spoken to some of Australia’s most respected finance journalists and asked them about their own investing, only to find out they aren’t active investors. They talk about investing for a living – they just don’t do much of it themselves. It’s like the barber who doesn’t cut his own hair.

And if they were any good at investing, they probably wouldn’t still be working their jobs and stressing over deadlines. Like Tony, they would have retired young.

But that’s the thing – most finance journalists aren’t trying to be investors. They’re storytellers. Their job is to transform chaos into digestible narrative before your morning coffee. And they’re good at it. Stories are seductive. Humans need them. Markets run on them.

Most short-term market movement is story-driven. Fear stories. Hype stories. “This time it’s different” stories. “Value investing is dead” stories. “AI is a bubble” stories. “AI is NOT a bubble” stories. The cycles are so predictable you could set your watch by them.

But QAV isn’t a storytelling system. It’s a numbers system. We don’t react to stories. We react to data.

That doesn’t mean stories are useless. It means they’re not decision inputs. Unless they are bad news stories. Those we listen to.

Here’s how we actually use the financial press:

Spot trouble early. When a company we own hits headlines for fraud, sudden C-suite departures, regulatory probes, accounting irregularities, whistleblowers, that gets our attention. Then we check the numbers. Sometimes we’ll put a “red flag” on a company until their management lifts their game – or gets replaced.

Discover new hunting grounds. Sometimes a journalist covers a company or sector we haven’t explored. Good. We don’t buy the story. We add the companies to our spreadsheet and see if the numbers work.

Filter the noise. Market predictions, analyst opinions, “experts warn,” “experts say”—none of this correlates with long-term returns. It’s entertainment cosplaying as insight.

The distinction: we don’t hate stories. We refuse to outsource decisions to them.

Stories tell you what people believe.

Numbers tell you what the business is and how it’s doing right now.

You need both to understand the world. Only one should drive your portfolio.

As Tony often says: “If I want to hear a story, I’ll buy a book.”

Interest rates are going up? Great – we follow our rules.

Interest rates are going down? Great – we follow our rules.

Some economist said the bubble is about to burst? Great – we follow our rules.

Some other economist said the first economist doesn’t know what she’s talking about? Great – we follow our rules.

If you’re new to QAV, this is the shift: stop letting headlines manipulate your emotions. Start treating stories as noise that occasionally contains signal. We have rules. We follow them, day-in, day-out. It makes investing simple and predictable. And it works.

The financial press can be useful. Just not the way most investors use it.

The market chases stories.

We chase value.

We laugh at the news cycles and keep our eye on the big picture – turning over rocks, looking for well-run companies that we can buy at a discount.

STOCK ANALYSIS

For our Light members this Monday, I did an analysis of Euroz Hartleys Group Limited (ASX: EZL), a Perth‑based, diversified Australian financial services firm operating principally through two segments: Private Wealth and Wholesale. Light and Club members can read it here.

On the weekly Australian podcast, Tony did a deep dive on Select Harvests Limited (ASX: SHV). See podcast link down below if you want to listen to his analysis.

On our U.S. show last week, I did a deep dive on AerCap (AER), the Irish plane leasing behemoth. See our U.S. show below for details.

BUY LIST

Each week we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week.

QAV Value Investing Buy Lists 2025-12-08

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top performing Super Funds in Australia.

AUSTRALIAN

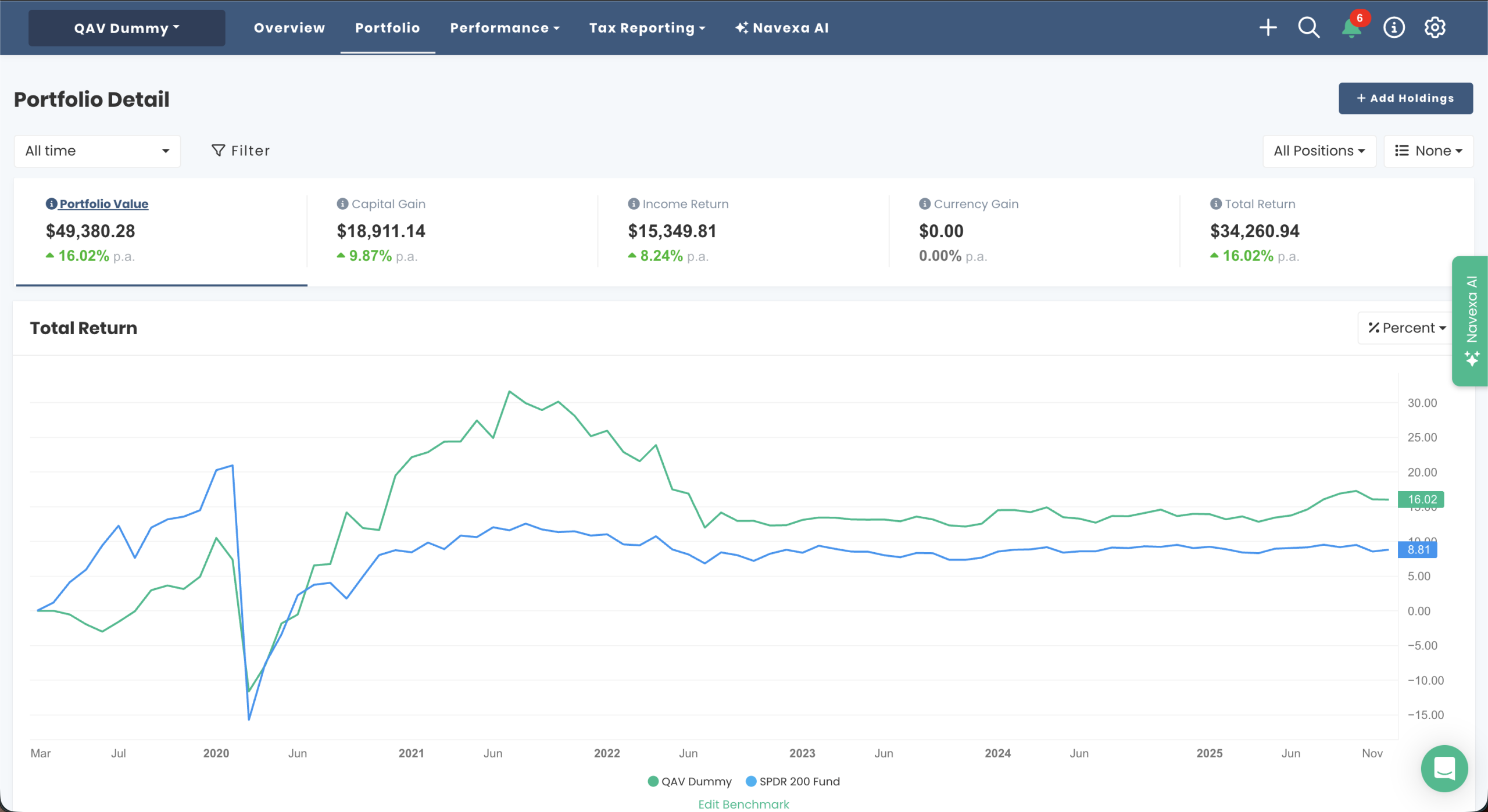

QAV DUMMY

Monthly Report: The AU Dummy Portfolio was -1.74% for the last 30 days vs the benchmark -1.75%.

Inception Report: Since inception (Sept 2019) our portfolio is +16% pa vs the benchmark +8% pa.

We also had to do some trading in that portfolio this week.

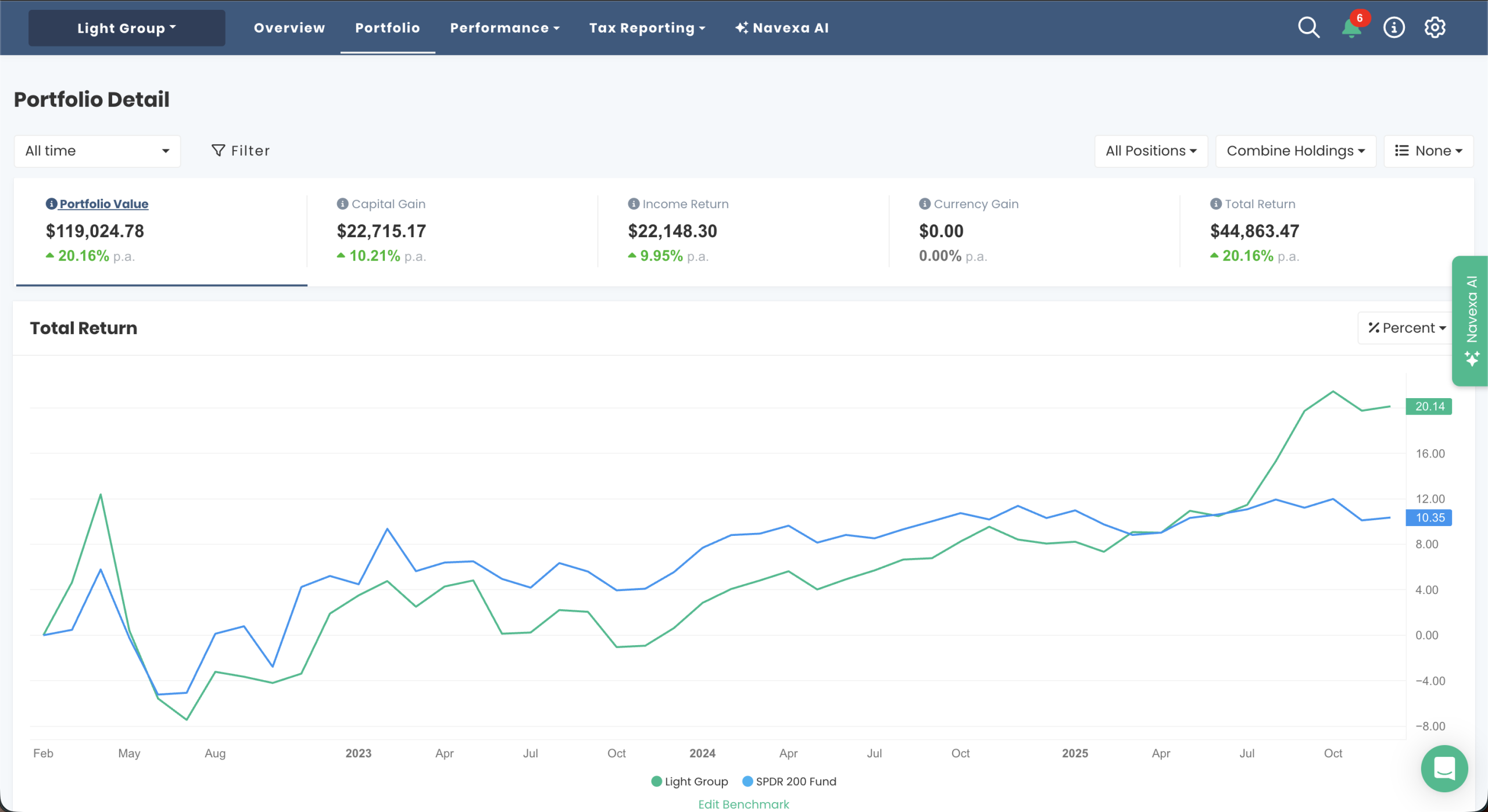

QAV LIGHT

Monthly Report: The AU Light Portfolio was -0.09% for the last 30 days vs the benchmark -1.78%.

Inception Report: Since inception (Feb 2022) our portfolio is +20% pa vs the benchmark +10% pa.

We did do some trading this week, which Light members are already aware of.

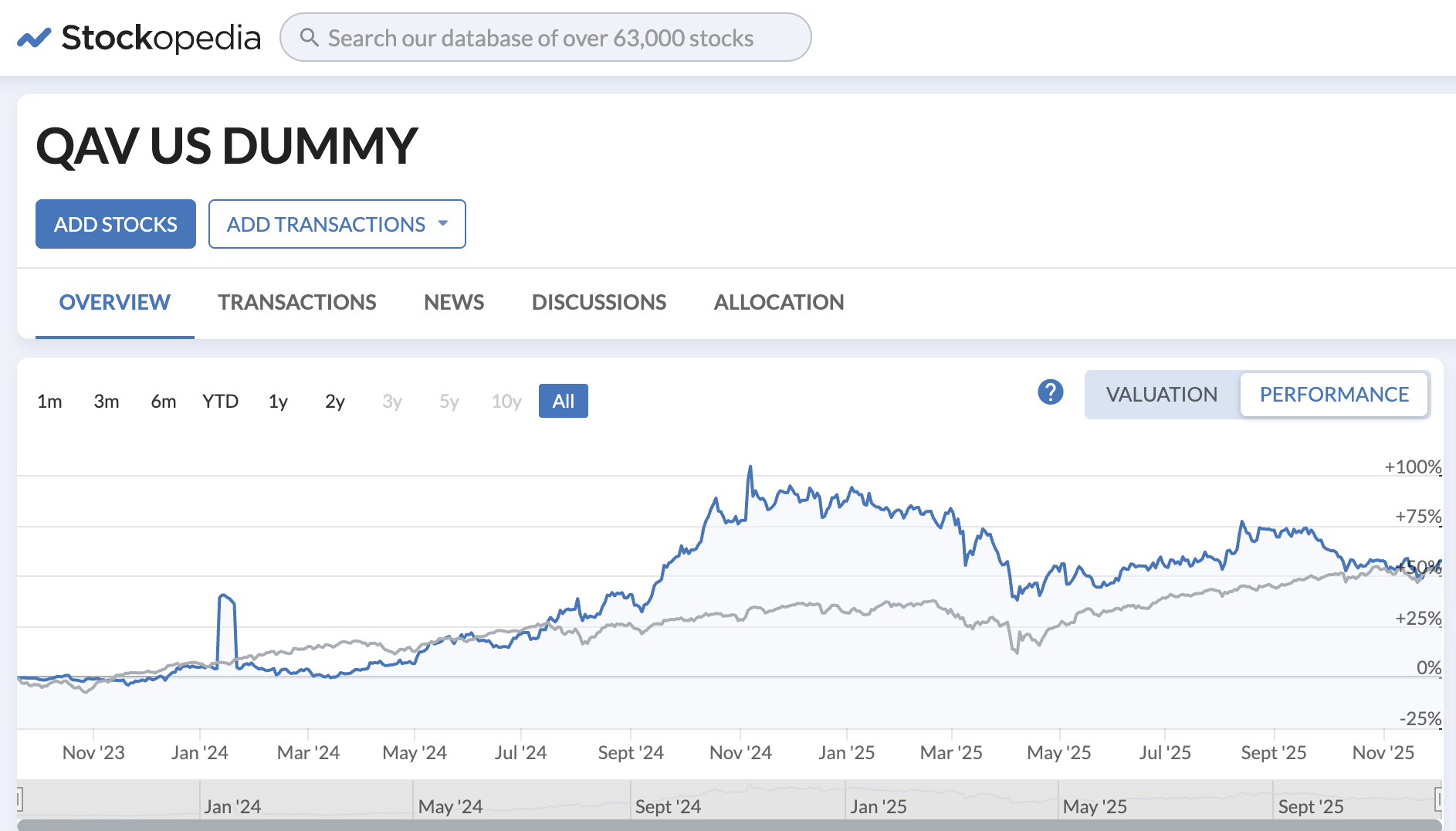

AMERICAN

Our U.S. portfolio for the last 30 days was +4.3% vs +0.79% for the S&P500.

Since inception (Sep 2023), our portfolio is +62% vs the S&P500 +55%.

No trades this week.

THIS WEEK’S EPISODES

QAV AU 849 — Shake the Tree and Let the Nuts Fall Out

Leasing the Sky: AER – QAV America #30

STOCK NEWS AND UPDATES

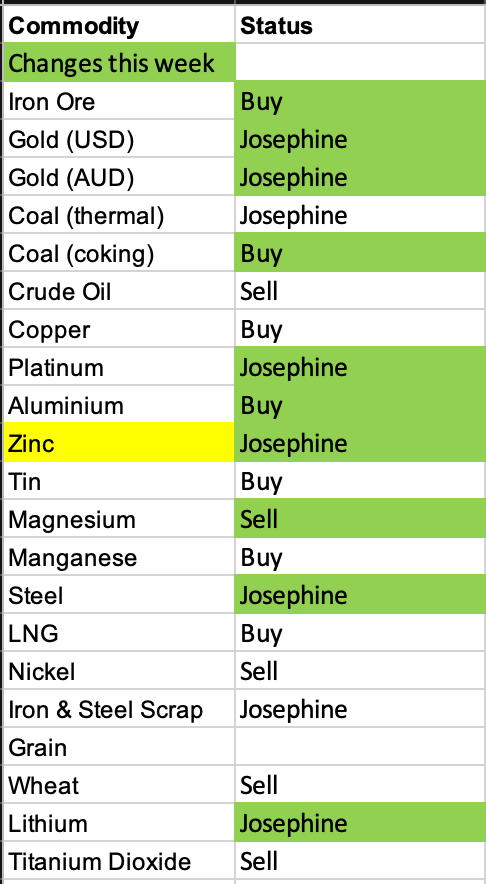

On the commodities front, this week’s buy list had a few changes, with GOLD becoming a Josephine, which is interesting.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com