Hi folks,

I hope you’re all having a great week and your portfolios are going strong. The markets have been skittish this week thanks to Trump’s new tariff threats but, now that those have been TACO’d, we seem to be back to normal. But hey, who knows what the week will bring?

All the Best,

Cam

QAV MYTH KILLERS

Bitcoin: The Investment That Isn’t

The Pitch You’ve Heard a Thousand Times

Bitcoin is digital gold. A hedge against inflation. The future of money. If you don’t own some, you’re missing out on the opportunity of a lifetime. The suits on CNBC say it. The crypto evangelists on TikTok say it. Hell, there are ETFs for it now, which apparently means it’s “real.”

Why It Sounds Good

Look, I get the appeal. Central banks are printing money like it’s going out of style, inflation is eating away at savings, and traditional investments feel… boring. Then you see someone turn $10,000 into $40,000 in a few months, and suddenly your sensible index fund feels like a waste of time. The FOMO hits hard.

The Problem Nobody Wants to Talk About

Here’s the uncomfortable question: What is one Bitcoin actually worth?

Not “what’s it trading for today?” Not “what could it be worth if everyone adopts it?” But what is its intrinsic value right now?

With a stock, you can look at earnings, cash flow, assets. With a bond, you’ve got interest payments and a maturity date. With real estate, you can calculate rental income. These things produce something. They have frameworks for valuation.

Bitcoin produces nothing. It sits in a digital wallet. Its only value is what someone else will pay for it tomorrow.

As of today, one BTC is trading around AUD $131,893. Eight days ago? $145,064. A couple months back? $184,574. For something marketed as a “store of value,” that’s a pretty wild ride.

The Scarcity Sleight of Hand

The main defence you’ll hear is “limited supply.” There will only ever be 21 million Bitcoin, therefore it must be valuable.

But scarcity alone doesn’t create value. There’s a limited supply of signed photos of my high school band “The Rhythm Pigs” (for sale if you get in quick), but I’m not pitching them as an institutional asset class. Something can be both rare and worthless.

The only argument anyone really makes for Bitcoin is that it will be worth more later because… well, because it will be. That’s not an investment thesis. That’s hoping you’re not the last person holding the bag. It’s a variation of the “Greater Fool Theory” (popularised by Burton Malkiel, an economics professor at Princeton, in his 1973 book ‘A Random Walk Down Wall Street’). In simple terms: you can make money on an overpriced piece of garbage as long as there is a greater fool willing to pay even more for it than you did.

The Real Cost

The money you might lose on a 40% drawdown is one thing. But there’s a deeper cost: the psychological toll of owning something you can’t value.

When you don’t know what something is actually worth, you have no anchor. No reference point. You’re just watching a number go up and down, trying to guess when to get out, paralysed by the fear that you’ll sell right before it moons.

And here’s the thing that should bother you: if Bitcoin is really heading to $1 million or $10 million with mathematical certainty, why are institutions selling it at $145k? Why are the same people pumping it also dumping it? Maybe because they understand something the retail investors don’t.

A Different Approach

Charlie Munger called investing in Bitcoin “it’s like somebody else is trading turds and you decide ‘I can’t be left out’.” Warren Buffett said he wouldn’t buy all the Bitcoin in the world for $25. These weren’t emotional reactions – they were observations from people who’ve spent their lives figuring out what things are actually worth. They had discipline and logic behind their investing strategy.

Real investing isn’t about guessing. It’s about having a process – a way to determine if something is cheap, fairly priced, or expensive. If you can’t run that calculation, you’re not investing. You’re speculating.

There’s nothing wrong with speculation if you know that’s what you want to do with your life. But let’s not confuse it with serious investing.

STOCK ANALYSIS OF THE WEEK

For edition 206 of my weekly Australian Light member email this Monday, I did an analysis of MLG Oz Limited (MLG). Australian Light and Club members can read it here.

For edition 5 of the U.S. Light member email, I did an analysis of AMTD IDEA (AMTD). U.S. Light and Club members can read it here. We’re also talking about it in more detail on the U.S. episode this week. It’s a completely bonkers story!

On the full Australian podcast this week, Tony did a deep dive on Stanmore Resources (SMR). See the podcast link down below if you want to listen to his analysis.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Australian Value Investing Buy Lists 2026-01-17

Below is a link to the US list for this week:

QAV American Value Investing Buy List 2026-01-20

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

AUSTRALIAN

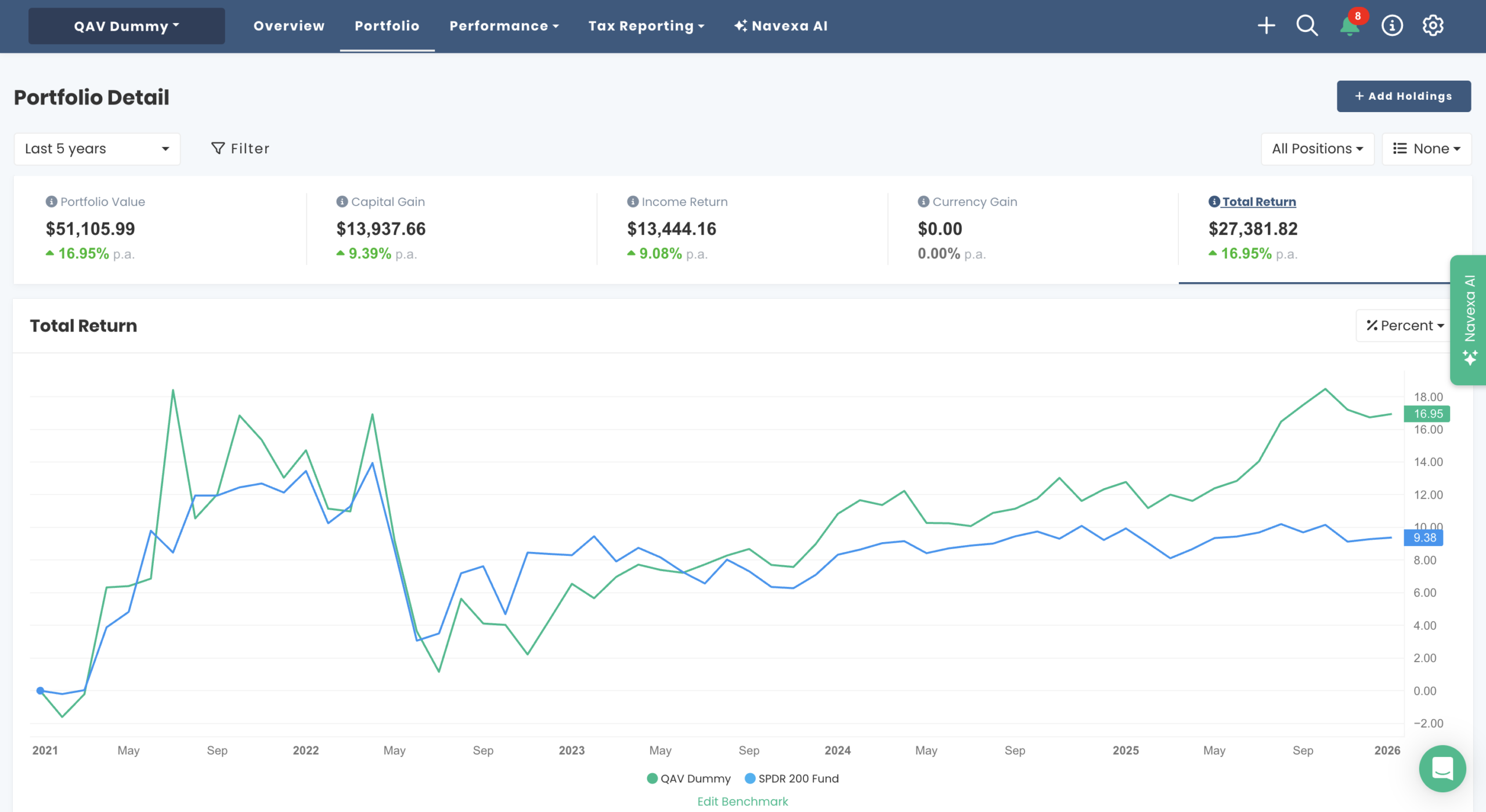

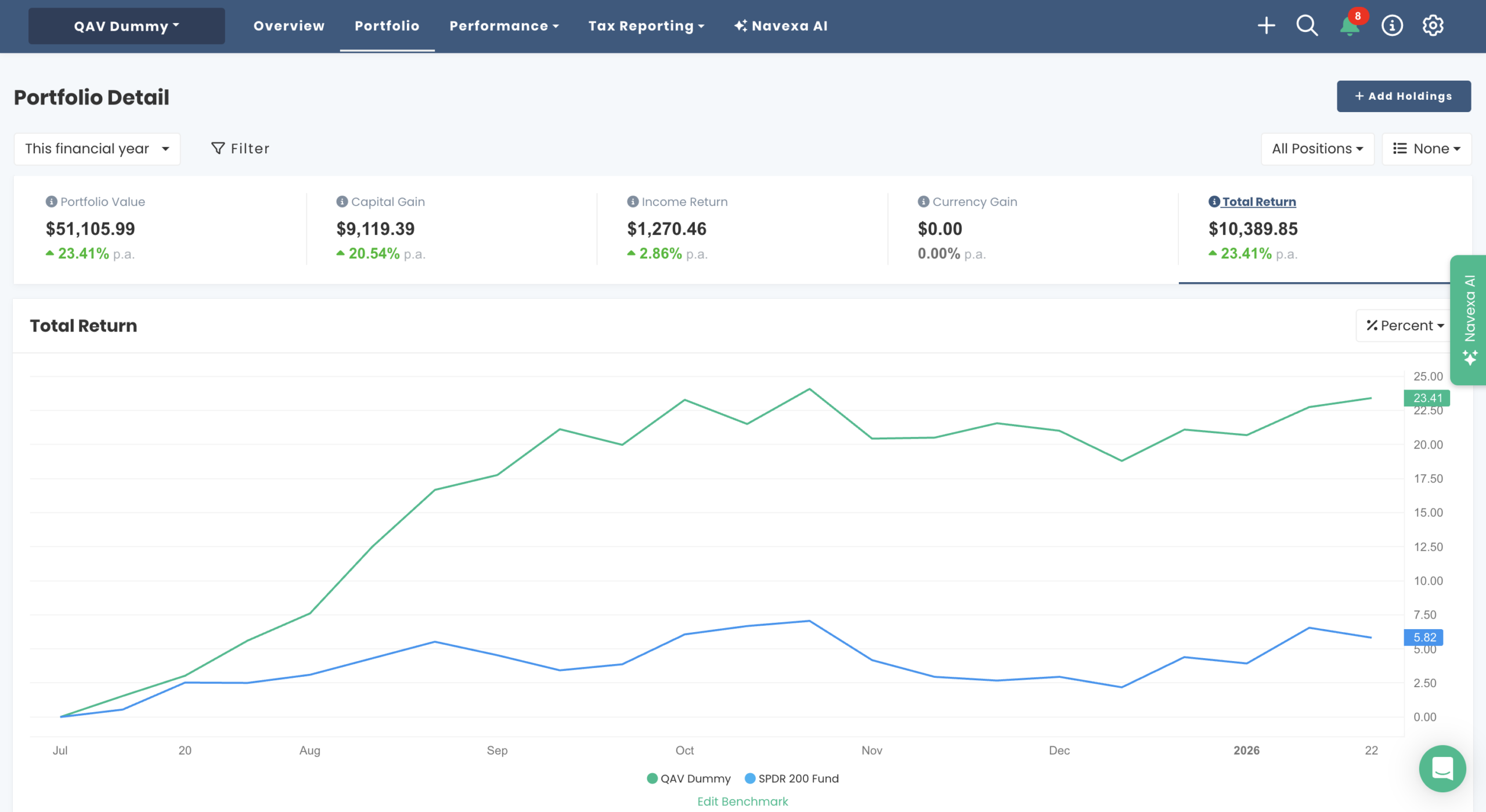

QAV DUMMY

Five Year Report: Over the last five years, our portfolio is +17% p.a. vs the benchmark +9% p.a.

Monthly Report: The AU Dummy Portfolio was +1.39% p.a. for the last 30 days vs the benchmark +0.92% p.a.

No trading in that portfolio this week.

For the 2025 FY, our portfolio is +23% vs +6% for the index – nearly QUADRUPLE MARKET.

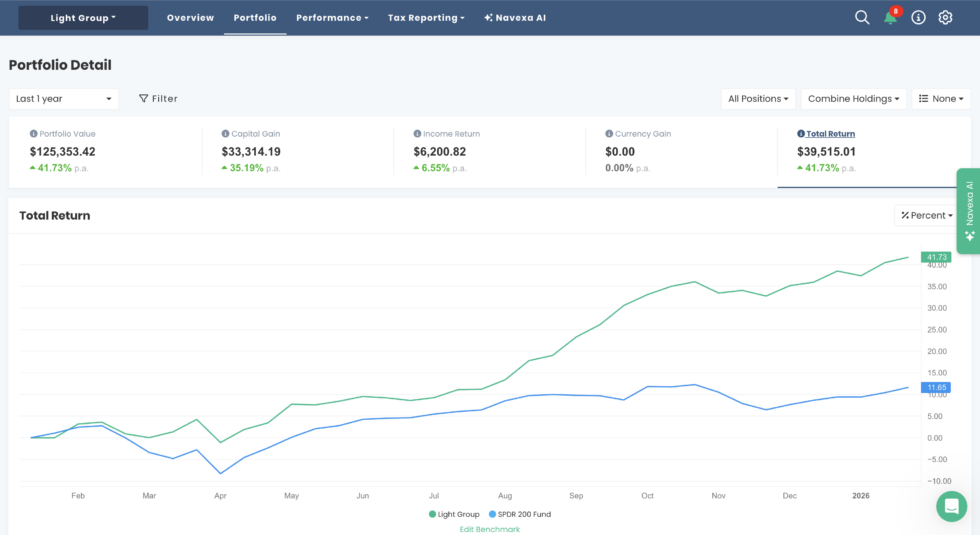

QAV LIGHT

In the last 30 days, the Light portfolio was +4% vs the index which was +3.7%.

Our most impressive return for the last 30 days is infrastructure contractor DUR which is +18% for the month. We’ve owned DUR since 14/11/2022 when we bought them at $0.505. The price is now $2.120, so that’s a lovely triple bagger.

For the last 12 months, the Light portfolio is +42% vs the index +11%, roughly QUADRUPLE MARKET.

Since inception (Feb 2022), the Light portfolio is +22% vs the index +11%, double market, right on target.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

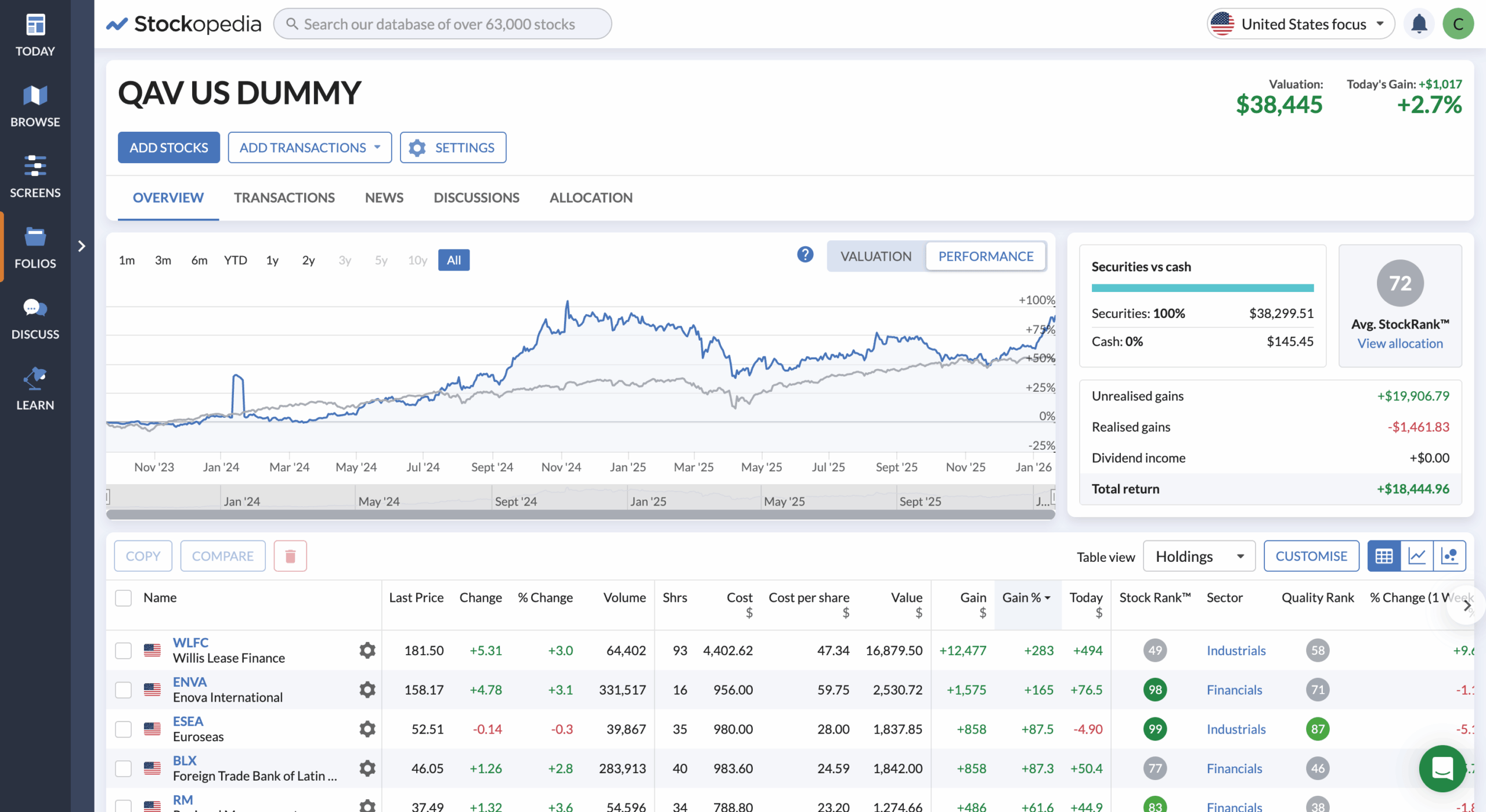

QAV DUMMY

Since inception (Sep 2023), our portfolio is +92% vs the S&P 500 +55%.

Our U.S. portfolio for the last 30 days was +17% vs +0.6% for the S&P 500.

No trades this week.

QAV LIGHT

I recently started our U.S. Light portfolio, and it’s had a rocky start (aka Trump’s “SELL AMERICA”), currently -3% vs the S&P 500 -0.04%.

THIS WEEK’S EPISODES

QAV AU 903 — Nobel Prizes and Negative Sentiment

## Flying at Bus Prices: Volaris (VLRS) – QAV AMERICA 35

STOCK NEWS AND UPDATES

COMMODITIES

The only change this week was Zinc which became a Buy.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com