Hi folks,

Happy New Year! Here’s my weekly portfolio and podcast updates and some thoughts on why we don’t engage in re-balancing our portfolio or set price targets for our stocks.

As it’s the start of a new investing year, I urge everyone to re-commit to a year of following rules and ignoring emotions (at least when it comes to investing). Whether the market is up, down, or somewhere in between – just follow your rules, forget about the noise and hype, and take a long-term view.

All the Best,

Cam

QAV MYTH KILLERS

Myth Killer: Why We Don’t Care About Price Targets

One of the most persistent habits in retail investing is the obsession with price targets.

“This stock is worth $X.”

“I’ll sell when it hits $Y.”

“I need to rebalance because this one’s run too far.”

We don’t do any of that. Deliberately.

We don’t rebalance because we don’t want to sell our winners

Rebalancing assumes you know when a stock has “had its run”.

You don’t.

Nobody does.

If a business continues to execute, compound cash flows, and improve its economics, the share price can keep surprising you for years. Selling just because it’s gone up is how you amputate your best performers.

Tony always comes back to Buffett on this:

Why would you bench Michael Jordan?

If a stock hasn’t hit one of our sell triggers, we let it run. Price action alone is not a trigger.

Our job isn’t trading. It’s ownership.

Our actual job as investors is hard enough already.

We’re trying to find:

• well-run businesses

• with strong economics

• led by capable management

• temporarily mispriced for understandable reasons

That combination is rare.

And management quality is one of the hardest parts.

Genuinely good management teams are scarce. When you find one that allocates capital sensibly, communicates clearly, and actually behaves like owners, the last thing you want to do is casually hand them back to the market because the share price hit an arbitrary number.

If you find a company with good management, you don’t want to sell them unless you have to.

Trading has costs. Holding has advantages.

Every unnecessary trade introduces friction:

• brokerage

• capital gains tax

• reinvestment risk

You’re not just selling a stock. You’re swapping it for something else. And there’s no guarantee the replacement will be better than the one you just sold.

In fact, the odds are against you.

Most long-term returns come from a small number of big winners held for a long time. Price targets and routine rebalancing are excellent ways to ensure you don’t hold them long enough.

Price targets create false precision

Price targets look scientific. They feel disciplined. They give investors a comforting sense of control.

They’re mostly theatre.

Businesses change. Valuations move. New information arrives. A fixed price target assumes the future stops evolving the moment you buy the stock.

It doesn’t.

We sell on triggers, not feelings

This matters.

We don’t sell because a stock “feels expensive”.

We don’t sell because it’s gone up a lot.

We don’t sell because a spreadsheet says it hit a target.

We only sell when predefined triggers – eg three-point trend line sell, Rule #1, commodity sell, governance red flag – are breached.

That’s it.

Triggers remove emotion, reduce second-guessing, and stop us from sabotaging our own best ideas.

Rebalancing is usually a confidence problem

Our view is blunt.

Rebalancing, like excessive diversification, is often a sign the investor doesn’t fully trust their framework.

If you’ve done the work:

• you know why you own the business

• you know what would make you sell

• and you trust your process

You don’t need price targets to tell you what to do.

You need patience.

And patience, inconveniently, is where most of the money is made.

STOCK ANALYSIS

For edition #203 of my weekly Light member email this Monday, I did an analysis of Stock Investment Report: MoneyMe Limited (ASX: MME). Light and Club members can read it here.

On the full weekly podcast, Tony did a deep dive on Perenti (PRN) and talked about his latest thoughts on Growth / PE. See the podcast link down below if you want to listen to his analysis. This week’s full episode is also available to free listeners.

BUY LIST

Each week, we produce a buy list based on our value investing system that we share with our QAV Club members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

Below is a link to the AU list for this week:

QAV Value Investing Buy Lists 2025-12-28

Below is a link to the US list for this week:

QAV Value Investing Buy List 2025-12-28

PORTFOLIOS

We compare our performance to what we think is the most relevant benchmark (SPDR 200 in Australia, S&P500 in the USA), but if you’re new to investing, these comparisons might not mean much. Instead, you can compare our performance to the top-performing Super Funds in Australia.

Overall, 2025 was a pretty great year for the QAV portfolios. It was one of those years we hold out for. I hope you didn’t miss out on it and were fully invested!

AUSTRALIAN

QAV DUMMY

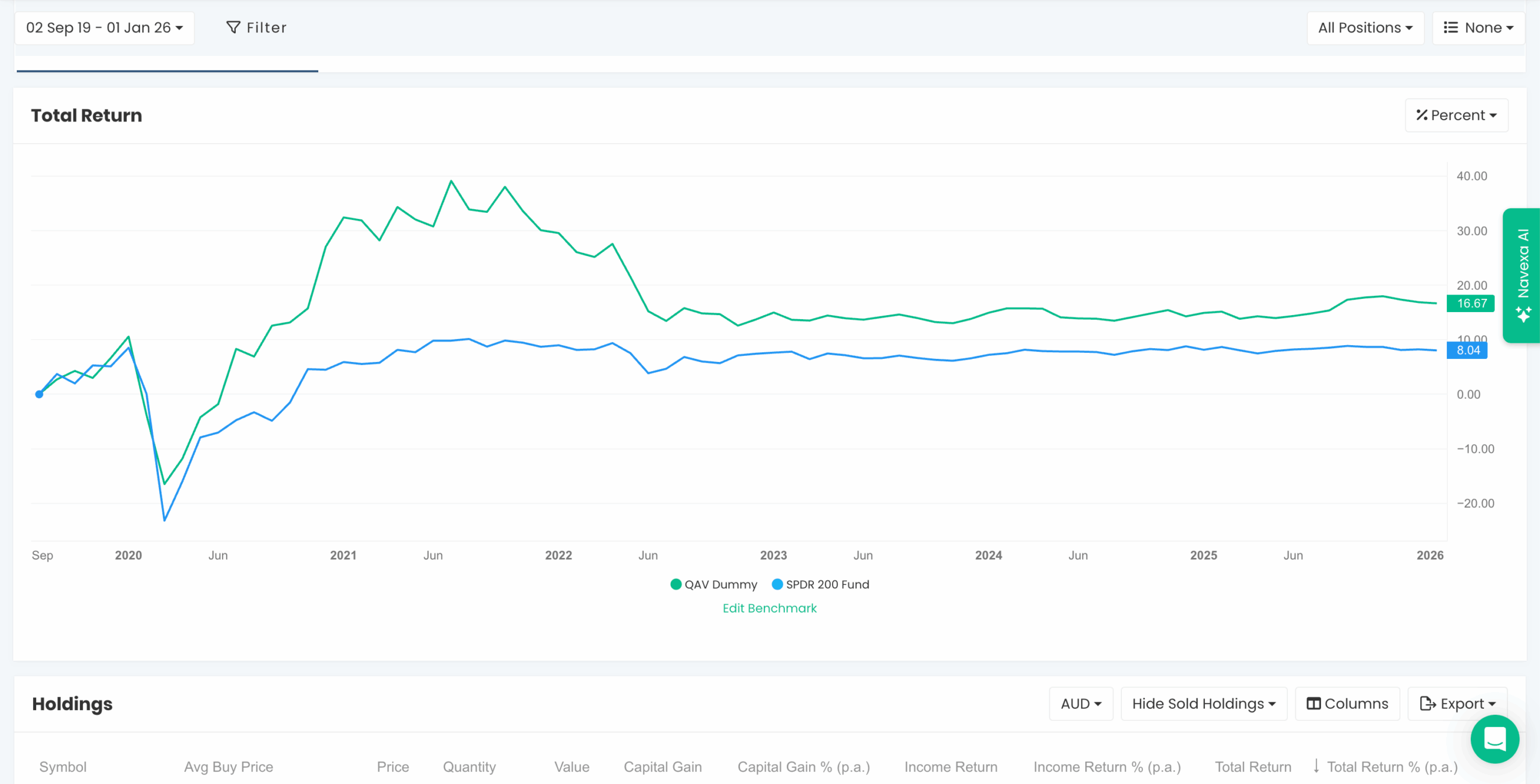

Inception Report: Since inception (Sept 2019) our portfolio is +17% p.a. vs the benchmark +8% p.a.

Monthly Report: The AU Dummy Portfolio was -0.8% p.a. for the last 30 days vs the benchmark +0.9% p.a.

No trading in that portfolio this week.

For the 2025 CY, our portfolio was +27% vs +10% for the index – nearly TRIPLE MARKET.

QAV LIGHT

Our most impressive return for the last 30 days is still EDU (+36%).

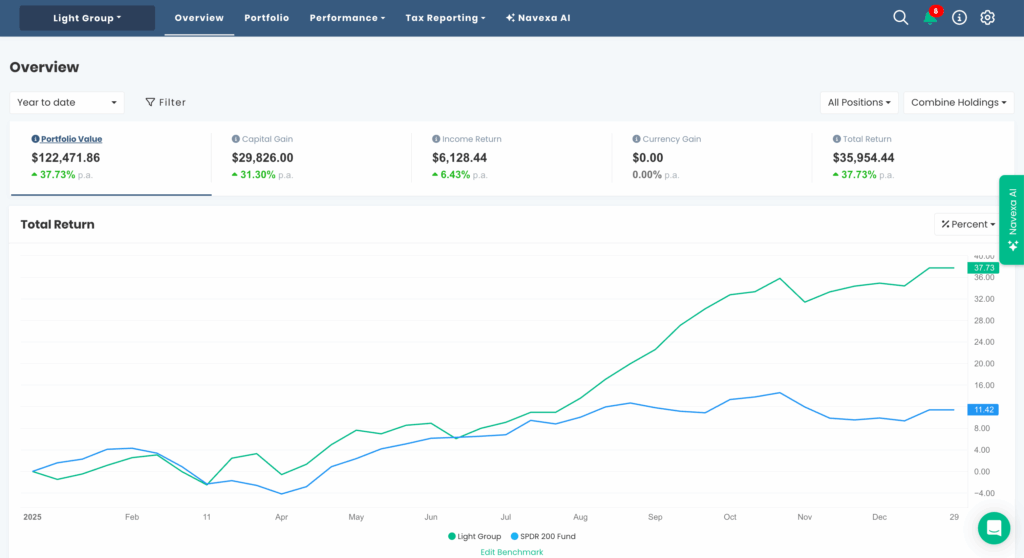

For the CY the Light portfolio is +37% vs the index +11%. In other words — over TRIPLE MARKET.

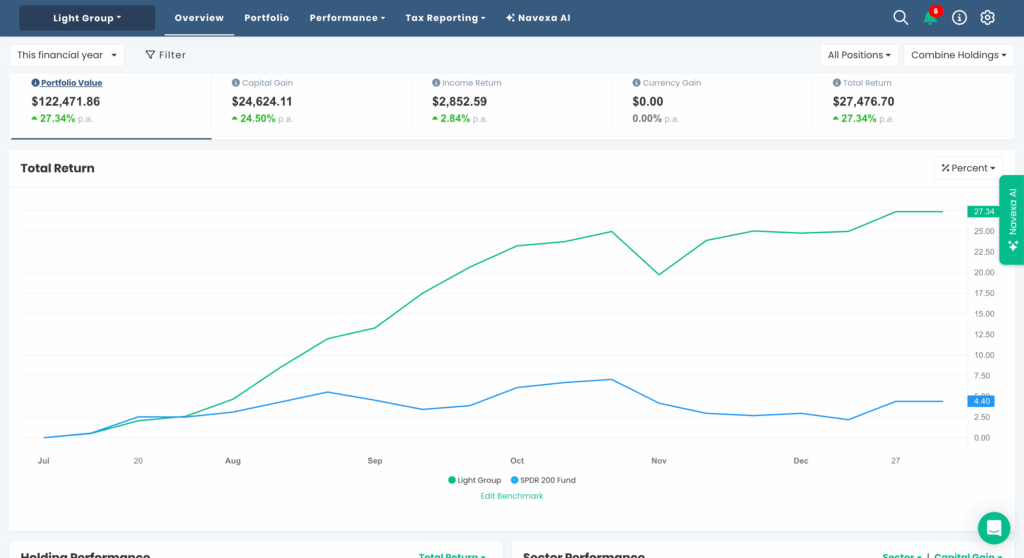

And the graph for this FY shows what a great six months it’s been for our portfolio. 27% vs 4%. This should give our portfolio a lot of wind in its sails.

Become a QAV Light Member today and start your investing on the right track

If you want to find out what we’re trading in QAV Light each week, sign up to become a member. You’ll get an email from me every Monday letting you know what we’re buying and selling in that portfolio. You can choose to copy our trades or not. It’s the easiest way to start your rules-based investing career… and you don’t even need to know the rules. I’ll follow the rules for you. It’s a good first step to eventually becoming a QAV Club member and learning how to run the system by yourself.

AMERICAN

Since inception (Sep 2023), our portfolio is +64% vs the S&P 500 +55%.

Our U.S. portfolio for the last 30 days was +7% vs +0.5% for the S&P 500.

No trades this week.

I’ve recently started our U.S. Light portfolio, too, but it’s too early to bother reporting.

THIS WEEK’S EPISODES

QAV AU 852 — Growth Over PE: The Metric That Ate 2025

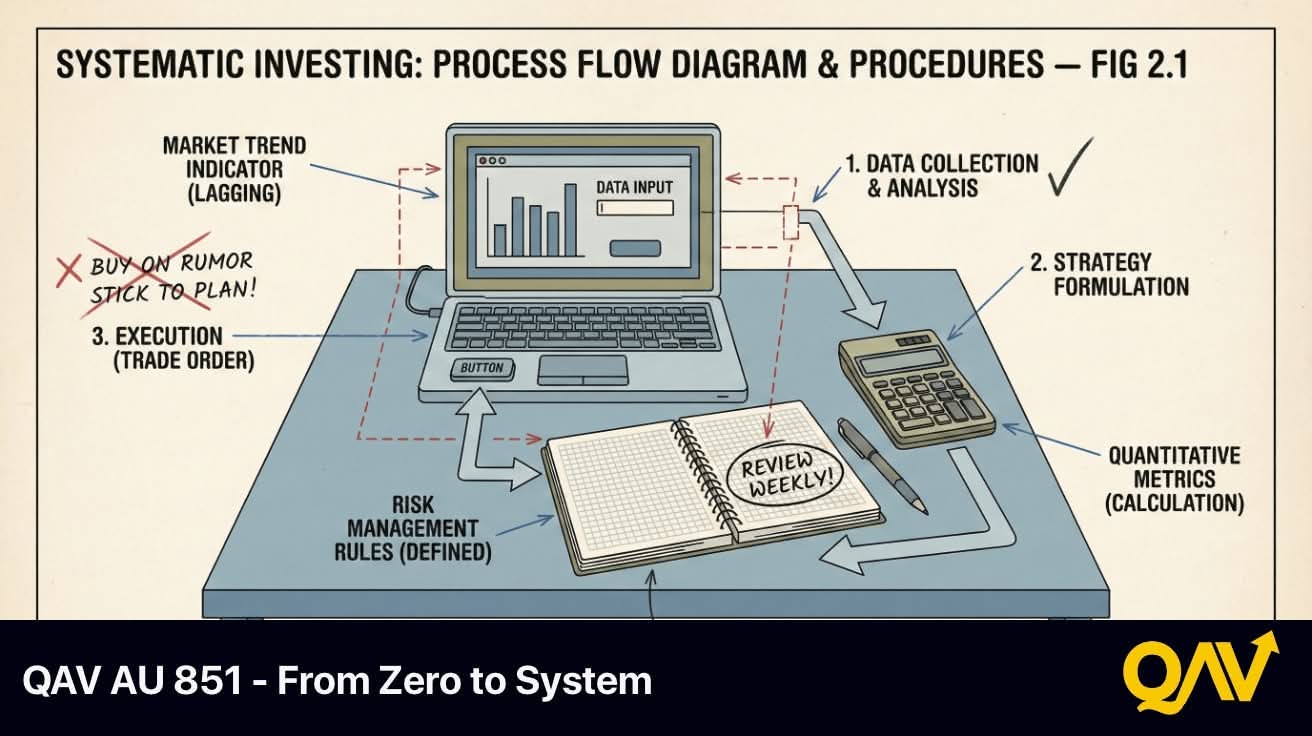

QAV AU 851 — From Zero to System: A First-Year QAV Journey

The Walking Dead Investment: AMC Networks – QAV AMERICA #33

STOCK NEWS AND UPDATES

No changes to our commodities this week.

DISCLOSURE

Please review our trading and disclosure policy.

That’s it for the week!

QAV A GOOD SHAREMARKET!

Got a question? info@qavamerica.com