Overview

In this episode, Cam and Tony dig into the strange, noisy twilight zone of the current US market: rate-cut expectations, mega-cap fatigue, and a broadening rally that’s finally throwing some love toward the small and mid-caps that QAV thrives on. They walk through the performance of the US portfolio, poke at the rotation narrative, and then Cam takes everyone deep into the iron-ore jungles of Brazil with a pulled-pork deep dive on Vale — “the FMG of Brazil”, complete with dam failures, lawsuits, ESG fallout, and fat cashflows. Along the way they contrast Brazil vs Australia, FMG vs Vale, talk iron ore cycles, passive-investing distortions, and the macro-agnostic stubbornness that keeps QAV on the rails. It’s part markets, part commodity history lesson, and part true-crime mining documentary.

—

Timestamps & Topics

00:00 • Fed rate-cut probabilities and why QAV ignores macro

04:00 • US portfolio performance vs S&P 500

06:00 • Small-cap underperformance creates QAV pickings

07:30 • Passive funds distorting large-cap flows

08:00 • US portfolio winners rundown

14:00 • SEC leadership change and weakening shareholder power • (none)

16:00 • Pulled pork intro: Vale (VALE), “the FMG of Brazil” • VALE, FMG

Transcription

Cameron: Welcome back to QAV America Tony, episode 31. Big News in America.

Tony the Fed is meeting rate cut widely Expected markets are pricing in a 90% chance that the Fed will cut rates by 25 basis points today. Tomorrow, we’ll see what happens. It’s driven a big rally across equities in the us. A Santa Claus year end rally, they’re saying, but we were just, we were just talking on our Australian show about our.

Reserve bank that’s meeting today, that’s, uh, gonna decide what they’re doing about interest rates and it doesn’t really matter. A great deal to us can have an impact on the broader economy, but from a QAV perspective, we play the cards as they’re dealt. Interest rates go up, interest rates go down, doesn’t really affect our system.

One jot does it.

Tony Kynaston: No. I mean, it may cause us a bit of work if we have [00:01:00] to buy and sell something, but no, we don’t. Rely on macro themes at all, nor can I explain them most times and even more remotely can I predict them, so I don’t, don’t even try.

Cameron: On the Australian show, I was just reading out results from some of our Australian listeners, uh, following our system. One guy was saying his portfolio’s up 90% this year. Another was saying it’s up 50, 55% this year. Great results across the board. Uh, and it’s a good year, uh, in the Australian market as well as in the US market.

Our portfolios are doing well. But as we were talking about, it’s just the system just tells us what to do, uh, tells us what to buy, when to buy, what to sell, when to sell. And what I’ve learned to do in the years we’ve been doing the show is just follow the system. It removes all of the emotion from it, and it also means I don’t really need to follow what’s happening.

[00:02:00] Macro economics or in the market, generally speaking. ’cause the system factors all of that in. It works in ups, boom cycles, it works in bear cycles, it works if interest rates are high, it works if interest rates are low. It really just tells us what to do and I, you know, I don’t really need to do much at all.

As I was saying on the Australian show, if one of my alerts goes off and says I need to sell something, I sell it. I replace it and then I go back to what I was doing before and just ignore the noise, which is a great way to invest.

Tony Kynaston: It’s the only way to invest, I think. And I, I just wanna add one more thing to that, and that is that, um, because of that, the, the, I guess the number one thing you can have as a trait to be an investor is persistence. It’s just if you know your system’s gonna work on all kinds of. Ups and downs in market situations, and it has for me over [00:03:00] decades. then rely on it. Don’t start second guessing it. Don’t start oh, it’s been a really good year because like, I’ve had a good year on the share market this year. And, and straight away my brain goes, oh, maybe it’s time to sell. What can we have two good years in a row? What about three? Can we have three good years in which it’s like, it’s like. They just fools errands trying to work out what’s gonna come

Cameron: Yeah.

Tony Kynaston: So you have a system and you stick to it, and if the market does turn down, you stick to it because you’ll ride it through and then you’ll catch it, at reasonably or low point and it’s way back up again.

Cameron: Yeah. Well, speaking of portfolios, so looking at our US portfolio in stock, EDIA, it’s up around about 3% this month versus the s and p 500, up about 1.75%. Um. All time. Our portfolio is up around about [00:04:00] 58%, which all time for this US portfolio is from September, 2023. So just over a couple of years versus the s and p 500, up 54%.

So we’re doing a little bit better then the market over that time and. It’s, there’s an interesting story I saw in Morningstar, Tony about rotation away from mega caps in the US towards value, small cap and core stocks. Um, this is dated 4th of December in Morningstar article says. As of November 28th, 2025, the US equity market was trading at a 3% discount to a composite of our fair value estimates.

Of the over 700 stocks we cover the trade on US exchanges. Later on in the article, he says, small cap stocks outperformed in [00:05:00] November as the Morningstar US small cap index rose 2.48% comparatively Morningstar’s, US mid cap index rose 0.64%, and the US large cap index declined 0.05%. Small cap stocks remain the most undervalued trading at a 50.

15% discount to fair value compared with large cap and mid cap trading at 3% and 2% discounts respectively. But obviously the big, the, you know, we’ve talked on earlier episodes that, like the Mag seven has been like 70% of the markets growth for performance this year. So the fact that it’s coming off a bit, uh, doesn’t really discount the impact that it’s had on the market over the course of the year.

But when I look at our buy list. Our US buy list each week. There’s still just plenty of opportunity at the small and mid-cap market space, which just seems to be getting ignored by the [00:06:00] general market for some reason. I dunno why we’re, we’re seeing so much, uh, opportunity of stocks that are coming up, showing up as undervalued, but you know, it’s a good time for us.

Tony Kynaston: well, I think, you know, that it’s, it’s been a tale of two markets, perhaps three markets really in Australia and in the us. Mag seven have driven the growth. And, and I guess if you can cast that net a little wider into things like, um, data centers and power supplies to data centers, that kind of thing, have all been dragged up, in the, um, in the AI revolution.

But. That if you exclude that from the market, it’s been reasonably flat or certainly it hasn’t been growing as quickly as all that. But what we also found in Australia, and I guess it’s the same in the us, is that with a lot of passive investing done these days, and even with big, even if it’s not passive investing, it’s if it’s big active fund managers because of their size, they still are buying into big [00:07:00] caps and um. That’s kind of opened the space a bit in the smaller cap market for, uh, stock pickers to come in and pick the eyes out of it and do really well because, um, you’re not, know, the, it’s, small caps go through cycles. They outperforming underperform, they’ve been underperforming recently. So, um, as people sort of, wake up to the fact that there’s not as much passive investment in the small cap universe, it, um, it’s, it’s doing better.

Cameron: Yeah, well, like, uh, just running through some of the stocks in our portfolio, some of the best performers over the last couple of years. Willis Lease Finance, we talked about them again on the show last week. They do, uh. Plane engine leasing, I think, uh, they’re up 168% since we bought them in Nova International, ENVA.

Uh, they’re a online financial services company. They’re up 120. [00:08:00] 7% Euro CS Limited, ESEA. They’re in the shipping business, dry bulk and container carrier stuff. They’re up 120% BLX, the Foreign Trade Bank of Latin America. Is what it says on the label. They’re up 82% since we bought them. Regional management, RM diversified consumer finance company, they’re up 57%.

Sarcos Energy Navigation, TEN. They’re a Greek based. Crude oil shipping company, they’re up 40% since we bought them. The list goes on. So, you know, these are companies I’d certainly never heard of before we started doing the show. I I, I would gather most Americans and most American investors have never heard of these companies.

They’re not well known Brad names. They’re your classic sort of, as we often say, classic Berkshire type companies. They’re just boring businesses that have [00:09:00] got. A line of business they’ve been in for decades. They’ve got good customer relationships, supplier relationships, they generate cash, and because they’re boring, we’re able to get ’em when they’re at a discount to their valuation, and then we just ride it out.

Tony Kynaston: Yep.

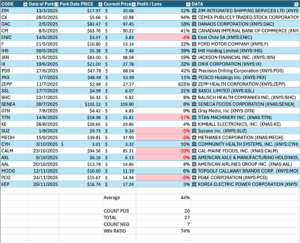

Cameron: Uh, regression to the mean, some of the stocks that we’ve talked about on the show, but don’t necessarily own the ones that I’ve done deep dives on over the last year, uh, that have done well. ChemX Corporation CX is the ticket code. Uh, they’re up 94% since I talked about ’em in March of 25. Canadian, Imperial Bank of Commerce, CM is up 40% since I talked about ‘ em in May.

Ford Motor Company is up 22%. IHS holding is up 39%. Precision Drilling Corporation. PDS, we talked about them in June. They’re up 42% Zep. Of course, the Chinese smartwatch company is still up [00:10:00] 825% since we talked about him in July. That’s the, uh, outlier. Uh, Sasol is up 22 and, uh, there’s a lot of others that are up nine, 10%.

Community health systems is up 10%, the ones that haven’t done as well. Just to be fair, Titan Machinery is down 17% since I talked about ’em in August. Uh, cow Main foods is down 10% since I talked about ’em in October. The world’s most hated energy company. PCG is down 5% since I talked about in November. So it seems like Reddit might’ve been right on that one.

Korean electric power that we talked about last week is up 3% since we covered those. But anyway, ORX Corporation, uh, IX is up 32%. Costco’s up 11%, you know, so there’s been a lot of opportunity even with these companies that. You know, we’ve all heard of Ford obviously, but um, I’d certainly never heard of Zep.

Now they’re up 825%. So [00:11:00] American Airline Group is up 8% since we talked about of October top golfers up 6% Callaway. So anyway, they’re doing okay.

Tony Kynaston: Yeah, they are. And who knows what will happen after interest rates get decided upon morning our It, it could drive another leg up for those kind of companies. the interesting thing is, like you take a, a stock like, uh, ORX, right? It’s been around for a long time. It’s not, uh, not doing anything sort of groundbreaking from memory.

It’s a leasing company uh, Japanese based, um, it’s mature. It’s, you know, it’s grown a lot over the years, but as far as I know, isn’t growing hectically. Now again, it’s up 30%, so. The only thing that can explain that to me, and I, I, you know, I’ll go out in a limb with this, is to say that people have just understood it’s undervalued they’re buying into it, you know, for the same reasons that attracted us, that, uh, eventually it’ll regress to the [00:12:00] mean,

Cameron: Well, they listen to the podcast. That’s, that’s what explains it, and I talked about it and they figured it out. Big news. Uh, what else is big news in the US today? Ob uh, obviously the whole Netflix Paramount battle over Warner Brothers. Discovery is going on. Netflix sounded like they’d landed the deal, which is gonna give them all of the Warner Brothers films, plus HBO, um,

Tony Kynaston: Mm-hmm.

Cameron: not CNN though.

And, but then Paramount’s come out today and. Tried to do a direct to shareholder thing to get around the board and get the shareholders to back ’em. Um, you know, I, I did see one.

Tony Kynaston: So did

Cameron: Mm

Tony Kynaston: came out and said he wasn’t sure Netflix was in the best interest of uh, or was in the best

Cameron: yes.

Tony Kynaston: to have such a big player in the streaming market, but

Cameron: And.

Tony Kynaston: has also had a bit to do with Paramount as well.

Cameron: Yeah, yeah. But [00:13:00] Larry Ellison, who’s a very pro MAGA and his son David Ellison, owning everything. That’s fine. So, yeah. But the other thing that’s happened, sort of tying in with this, is there’s a, a shift. In the US Securities and Exchange Commission leadership, there’s a new regime at the SEC aligned with the Trump administration, and that’s apparently moving to weakened shareholder power.

This is from Reuters. This, uh, news goes back to, uh, February, that there was, um. A change in the administration there, but the recent news is that they’re pushing through rules or trying to push through rules, which will dilute shareholder influence. And empower corporate boards to just push ahead weaken ESG [00:14:00] governance stuff, uh, put limits on shareholder proposals.

So it’s sort of this structural shift away from shareholder capitalism towards more of a managerial capitalism where the boards get to ignore shareholder demands for more corporate accountability or ESG pressures or. Weaken the ability of activist investors to engage with companies and funds to engage with companies.

So we’ll see how that plays out. Be interesting to see if Buffet has any views on that before his retirement kicks in.

Tony Kynaston: Yeah. Interesting one. I mean, I think that it’s, some of that’s in retaliation to the pendulum, which has swung far. I know at, at some AGMs in Australia, someone can buy, you know, a handful of shares and then get up and espouse why this companies no good for the environment or whatever. And, um, I think a lot of shareholders are sick of it. So I, I don’t [00:15:00] know the laws that you’re talking about, but I that. You know, that kind of, um, taking things towards, yeah. Comment on our financials, but, um, don’t, don’t soapbox your policies that our, um, AGMs might be behind, um, some of that change too.

Cameron: Hmm. Well, we’ll see how that plays out, but again, we’ll just play the cards as they’re dealt to us. Well, my, my, uh, deep dive this week. Tony is, uh, a company I’m calling the FMG of Brazil. That’s meaningful to Australians, but probably not to anyone outside of Australia. FMG is a very, very large Australian iron or minor.

And this company, valet is the largest producer of iron ore and nickel in the world. They are a very, very large company, been around a long time. They also [00:16:00] produce manganese, Pharaoh alloys, copper, boite, potash, cobalt. They operate. Nine Hydroelectricity plants a large network of railroads, ships, and ports.

They arguably have been the largest producer of iron ore since 1974. Although Rio Tinto might argue that Rio Tinto and Vallejo often quoted as the world’s largest iron ore producer, depending on the specific year and whether or not you count shipments versus production. But as I said, they’ve had this title since 1974.

And uh, I was just wondering, Tony, do you wanna take a guess at what some of the top 10 US pop chart hits of 1974 were?

Tony Kynaston: um, that’s back in the disco era, so, um, maybe, uh, Donna Summer, I’m gonna say.

Cameron: No, no. Donna Summer, um, and in fact the top 10 didn’t have a lot of disco. It’s kind of slightly [00:17:00] predis. I think 74. The number one song was The Way We Were by Barbara Streisand. Probably the least disco song

Tony Kynaston: true.

Cameron: to chart. Uh, Terry Jacks Seasons in The Sun was number two. Uh, love’s Theme by love. Unlimited orchestra could have been the beginnings of disco.

It sort of has a bit of that going on. Bit lower tempo than disco, but it’s got a bit of the groove going on. Dancing machine by the Jackson five grand funk railroads version of the locomotion Australians know from it was Kylie Minogue’s first big hit. Um, Benny in the Jets by Elton John was number nine.

Again, not very disco, but not a bad track. Anyway, [00:18:00] enough of that. So valet is basically Brazil’s iron ore and base metals machine. Digs up iron ore, turns it into pellets, and higher grade products for steel makers, sells copper and nickel into the energy transition story. And from 2000 to 2006, they invested more than $1.3 billion on the acquisition of over 361 locomotives and around 14,000 freight cars for iron ore transportation and some for regular cargo.

So that’s basically what they do. They pull stuff outta the ground and they sell it. Uh, we are very familiar with those sorts of businesses in Australia. A large percentage of our portfolio at most stages involves companies that dig things outta the ground, uh, depending on where the commodity cycle’s at.

And iron ore is actually in a by state for us at the moment. It hasn’t been for the [00:19:00] last couple of years, but has been recently. So that means we can look at companies like this. This company started life in 1942 as a state owned company called Rio Doce, created by the Brazilian government to monetize the Doce River Valley’s iron ore, and helping industrialize the company privatized in 1997.

And since then, it has morphed into a global mining giant. But it has some dark stories. Tony, you know I love a good

Tony Kynaston: no,

Cameron: tragedy.

Tony Kynaston: make a cup of

Cameron: Yeah.

Tony Kynaston: I, uh, I dunno the valet story that well, but I know BHP and Rio both had those kinds of pass as well.

Cameron: Well, BHP is part of this one, so there you go.

Tony Kynaston: Yeah,

Cameron: And in fact, a couple [00:20:00] of weeks ago, yeah, well, I’ll get it. So it’s had two. Dam disasters in the last decade.

Tony Kynaston: because

Cameron: the first one,

Tony Kynaston: what they call a tailings dam that you can run the, uh, off offshoots or the off cuts through. Yeah.

Cameron: why don’t you explain what a tailings dam is to the listeners? Tony?

Tony Kynaston: all I know. Camp nor mine involves a damn.

Cameron: Uh, alright, Ray, um, I, I had. I had to look this up. Basically, just the sludge from the mine gets built up upstream and then you keep adding to it and adding to it and adding to it. And it’s not very stable is the bottom line. It, it can look stable, but it’s not. And in fact, they’ve now been pretty much outlawed all around the world, largely as a result of what happened to these two dams.

The first one was in. [00:21:00] 2015, the so Marco joint venture Damn failure at a place called Mariana sent a sludge wave down the Doche River killed 19 people, created billions and billions of dollars of damage, killed all sorts of animal tr fish and plant life, and destroyed property and BHP bulletin. Good Australian company, well, Australian, British would, depending on how you slice it, was a 50% owner of Sammarco, so they got embroiled in the uh, court cases that came after this.

And in fact, just a couple of weeks ago, 14th of November, 2025, the high court in England ruled that the BHP group was liable for the disaster, citing negligence, technical warnings, and a lack of essential studies. Which permitted the height of the dam to increase beyond safe [00:22:00] levels. There’s been massive lawsuits, uh, from the Brazilian government and from shareholders.

’cause the share price, I think for valet dropped like 50% when this thing happened. Um, there were big plus actions, criminal lawsuits against executives and former executives, uh, for allowing this to happen. BHP of course, um, as a good corporate citizen is appealing the high court’s ruling and denying all involvement, uh, in it.

Then four years later, after the 2015 disaster, another damn failed at a place called Bino, which killed 270 people, and most of them were employees of the company. Three locomotives and 132 wagons were buried and four railway workers were missing.

Tony Kynaston: [00:23:00] Hmm.

Cameron: So again, lots of fines, chargers, management style, shakeups class actions, uh, and share price collapse.

Tony Kynaston: But no reinforcing of the dams.

Cameron: Well.

Tony Kynaston: The, the first one, you know, shouldn’t have happened, but did the second one after you know about the first one is, is, you know, much worse I think.

Cameron: Yeah, one once in a lifetime thing Tony could never happen again. Bit like climate change disasters that we have in Australia could never happen again. Um, if you look at, uh, the share price, I have to go back a bit further than that. Share price in 2008 for this company was trading at about $41. Uh, it had already been declining.

2015, it was down to $5 70, dropped down to $2 98 after the [00:24:00] first disaster, climbed back up, uh, to $12. Then the second disaster happened, dropped down to $7 66. Since then, it’s been on a bit of a ride. Got up to $22 in 2021. And it’s back down to about $13 now. But you know, they’ve done a little bit of work on fixing this.

As I said before, after these happened, pretty much the entire world banned these tailings dam solutions and everyone’s had to figure out better solutions. I think they’ve been doing that. The bottom line from our perspective, look, disasters are terrible. And um, you know, it’s one of those things that I think the market looks at companies like this and sees, um.

Uh, red alerts, red lights flashing because it’s had [00:25:00] two disasters in living memory. But from our perspective, it generates a lot of cash when it doesn’t have a disaster and it’s, uh, you know, a pretty profitable business. If we look at, uh, where it’s at today, still mostly iron ore about it, it reports in real Brazilian rial if you look on stock edia, but if you do the translation into USD, I think it’s revenue in 2024 was about.

31.4 billion. Then, uh, sorry, that was coming from, uh, just the iron side of the business. The energy transition metals, the copper and nickel nickel business added about 6.6 US billion, which is about 70% of the revenue. So, uh, that’s pretty much what they’re doing. Chasing higher grade, higher margin, iron autos, and trying to lift their output.

At [00:26:00] s Decarbonization, they’re targeting 33% lower operational emissions by 2030 and net zero by 2050 with a hundred percent renewables already reached in Brazil. They’ve got a lot of, uh, legal cases going through that could, uh, affect them. By the way, I did some comparison between them and FMG just for the Australian listeners if they’re interested.

Uh, valet reported iron ore output in 2024 was about 328 million tongs. By contrast, FMG shipped 192 to 194 million. Tons. So makes valet roughly 1.7 times larger in annual output by tonnage than FMG. So they’re the global heavyweight, but FM G’S major, but clearly second tier if you stack ’em head to head.

Uh, in terms of country rankings, Australia and Brazil are the two top global iron ore [00:27:00] powerhouses, China, India, and Russia come after them. Brazil’s iron ore reserves remain among the world’s largest. Australia is up there, particularly the Pilbara region, but it’s really between Brazil and Australia as the two global iron ore behemoths.

Tony Kynaston: was something developing in Africa too, which is interesting. Um,

Cameron: Oh yeah.

Tony Kynaston: yeah, I think it’s in Guinea. We were talking about a, um, Perseus mining in Australian gold miner operating in Guinea, but there’s a big, uh, I think it’s on ore coming in a place called SE Mandu. In, uh, Guinea and Africa, um, which is supposed to also be of a world class type nature and what they can mine and export.

Cameron: Right. Well that might add some interest to it, and obviously a lot.

Tony Kynaston: other thing too, sorry Ken for interrupting is, is, uh, companies like BHP are actively. Trying to get more into copper than iron ore these days. [00:28:00] So saying there’s not a future for steel around the world, there obviously is, but um, the, the big wave in iron ore mining and exporting was when China was doing Double digit growth in the nineties and early two thousands, um, and using steel handover fist, and that’s, that’s come off the boil. It’s still quite strong. China’s economy’s growing at five or 6%, which is nothing to be sneezed at. But you look at companies like Fortescue, as you mentioned it, its value went from like less than a dollar to 20 odd dollars in share price. and Rio haven’t done as well. Um. BHP, you know, had a lot of false steps with acquisitions along the way, and it looks like valet hasn’t done as well either during that. So the golden year of iron ore mining and ex exporting. So it’ll be interesting to see they go going forward if iron ore is, um, still [00:29:00] important, but not as strong in terms of its demand, um, going forward.

Cameron: It’s interesting. I haven’t done this, but if I, um, compare the charts. So, as I said, if I look at valets 10 year chart, uh, it’s 10 year looks all right. Share price 10 years ago was about three bucks. Now it’s about 12, 13, so about four times. If I look at FM G’S 10 year chart, 2015, it was trading at the end of the year around $2.

And it’s currently about $22.

Tony Kynaston: Hmm.

Cameron: So it’s done far better in terms of its, uh, share price growth over that period anyway, but it sort of grew from a small operation into a pretty big operation at that time around

Tony Kynaston: Yeah, and it also FMG,

Cameron: from a lower [00:30:00] base.

Tony Kynaston: uh, has made a, a, a niche for itself in selling lower grade iron ore into China. So when,

Cameron: Yeah.

Tony Kynaston: you know, there was so much demand for iron ore that the China was happy to buy a lower grade, uh, FMG capitalized on that, whereas,

Cameron: on that.

Tony Kynaston: I’d be surprised, valley’s probably still in that market, but it, it probably also sells a lot better grade of iron ore as Well,

Cameron: Yeah. And of course China that was getting to my next point is the biggest market for them, as it is for Australian iron ore miners. Brazil in total exported about 37 million tons of iron ore in a recent monthly snapshot, and China imported about 24.26 million tons of that. So by far the largest single market for Brazilian ore exports.

And you know, I know that China’s trying to, um, sever its [00:31:00] global trade as much as possible from exposure. I’m not sure if they’re gonna be able to, yes, it’s, IM, well, yes, it’s imports, not its exports. Love keep, keep the exports, just get rid of the imports. So, um, yeah, we’ll see, uh, if that has a big impact, I guess, on iron ore in the coming years.

They might just buy less from Australia because I, I’m not sure what their diplomatic relationship is with, uh, Brazil. Um. With Lula. I’m not sure what Lula’s relationship is with China, but I know the Australian relationship is bipolar. Um, from a trade perspective, we love China. Can’t get enough of China.

China’s the best from a military perspective. They’re, uh, our greatest foe and our greatest enemy in the greatest threat to our security. So it’s kind of weird.

Tony Kynaston: It is

Cameron: Very weird. So, uh, free cash engine is still eye and AE for [00:32:00] these guys In 2024, they generated around 1415 US billion dollars of adjusted EBITDA on about 38 US billion of revenue.

Recurring free cash flows around 817 US million in Q4. And it’s just like, if you look at the, um, Stock Doctor numbers. It’s, it’s total revenue has jumped a lot since 29. 2019 was a low year, hun. We’re doing real here, not USD 2, 2 20 thou 2019, about 145. Billion real, uh, jumped up to about 293 in 2021 and then came back down to 206 billion in 2024.

Estimate for 2025 will be about 207, so it’s about a 7% CAGR over that period. But it. Spiked [00:33:00] sort of just after COVID during that COVID year. That has come down since then, but their operating profit has jumped from 12.8 billion in 2019 to the TTM this year is around about 42 point half billion. It was 55 and a half billion real last year.

2024 and their net profit is tracking around, uh, the estimate for 2025 is about 45 and a 5 billion real. So it’s, uh, making money hand over fist. It’s operating margin. The average is around about 31%. Um, TTM is about 20% this year, but it has been higher, uh, over the years, depending on the price of iron ore, I guess.

It’s got a lot of debt, but it’s also sitting on a lot of [00:34:00] cash. 33 billion rial in cash. Net debt is about 66 billion net fixed assets, 339 billion. Rial book value, 218 billion rial. So it’s, it’s huge and it’s making a lot of money. Is the bottom line here.

Tony Kynaston: the conversion rate I think is about Five to one between the real and the US dollar something like that So

Cameron: Yeah, I do have that in my, yeah, I’m not doing that in my head, but, uh, yeah, I did have to recalculate some numbers. Yeah. When I was doing our, uh, numbers.

Um, so what can I tell you about it? Uh, what’s it, what is it doing? Um, it’s phasing out all of those upstream raised tailings dams, as I mentioned, the time the, the, the type that were used in the [00:35:00] disasters. Um. Upstream dams were legally banned in Brazil after the disasters. They’re reporting that all of their upstream raise structures are being decommissioned under their dam elimination program.

Um, you would hope that they would be decommissioning them quickly. Um, they now. They now have a formal tailings and dams management system to track this. There’s a global industry standard now on tailings management, the G-I-S-T-M, which has been widely accepted internationally, and they’re apparently, uh.

Aligning their practices with that. They’ve got a formal process of hazard identification and risk analysis in place, which means they’re periodically assessing all of the existing tailing structures for structural risk. You would’ve thought [00:36:00] that would’ve been par for the course over the years anyway, but, uh, apparently not.

So that’s going on. They’re trying to avoid that, which is a good thing. So hopefully no more massive damn failures for the company. I mean. As I said earlier, they’re still facing lots of class actions and lawsuits that are being dragged out in the courts and you know, they might might end up with lots of fines.

I think both them and BHP have agreed to pay billions of dollars in damages and reconstruction and all of that kinda stuff from Brazil. And they’re arguing in the courts that. You know that they’re taking their responsibility seriously and there’s no need for further punishment or further reparations, but we’ll see how that plays out.

But damn foes can still occur. These are decades old weaknesses in a lot of these places. [00:37:00] Uh, there’s no guarantee they won’t have another one, and the share price could take another hit. So that, those are sort of the big risks I see with companies like this. You’ve got all of the normal ESG pressures as well of, uh, mining companies and digging stuff outta the ground.

It’s that thing that we’ve seen happen in Australia though, where some of the big funds. Won’t buy some of our coal mining companies because of ESG concerns. Uh, but it means that the price looks good to QAV and we, we can pick them up at a, at a discount. I think these guys fit that category. There’s like a whole bunch of nasty looking components on the surface.

ESG issues, dam failings, tainted brands, uh, all that kind of stuff.

Tony Kynaston: I think, I think in terms of the Australian perspective, that, uh, people who are focused on ESG that, [00:38:00] uh, have something to say about BHP or Rio or Fortescue, it’s around the fact as well that, uh, lot of coal used in converting iron or into steel. And so it’s a

Cameron: Yeah. Right.

Tony Kynaston: scope three reduction.

So, uh, the miners. Uh, do a bit of work, quite a lot of work on reducing their own emissions. Um, for example, in the Australian case, they often, uh, build their own, um, wind or solar power plants to power the mines. Uh, but it’s what the, what the customers are doing with the iron ore, which is of concern to a lot of ESG focused investors,

Cameron: The, the trickle on impacts, the secondary impacts of Yeah, people.

Tony Kynaston: getting back to your point before about raising issues at e at AGMs, have tried to bring in a regime of Scope three emissions control via the miners, um, which is, know, pretty hard for the miners to do when they’re trying to sell something to this customer to say, well, you can’t use it or sell it to you

Cameron: [00:39:00] Yeah.

Tony Kynaston: you can’t mix it with coal to make steel.

Yeah.

Cameron: Yeah. Unless you clean up your act.

Tony Kynaston: Yeah.

Cameron: So, I mean the, the one line thesis for these guys is they’re a dominant low cost iron ore producer, high grade deposits, fat cash generation. They pay a big dividend, uh, their dividend per share. It’s fluctuated. But, um, you know, it’s, uh. An average of about 30% by the looks of it, it’s been up as high as 14.

Uh, this year it’s more like 4.68, but um, it’s quite a good yield, six, 7% yield. Um, downside. Lots of red flags. Uh, Chinese still demand, as we said, could be flaky, Brazilian political, legal environment. Other [00:40:00] potential disasters, um, foreign exchange exposure. You know, they, they report on Brazilian real, but the a DA trades in USD, so you gotta be careful of that.

But, um, the punchline is there are dirty. Cyclical cash gusher sitting on world class iron ore question isn’t whether or not it makes money. It’s whether you are brave enough to sit through the politics, the mud, the commodity swings, and, and just let it play out, which is a classic QAV sort of a stock from my perspective.

Um,

Tony Kynaston: it’s cheap

Cameron: you know.

Tony Kynaston: It’s a big, it’s a big company. Even though demand might be slowing, it’s still, it’s still enough demand for steel around the world for iron ore companies to keep going for decades. Um. If not forever. There are, there is progress being made in terms of [00:41:00] production of steel.

I, I think it’s a, like, uh, it’s probably about 10% these days, but, um, uh, there, there are, uh. You know, better ways of doing it than heating coal and, um, putting it in a blast furnace, putting the iron on a blast furnace to make steel. So slowly taking hold across the, the factories in China and other places.

So, yeah, I mean, this is one of the reasons why it’s good to be your, uh, an individual investor because you are worried about ESG concerns, you can do your research and you can screen. On your buy list to not buy these stocks. Or you can say, well, I use steel, um, which we all do. And um, you know, I’m resigned to that fact.

And the manufacturing of steel will slowly get cleaner. It hasn’t happened yet, but it will improve and I’m happy to buy a share off somebody else. be selling for ESG concerns and, um, and hold this stock until it rerate back to what we think [00:42:00] is fair value.

Cameron: Well, just running through the numbers to finish up. Um, average daily trade is about 412 million. So it’s pretty big. Uh, the price to operating cash flow is 5.59, so getting close to our cutoff of seven, but definitely below it in terms of the stock edia numbers that. Kills, uh, quality rank is 92, so we score it for that.

Uh, the stock rank is, um, well, let me check, look over here. The stock rank is 99, so we score it for that. Uh, the F score is a six out of nine, so we score it for that. Its price is not less than our IV number one, [00:43:00] so we can’t score for that, but it is less than our IV number two, I think. Uh, IV number two was about 18 bucks and it’s trading around about just south of 13, $12 81 today.

So scored it for that. The price is not less than the book. It’s not less than the book plus 30. So I couldn’t score it for either of those either. Book value growth is positive. Um, so it got a score for that. P is not less than the yield. The yield though, is higher than the bank debt. As I said, it’s got a pretty strong yield.

The forecast iv, IV number two is, uh, not higher than. Twice the share price, so I couldn’t score it for that all up. It got a score of 10 out of 14, which is a QAV quality score of 71%. And a QAV score [00:44:00] of 0.13 puts it down on the lower part of our buy list this week. And by the way, if you’re interested in what our buy list looked like this week, um.

Well, no, I won’t go through it, but there was like a hundred companies on our buy list again this week in the us Like it’s kind of, uh, it’s just so much opportunity over there at the moment. And as I said, well, I didn’t say it before, but looking at the companies that I’ve done deep dives on over the course of the last year from the us, um, I’ve done 27 of them.

20 of them are in positive territory, seven are in negative territory, so it’s a win lose ratio of about 74% of the companies that we’ve, uh, covered so far this [00:45:00] year, which is pretty good.

So that is, uh, my pulled pork for this week. Do your own research. It’s not a recommendation, but definitely worth checking out if you can get over the death toll and the dirty dams and the ESG issues of digging stuff out of the ground and having it smelted, uh, and all of that kind of stuff. It’s a cash generation machine outta Brazil.

Tony Kynaston: Very good. Thanks for that. We’ve, we’ve covered a lot of overseas companies that are listed on the US stock market. Um. I mind if, if anyone listening who is listening to this can tell us if, uh, there is an issue with investors buying a DA stock in the us. That seems to me that these companies aren’t as heavily bought as, as some of the other ones that might be listed.

I’m, I’m not sure if that’s the case, but it’s a bit of a theme, so I just wondered if that was an issue.

Cameron: We did talk [00:46:00] about it on an earlier episode, how it’s a little bit tricky for funds, et cetera, to buy, but I dunno about private investors. Yeah. Hmm. Alright, well that’s it for this week. Thank you, Tony. Have a good week.

Tony Kynaston: Bye.

Bernard: Q A V is a checklist-based system of value investing developed by Tony Khighneston over 25 years. To learn more about how it works and how you can learn the system, visit our website, Q A V Podcast dot com.

This podcast is an information provider and in giving you product information we are not making any suggestion or recommendation about a particular product. The information has been prepared without taking into account your individual investment objectives, financial circumstances or needs. Before you decide whether or not to acquire a particular financial product you should assess whether it is appropriate for you in the light of your own personal circumstances, having regard to your own [00:47:00] objectives, financial situation and needs. You may wish to obtain financial advice from a suitably qualified adviser before making any decision to acquire a financial product. Please note that all information about performance returns is historical. Past performance should not be relied upon as an indicator of future performance; unit prices and the value of your investment may fall as well as rise. The results are general advice only and not personal product advice.

Transparency is important to us. We will always be very open and honest about the stocks we own. We will also always give our audience advance notice when we intend to buy or sell a stock that we are going to talk about on the podcast. This is so we can never be accused of pumping a stock to our own advantage. If we talk about a stock we currently own, we will make it known that we own it.

This email is authorised by Anthony Khighneston Authorised Representative [00:48:00] Number zero zero 1 2 9 2 7 1 8 of M F & Co. Asset Management Proprietary Limited (A F S L five 2 zero 4 4 2). No part of this content may be reproduced in any form without the prior consent of Spacecraft Publishing.

0 Comments