Hi folks,

I hope you’re all having a great week and your portfolios are doing well. The markets recovered this week from a hard collapse at the end of last week. As always, we just keep following our rules and staying frosty.

All the Best,

Cam

QAV MYTH KILLERS

Invest in MASS, not GAS

This week I’ve been reading The Black Hole War by American theoretical physicist Leonard Susskind. Funnily enough, it got me thinking about investing.

As you might expect from the title, he’s talking a lot about black holes and the relationship between mass, gravity, acceleration, and Einstein’s General Theory of Relativity. As I’m reading it, analogies to investing keep jumping out at me.

Finding the Mass

When thinking about how we invest in QAV, I think of our ideal targets as being mass-heavy businesses. Mass, in this case, is their intrinsic value and quality as a company.

One of the key mass metrics we look at is the comparison between their Price and their Operating Cash Flow. We like a business that generates cash. Cash is king. Cash is mass. It’s the cash flow that attracts us. It creates a gravitational pull. Companies with strong cash flow have options: they can reinvest, acquire, return capital to shareholders, or weather downturns. Gas companies have only hope.

A typical QAV target looks like a large planet that’s billions of years old. It has a functional ecosystem that’s been evolving over millennia and is predictable. It might be boring when compared to newly-formed planets that are still a ball of hot molten metal, giving off lots of heat, but we prefer to settle on something that is up and running. That doesn’t mean it can’t have problems, but it’s proven its ability to make money. It’s what physicists call a Low Entropy system: it’s ordered, disciplined, and predictable.

Some QAV targets are bigger than a planet. They are a star system, “star stocks”. We don’t end up with many of those, because usually they are overvalued, but occasionally they turn up on our buy list (MQG, QAN, etc). They don’t just have an internal ecosystem, they have an entire solar system of value creation surrounding them.

Of course, not every business we invest in is a giant planet or star. Some are smaller, “cigar butt” types that have seen better days but are still generating some mass. Some are turn-arounds: businesses that have had some major challenges and had to re-invent their own physics.

But they still have cash. Either from regular operating activities or, in some cases, from selling off business units and cashing themselves up. I’m particularly thinking of TUSK, the company I did a pulled pork on this week for QAV America. An experienced management team will use that cash wisely and it will bring in even more mass.

Don’t Bet on Gas

On the other hand, the companies that get the most attention in the financial media are gas entities. You have the “Gas Giants” and you have the “Comets” racing through space. Gas giants are impressive to look at. They generate a lot of hype but haven’t developed any serious mass. Their share price is often predicated on predictions of future earnings, which are mostly gas. We struggle to justify the buy price when we look at their current intrinsic value (i.e. their actual mass).

At its peak in early 2021, Afterpay hit a market cap of around ~$39 billion AUD while reporting revenue of ~$920M and without being profitable. Their valuation was entirely based on “we’ll monetise this user base eventually”. Classic gas giant. Huge, impressive-looking, but the price was all predictions about future dominance in BNPL, not current cash generation. Square (now Block) bought them for $29B USD in 2021, and the acquisition has been (let’s say) underwhelming for Block’s shareholders.

In the American market, WeWork was valued at $47B in 2019 despite never turning a profit. Presented itself as a tech company when it was really just a real estate sublease business haemorrhaging cash.

Even genuine stars can be overvalued. The Mag7 companies generate real mass, but their stock prices have inflated into gas clouds: trading at P/Es of 25-46 when our value approach typically targets much lower multiples. We’re not paying $46 for $1 of current earnings, no matter how bright the star.

Nobody knows for sure if the future will come to pass. The analysts are just guessing (or… gassing).

Then you have the Comets. A comet is a smaller, fast-moving icy body that warms up and begins to release gases when passing close to the Sun: a process called “outgassing.” They look spectacular. They are pretty and we wish upon them at night. But investing isn’t about wishing. It’s about science. It’s about finding mass, not betting on gas.

And don’t even get me started on Crypto. If Future Earnings are Gas, Crypto is Plasma. It’s the fourth state of matter: high-energy, electrically charged, and completely lacking a fixed shape or “Rest Mass.” It looks like a sun while the social “heat” is high, but it has no internal gravity to hold it together. When the market heat turns off, the plasma doesn’t just shrink: it vanishes back into the vacuum. You can’t land a ship on plasma… but you might get burned.

The Event Horizon

While a lot of companies we invest in continue to grow in mass every year (see KOV, up nearly 400% since we bought into them in 2020), sometimes companies we invest in disappear.

When a star becomes dense enough, it creates a Singularity: it collapses in on itself and becomes a black hole. The star disappears. When a company becomes dense enough (meaning the value is high but the price is low), it can also disappear.

Quite often, this takes the form of an acquisition or privatisation. We see that happen with a lot of QAV stocks. AHX was suspended last week after a takeover approval and PPM surged this week on a buy-out bid. In these situations, we tend to do quite well, as the Singularity takes the form of a rapid re-rating of the price.

Alternatively, a company might descend into high entropy: chaos and bad decisions that burn through its cash. That kind of system doesn’t become a black hole, it just becomes a dead planet and delists. That’s usually not a good outcome for investors and it’s why we need to understand our escape velocity, our Sell Triggers (3PTL, Rule 1, etc).

So we’re like Captain Kirk and the Enterprise. We’re out there searching for systems with a lot of mass. We zoom on past the gas giants, the comets, the major stars and the balls of hot plasma, acknowledging how pretty they are to star-gazers, but not deeming them worthy to land on. We’re going to land on planets with a lot of mass and maybe meet a nice green alien lady to talk to. Just be careful of the Tribbles.

STOCK ANALYSIS OF THE WEEK

We are still in “Reporting Season”, and there’s still been nothing on my buy list this week that has reported yet, so I’m still in waiting mode.

For edition 8 of the U.S. Light member email, I did an analysis of Mammoth Energy Services (TUSK). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week. It’s a pretty crazy story involving hurricanes, bribery of federal officials, executives going to prison and nepotism. I swear the companies on our American buy list have much more interesting stories…

On the full Australian podcast this week, Tony did a deep dive on Atlas Pearls (ATP). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-02-09

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-02-09

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

QAV DUMMY

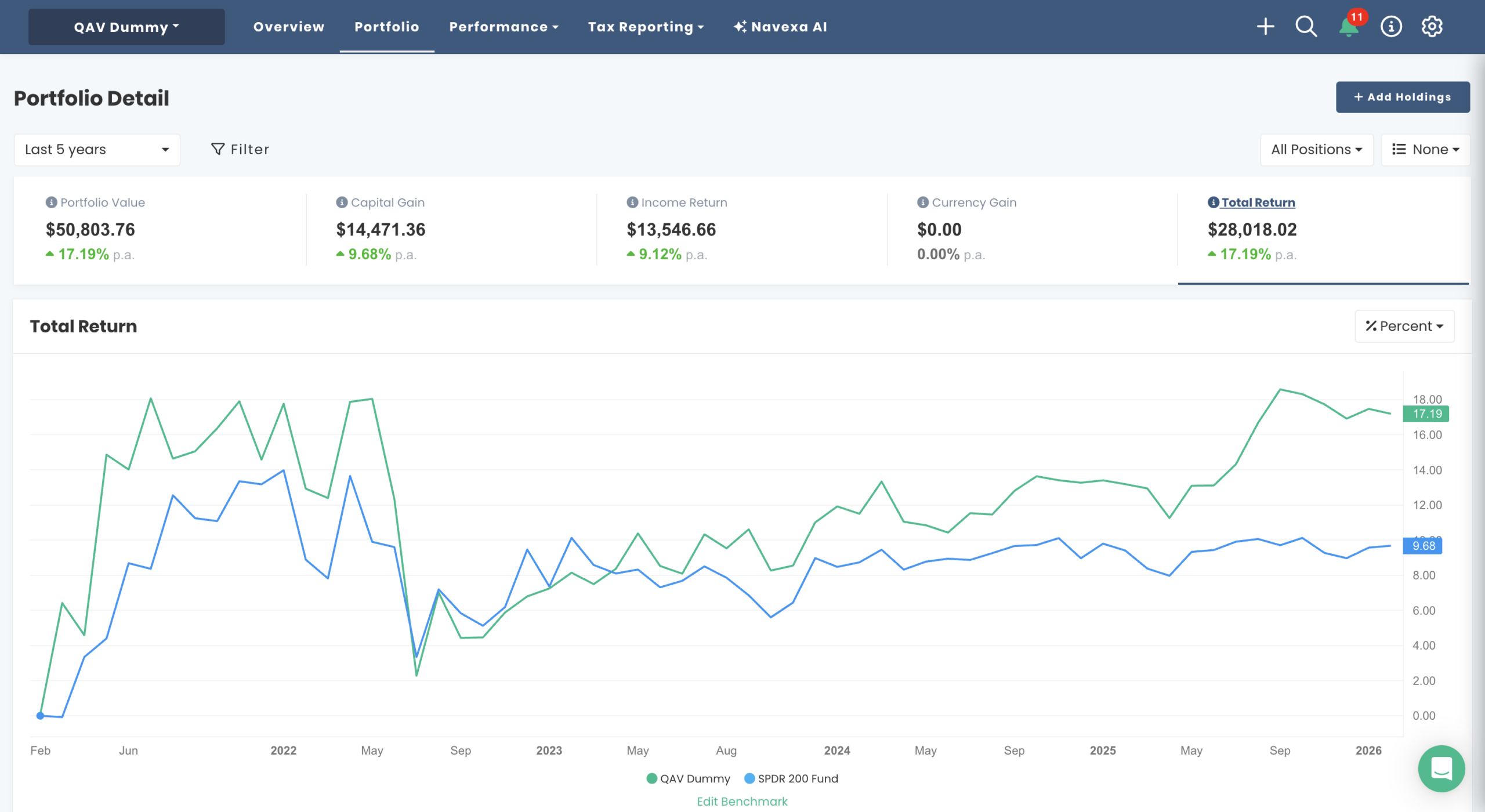

Five Year Report: Over the last five years, our portfolio is +17% p.a. vs the benchmark +10% p.a.

Monthly Report: The AU Dummy Portfolio was +0.7% p.a. for the last 30 days vs the benchmark +2.65% p.a.

No trading in that portfolio this week.

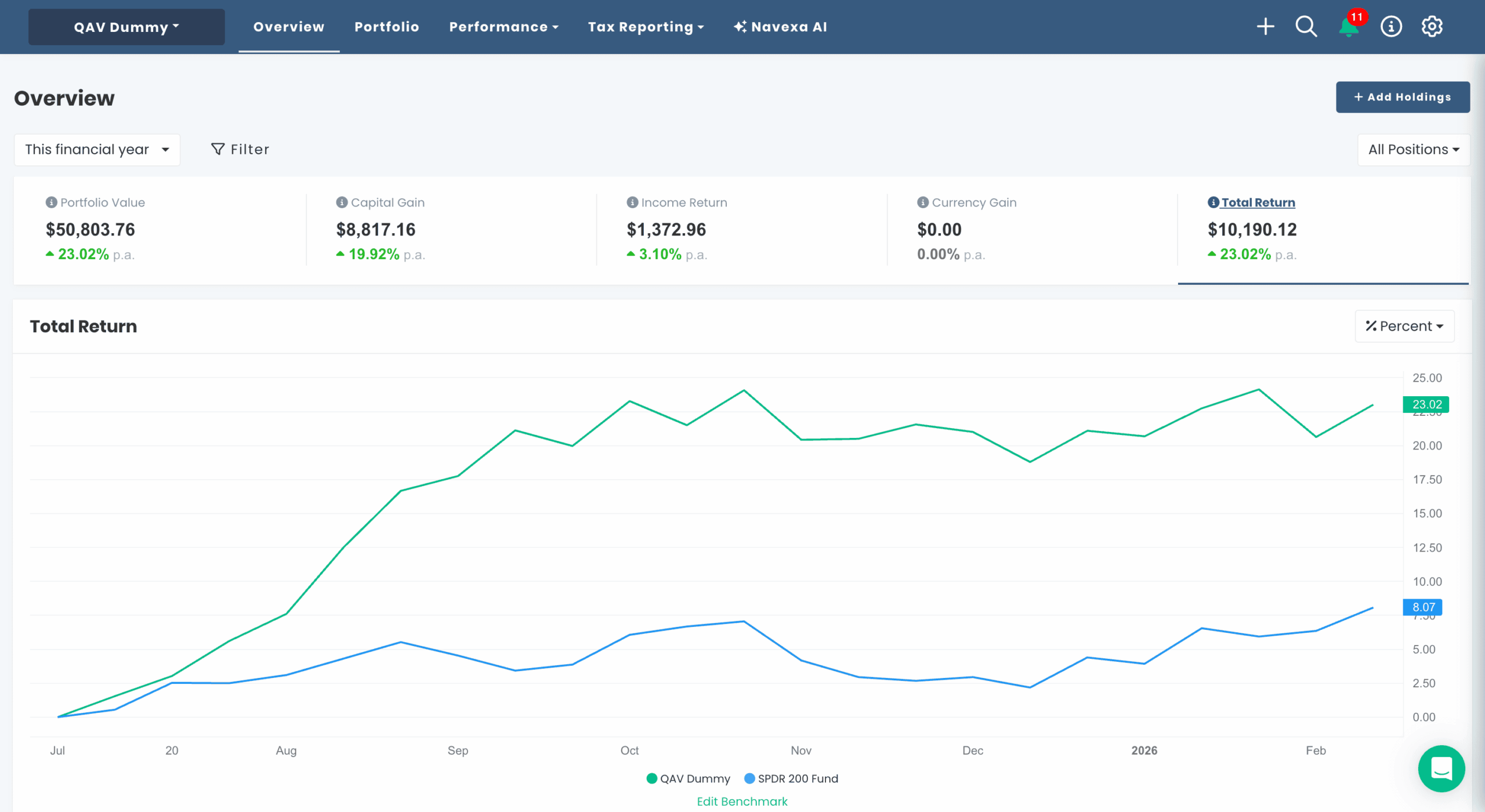

For FY26, our portfolio is +23% vs +8% for the index.

QAV LIGHT

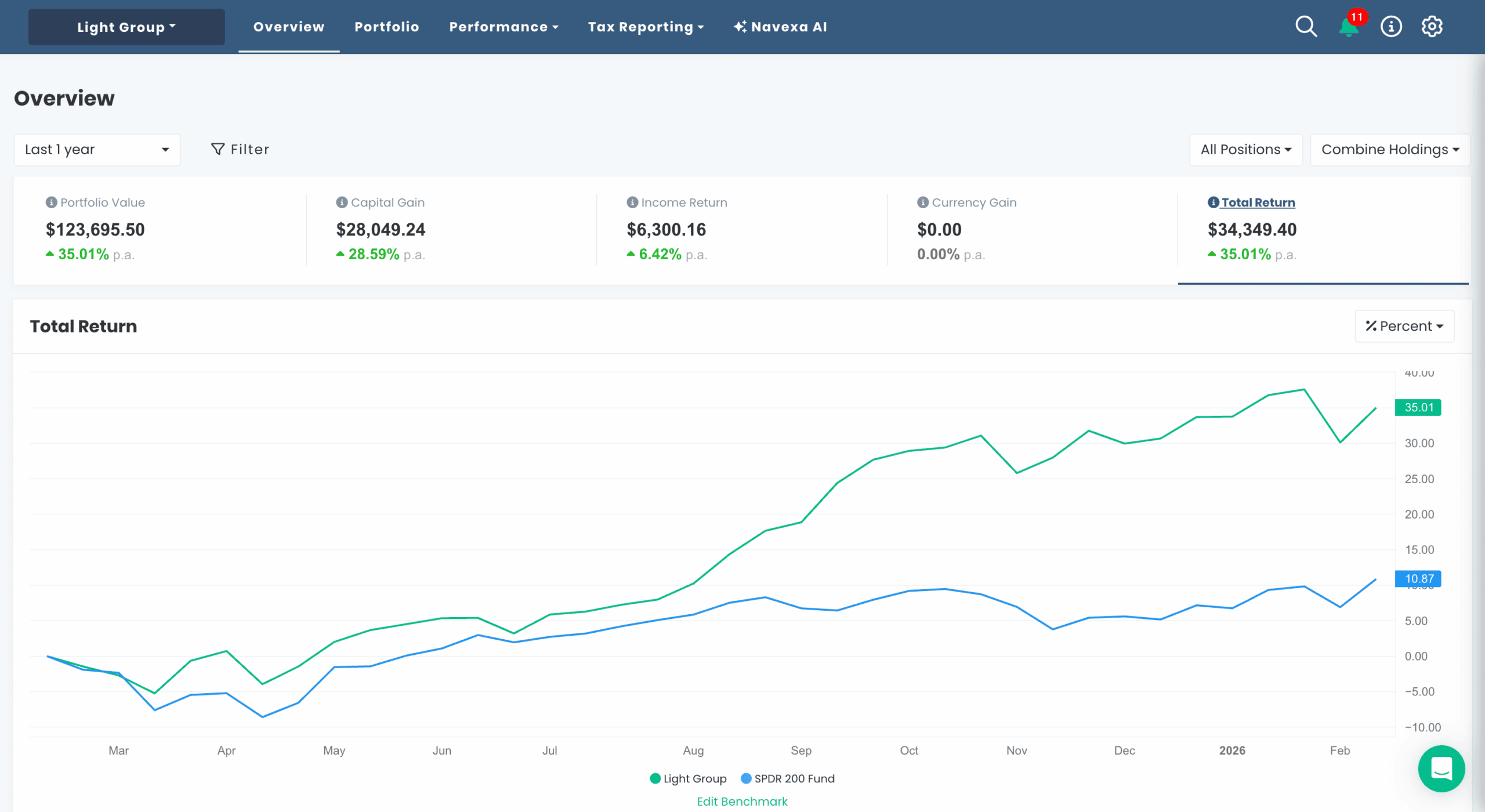

In the last 30 days, the Light portfolio was -0.43% vs the index which was +2.65%.

Our most impressive return for the last 30 days is KOV, which is +16% for the month. It’s up about 400% since we bought it.

For the last 12 months, the Light portfolio is +35% vs the index +11%, roughly TRIPLE MARKET.

Since inception (Feb 2022), the Light portfolio is +21% vs the index +11%, double market, right on target.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

Since inception (Sep 2023), our portfolio is +103% vs the S&P 500 +56%. Not quite double market but getting close.

Our U.S. portfolio for the last 30 days was +15% vs -0.3% for the S&P 500.

No trades this week.

QAV LIGHT

I recently started our U.S. Light portfolio, and it’s had a slow start, and is currently -1.6% vs the S&P 500 +0.9%.

THIS WEEK’S EPISODES

QAV AU 906 — It’s What You Do With It

## EC: Pump and Dump – QAV AMERICA 38

STOCK NEWS AND UPDATES

COMMODITIES

This week all of the commodities were either in a Sell or a Josephine state with the exception of Gold, which remains a buy.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com