Hi folks,

I hope you’re all having a great week and your portfolios are going strong. The markets have been skittish again this week but we’re still having a great year. Let’s break it down.

All the Best,

Cam

QAV MYTH KILLERS

The Myth: Marry the Business, Not the Ticker

If you’ve spent five minutes reading mainstream investment media or listening to the high priests of Old Guard value investing, you’ve heard the sermon. They tell you to find a great company, buy it, and hold it until the heat death of the universe. They preach that if you’ve done your homework, you should be prepared to “weather the storm” and “ignore the noise.”

The gurus want you to believe that selling a stock is a sign of intellectual weakness, a failure of your original thesis. They’ve romanticised the act of holding through a 40% drawdown as a badge of honour, a test of your “conviction.”

Why People Believe It

It’s easy to see why this sticks. It feels noble. It sounds like the “sophisticated” thing to do. We are told that Warren Buffett’s favourite holding period is “forever,” so we try to emulate that stoicism. It also appeals to our natural human laziness and our psychological aversion to admitting we were wrong. If we don’t sell, we haven’t lost. We’re just “long-term investors.” It’s a comforting blanket that protects us from the harsh reality of a red screen.

The Trap: Your Thesis Doesn’t Control the Market

Here is the blunt truth: The market does not care about your thesis. It doesn’t care how many late nights you spent pouring over annual reports or how much you love the CEO’s “vision.”

The trap of “falling in love” is that you stop being an investor and start being a fan-boy. You become invested in being right rather than making money. When the price starts to slide, the “Buy and Hold” cult tells you to double down because the “fundamentals haven’t changed.”

But fundamentals are lagging indicators. By the time the balance sheet reflects the rot, your capital has already evaporated. The logic that you should stay loyal to a falling stock assumes the market is “wrong” and you are “right.” That is a level of arrogance that leads straight to the poorhouse. In 2008, plenty of “great businesses” with “strong theses” went to zero or spent a decade in the wilderness. Loyalty to a piece of paper is not a strategy. It’s a suicide pact.

The Humility of the Exit

A major point of departure between us and the Buffett acolytes is a simple admission of reality: we aren’t experts on these businesses. We don’t spend hundreds of hours studying the intricacies of a company’s logistics or its five-year market share projections. We have better things to do with our lives, like playing golf, doing kung fu, or spending time with our families.

However, we know there are thousands of analysts at massive funds who do spend their lives doing that. They might know something we don’t. When the market starts dumping a stock, it’s often because those people are heading for the exits. Maybe they see a structural shift in the industry or a looming debt crisis that hasn’t hit the headlines yet.

The market might be wrong, but we aren’t going to bet our retirement on it. We err on the side of caution. If the big money is leaving, we follow them out the door. We don’t need to be the smartest person in the room; we just need to be the one who isn’t left holding the bag when the lights go out.

The Hidden Cost: The Decade of Lost Time

The mainstream logic ignores the most expensive thing in the world: Opportunity Cost.

When you “stay the course” through a massive market collapse, you aren’t being brave. You’re being a hostage. Look at the GFC. It took the All Ordinaries ten years to claw back to its 2008 peak. Ten years of your life. Ten years where your capital sat stagnant, doing nothing but trying to get back to zero.

If you’re “in love” with your stocks, you’re paralyzed. You watch the value plummet and you do nothing because your “thesis” says the company is still good. Meanwhile, the real professionals are liquidating. The hidden cost isn’t just the money you lost on the way down; it’s the massive gains you could have made if you had preserved your capital and had it ready to deploy when the market finally bottomed. In 2020, the “conviction” crowd sat trembling while their portfolios halved. The mercenaries sold, waited for the dust to settle, and bought back in when the tide turned. They didn’t care about the names on the stocks. They cared about the direction of the money.

The Hint of the Fix: Logic Over Loyalty

We don’t do “conviction.” We don’t do “loyalty.” We are cold-blooded mercenaries.

The secret to surviving and thriving in this game isn’t finding a better “story” to believe in. It’s removing the human element entirely. You need a way to kill your darlings before they kill your bank account. You need a cold, hard set of triggers that tell you exactly when the party is over, regardless of how much you like the host.

We don’t “hope” a stock recovers. We don’t “feel” like it’s a good time to buy. We operate based on a rigorous, dispassionate framework that prioritises the preservation of capital above all else. When the light turns red, we stop. When it turns green, we go. No ego, no “thesis,” and absolutely no love.

We use a system of rules because our brains are designed to make us fail at investing. Rules don’t get emotional. Rules don’t care about “forever.” And rules are the only thing that will keep you from being the one holding the bag when the next “unforeseen” crash hits.

STOCK ANALYSIS OF THE WEEK

For edition 207 of my weekly Australian Light member email this Monday, I did an analysis of almond farmer Select Harvests (SHV). Australian Light and Club members can read it here.

For edition 6 of the U.S. Light member email, I did an analysis of a huge shale oil miner in North Dakota, Chord Energy (CHRD). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week.

On the full Australian podcast this week, Tony did a deep dive on HUMM (Hum). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-01-24

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-01-25

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

QAV DUMMY

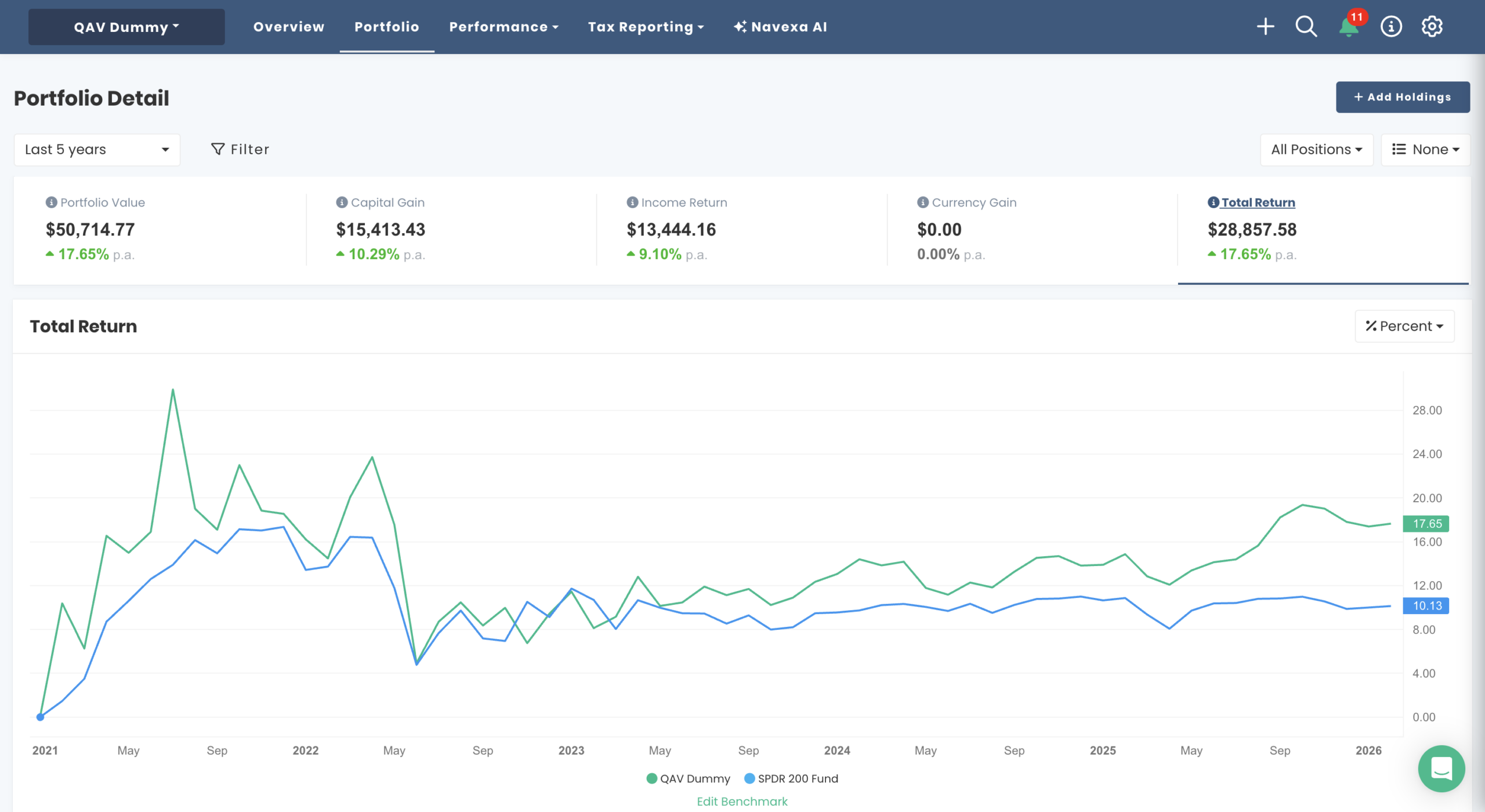

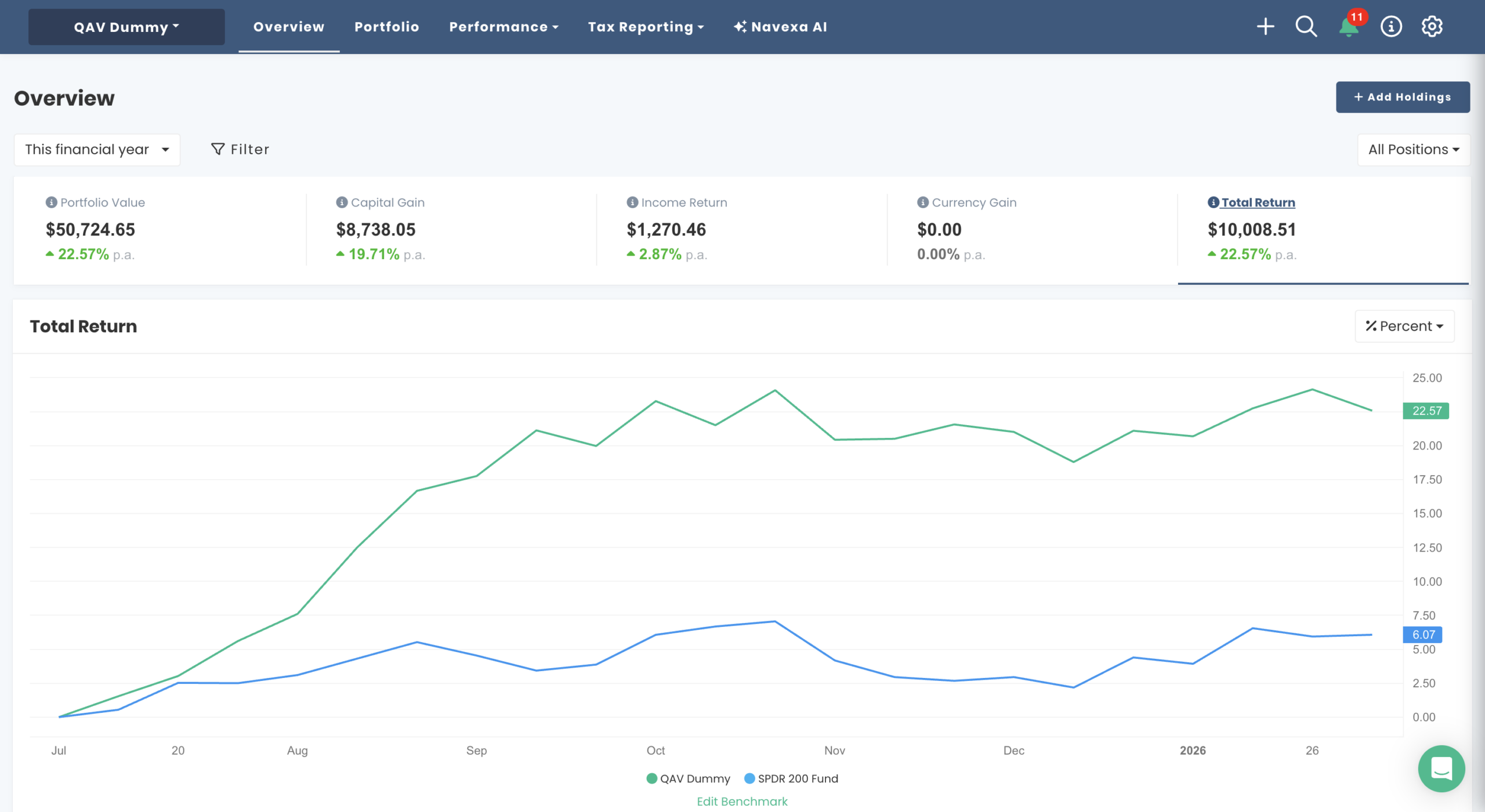

Five Year Report: Over the last five years, our portfolio is +17% p.a. vs the benchmark +10% p.a.

Monthly Report: The AU Dummy Portfolio was +2% p.a. for the last 30 days vs the benchmark +1.9% p.a.

No trading in that portfolio this week.

For the 2025 FY, our portfolio is +23% vs +6% for the index – nearly QUADRUPLE MARKET.

QAV LIGHT

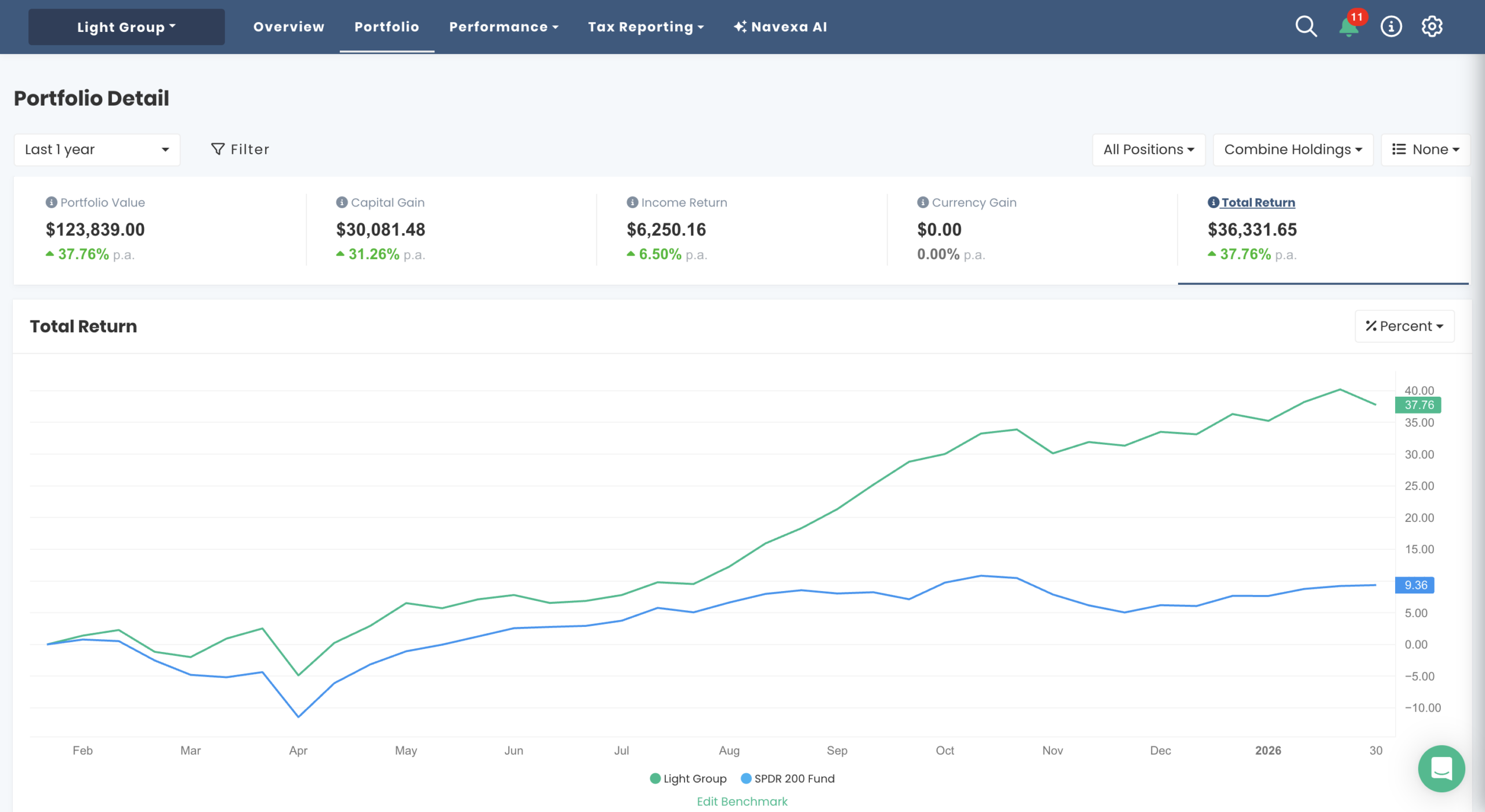

In the last 30 days, the Light portfolio was +1.56% vs the index which was +1.87%.

Our most impressive return for the last 30 days is power and communications infrastructure services provider GNP, which is +25% for the month. We’ve owned GNP since 14/11/2024 when we bought it at $2.54 — it’s now $7.76 which means it’s up 206% in a little over a year.

For the last 12 months, the Light portfolio is +38% vs the index +9%, roughly QUADRUPLE MARKET.

Since inception (Feb 2022), the Light portfolio is +21% vs the index +11%, double market, right on target.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

QAV DUMMY

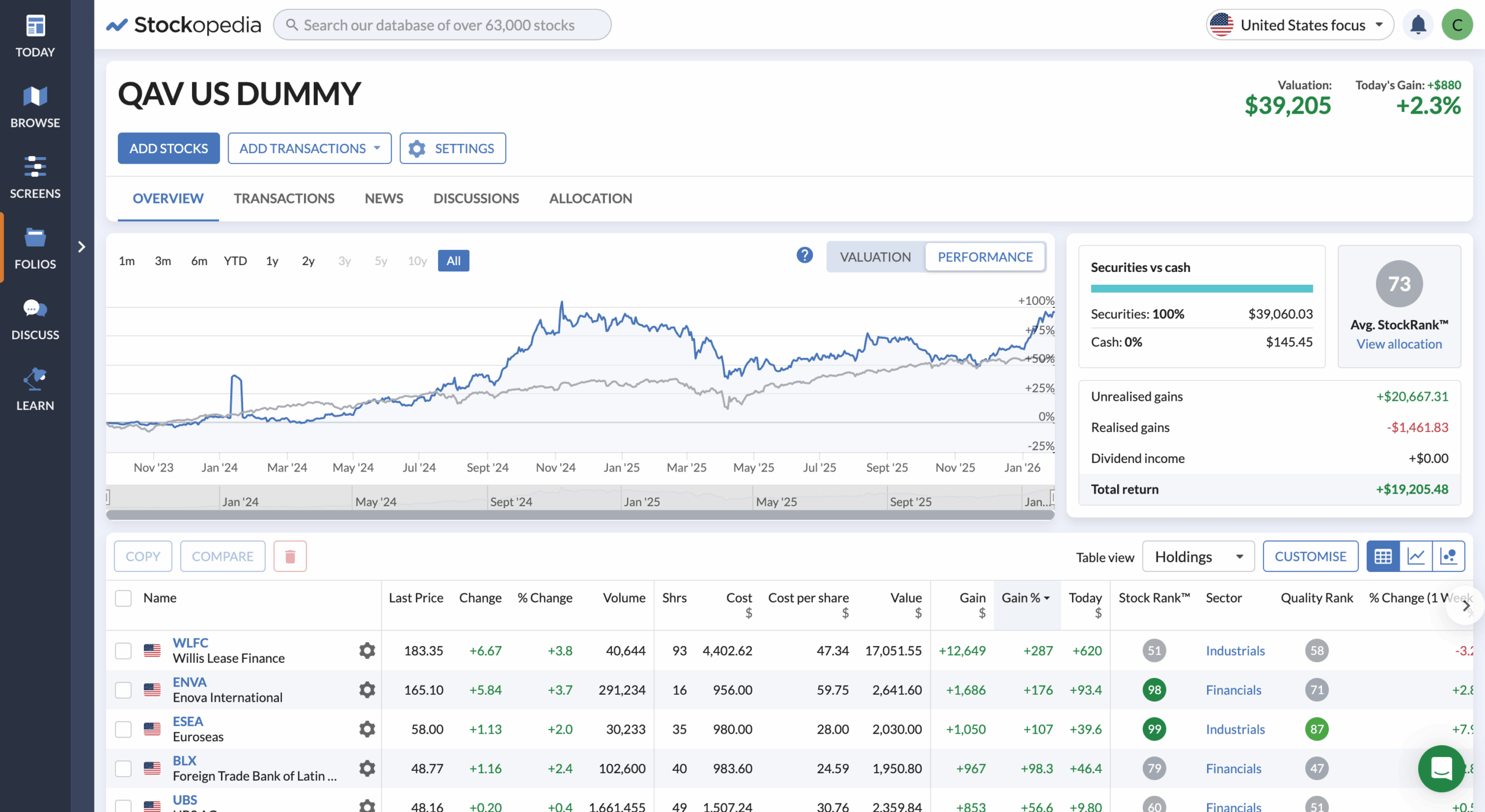

Since inception (Sep 2023), our portfolio is +96% vs the S&P 500 +57%. Not quite double market but getting close. It’s been booming again for some reason since late last year.

Our U.S. portfolio for the last 30 days was +18% vs +0.9% for the S&P 500.

No trades this week.

QAV LIGHT

I recently started our U.S. Light portfolio, and it’s had a slow start, and is currently -2% vs the S&P 500 +1.3%.

THIS WEEK’S EPISODES

QAV AU 904 — Humm-ing a Different Tune

AMTD: The Murky SpiderNet – QAV AMERICA 36

STOCK NEWS AND UPDATES

COMMODITIES

The big changes this week were that Crude and LNG both became buys again.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com